Is Transparency Helping Markets Function?

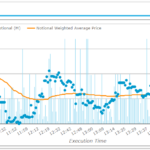

Trading has continued uninterrupted across the markets that we monitor, despite the extreme levels of volatility we have seen over the past week. Transparency data shows that Rates, Credit and even Funding markets continue to function “normally” in terms of volumes transacted. Crucially, markets have not “seized up” during some crazy price moves. Market participants […]

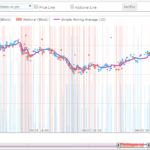

Crashing Rates and Swap Margins

In observing the markets over the last few weeks there are so many significant moves; Oil prices collapsing by 30% in a day, S&P500 declining 7.6% in a day, the 7th worst move since WW2 and worst since 2008, the whole US Treasury Curve out to 30Y trading below 1% for the first time ever. […]

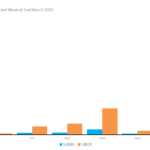

SONIA Update

70% of GBP risk transacted last week was in SONIA. Just 7.6% of GBP notional cleared at LCH SwapClear was in LIBOR last week. In these extremely volatile markets, much of this activity is due to large amounts of short-dated risk trading. 91% of SONIA risk was in short-dated tenors (2 years and shorter). There […]