FRTB – The Default Risk Charge

Following on from my articles, Fundamental Review of the Trading Book and Internal Models or Standardised Approach, I wanted to take a look at a specific component of the Market Risk Capital, namely the Default Risk Charge as required under the Standardised Approach. Background In January 2016, the Basel Committee on Banking Supervision (BCBS) published its Standards for Minimum […]

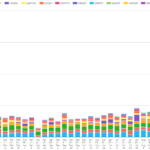

Two Month Update: Uncleared Margin Rules & Swap Data

Over the past 2 months, my colleagues and I have occasionally studied swaps data for hints of impacts from the September 1 implementation of Uncleared Margin Rules (UMR) effecting behaviors. There have been a few general themes: Uptick in NDF Clearing Uptick in Inflation Swap Clearing No notable effect on Swaptions Now with 2 months […]

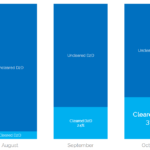

BRL NDF Market – 30% of Dealer to Dealer flow is now cleared

We look at the USDBRL market in the latest in a series of NDF blogs Clarus data covers over 66% of the market on a trade-by-trade basis For the Dealer-to-Dealer market alone, our coverage increases to 73% Our data shows that clearing has increased from 6% to 31% of dealer-to-dealer flows. Bringing Old Blogs Up To […]