Market making in Swaps is a business in the midst of significant change. Regulatory drivers are increasing cost and complexity and while central clearing has helped, it has not yet simplified the business to one which is automated, high-volume and low cost.

When making prices Swap dealers have “usually had an axe”, meaning a bias to pay or receive fixed. A bias driven by the core interest rate position of their franchise or their customer base and colored by their own view on the yield curve.

In this article I will look at the added factor of Initial Margin in making prices. You could think of it as a “sharpening of the axe”.

Prices, Risk and P&L

A market maker needs to offer prices to the market, whether in response to an RFQ or as orders to a CLOB and in so doing earn the bid/offer spread. When lifted on one side, they need to be able to find the hedge and perhaps adjust their subsequent prices. For trades larger than market size, it takes longer to find the hedge and they may use Treasuries or Futures until the Swap hedge is found.

A trade that brings a market makers DV01 back towards zero is one that is worth attracting by changing the bid offer. And managing risk and making profit is key in benign able to offer prices.

An Example

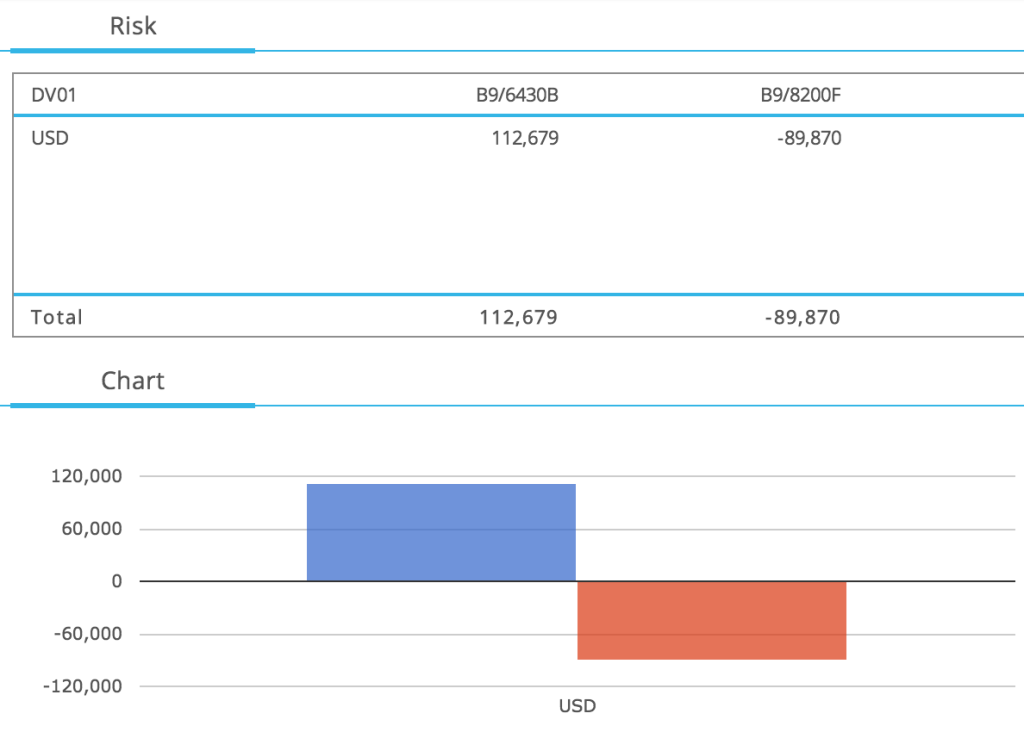

Lets take two market makers, one currently long DV01 and one short DV01, as below.

Which shows:

- Market maker 6430B has a positive DV01; not shown is the fact this is mostly in 9Y

- Market maker 8200F has a negative DV01; not shown is the fact this is mostly in 5Y

Each of these should want to move their DV01 closer to zero, so they have trades they prefer to attract into their books.

- Market maker 6430B, would prefer to receive fixed, as this decrease the book’s DV01

- Market maker 8200F, would prefer to pay fixed, as this decrease (to closer to zero) the book’s DV01

- Both should adjust their bid-offer slightly to make it more likely to attract the appropriate trade.

Initial Margin

What does this have to do with Initial margin?

Well I want to show that rather than looking just at DV01, the market maker could look at Initial Margin and come to the same answer. In-fact in some cases a better answer than looking just at DV01.

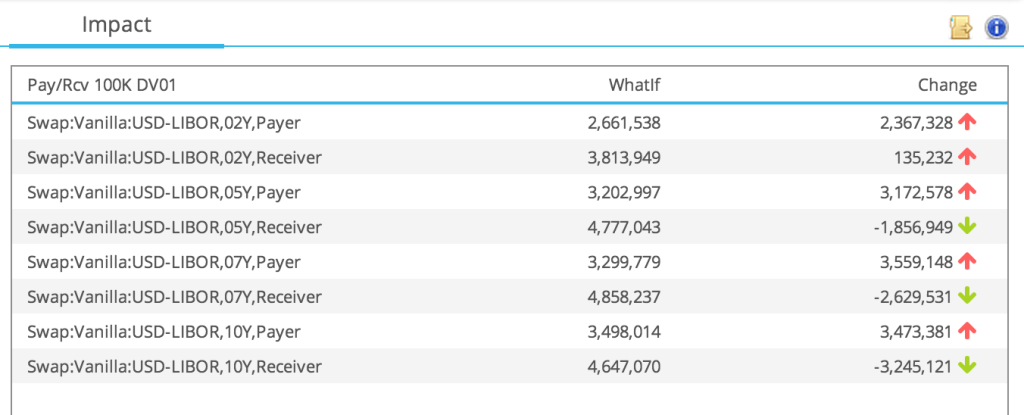

Using CHARM we can run an Incremental IM analysis, to determine the impact of paying and receiving on each book.

First for 6430B, assuming Swaps in a CME Cleared account and the Swap Dealer is a Client of a FCM.

Which shows:

- The impact of Pay/Rec in 100K DV01 size on specific tenors

- The Whatif column is the stand-alone margin of these trades

- The Change is the more interesting column

- It shows that a Pay Fix trade would increase the IM in all tenors

- While Receive Fix would decrease IM, except in the 2Y tenor

- And 10Y Rec Fix has the greatest reduction

- (Remember this is a book with a large 9Y position)

This is consistent with our earlier statement that this market maker would prefer to receive fixed.

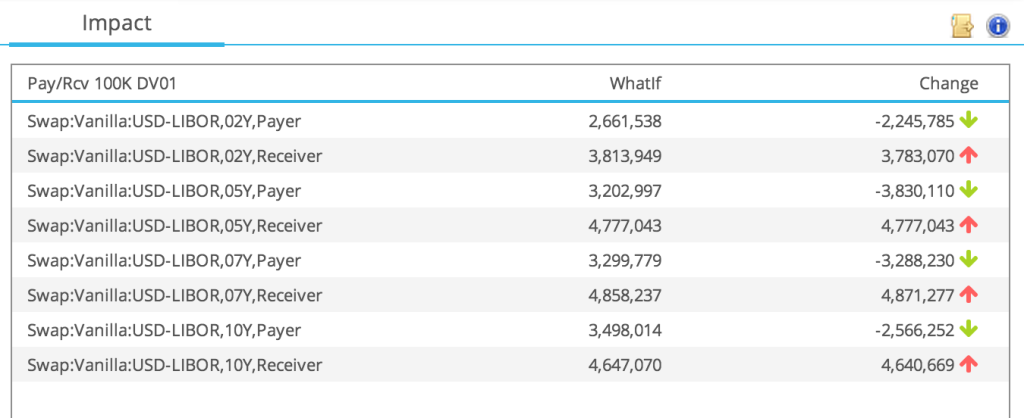

And the same analysis for 8200F:

Which shows:

- Pay Fixed in 5Y would reduce IM the most

- (Remember this is a book with a large 5Y position)

What does this tell us?

Does it tell us anything more than DV01 or DV01 by tenor?

Well yes, because it helps us to quantifying by what fraction of a basis point we could sharpen our price to attract a trade.

A reduction in IM is a benefit, as it lowers the funding cost of collateral to cover the margin requirement. Assuming a funding cost and a term we could quantify this benefit and in many cases it would be material enough to alter the bid-ask spread. Which could result in a more attractive price for a customer and so win us business.

Of course the opposite is also true; an increase in IM would cause us to worsen our price and could lose business.

There is also another benefit in using IM. The fact that it takes correlations between curve points and between curves in the same currency (basis) and curves in other currencies into account. The reduction in risk resulting from this is also quantified in the margin model.

I am not advocating a replacing of managing risk by DV01 to one by managing IM. After-all we only have to look at the lessons from the Financial Crisis of 2008 to know that use of a number of risk measures (gross and net, greeks, var and stress tests) and an understanding of the assumptions and meanings of these measures is critical to success.

What I am advocating is that quantifying incremental IM is a useful measure in making prices, managing risk and realising P&L. It can assist the market maker or indeed be added as a step into an algorithm that responds to RFQs or streams prices to a CLOB.

A Final Thought

There is the question of whether funding cost of IM is charged down to a book level or taken at a Global Markets business level. As most firms will have a single house account at each CCP, it would seem to make sense to manage this at a Global level. However active trading and market knowledge is at the book level and at this level should we optimise just for the book level and ignore the global level?

The answer to that is a complex one and a topic for another day.

For today I want to leave you with the thought that pre-trade Incremental Initial Margin is an important measure.

A very interesting approach and one which should interest an increasingly wide audience as compulsory clearing and compulsory bilateral IM affect broader and broader sectors of derivatives trading.

A small niggle: do you mean 100M rather than 100K notional in your impact table examples? I am used to single case or standalone IM of the order of 2% to 4% of notional depending on tenor and WCL parameters

Thank for your comment.

I could have used 100M notional for each tenor but in the examples shown I used 100K DV01 and computed the equivalent notional for each tenor.