The move from Libor to Risk Free Rates should accelerate in 2020. We recently published, Will GBP Libor stop trading on 2nd March 2020? and Have SOFR and SONIA Swaps and Futures lived up to expectations?

On 16th January 2020, the PRA and FCA published another letter to market participants (in this case SMFs) focused on the transition from Libor.

In the USA, the ARRC has also started 2020 with a number of important papers. The consultation on potential spread adjustment methodologies and the recommendations for inter-dealer cross currency swap conventions are well timed and address two of the outstanding issues for transition from Libor to RFRs.

The markets are moving from Libor to RFRs (compounded or term) and the derivative markets are evolving to create tradeable products

Is it the right time to address the conventions for derivative markets?

Could these be more consistent across currencies to make trading and comparisons easier and more transparent for end users?

Current IRS quoting conventions

Interest rate swap markets have been quoted for well over 30 years in most common currencies. In many cases, the inter-dealer quotes are standardized and follow the original conventions in each currency.

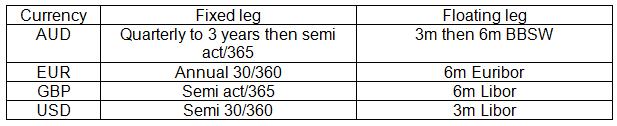

The typical quotes are as follows (for swaps over 1 year in a few popular currencies):

All this is rather confusing when trying to compare rates across the currencies. Not only do the fixed rate leg conventions vary but the floating rate legs vary the tenor of the fixing.

And to make it even more complex, the AUD swap market has evolved such that swaps to 3 years are quarterly on both legs and from 4 years out both legs are semi-annual!

The conventions often developed to match the underlying demand from end users and/or the government bond market conventions in each currency.

All this can be very confusing:

- Fixed legs can be act/365, act/360, 30/360 (bond basis) or occasionally other variants. They can also be annual, semi-annual or quarterly payment schedules; and

- Floating legs can be 1, 3, 6 or occasionally 12-month Libor (or local equivalent like BBSW). One of the main complexities in the choice of tenor is the existence of ‘basis’.

The basis is the difference between, for example, taking 2 consecutive quarterly rates to create a 6 month rate and the actual 6 month Libor. This basis is typically non-zero and will impact pricing of derivatives.

Is there a better way when we move from Libor to RFRs?

A more transparent swap market post Libor

Markets have an excellent opportunity to standardize the conventions across different currencies as we transition to using RFRs instead of Libor for the floating legs.

Swap rates could be readily compared across currencies and tenors which could greatly enhance transparency and efficiencies in booking systems.

A simple set of common conventions could be a very simple way to remove current complexities which most probably add cost and potential errors for many users.

Fixed rate legs

The fixed rate leg could easily be standardized for most currencies and tenors.

Perhaps the semi-annual 30/360 options may be a good choice as it matches many of the capital market debt issue coupons.

But I can also appreciate other options such as semi-annual act/360 (or 365) may be easier to calculate but are not as consistent.

Floating rate legs

The floating rate leg is inherently much less complex for RFRs (term or compounded) than in the current Libor fixings: simply put, there is no ‘basis’ when using RFRs.

This is a very important point. Market conventions may choose, for example, semi-annual RFR fixings but there is no pricing difference if a quarterly option is used.

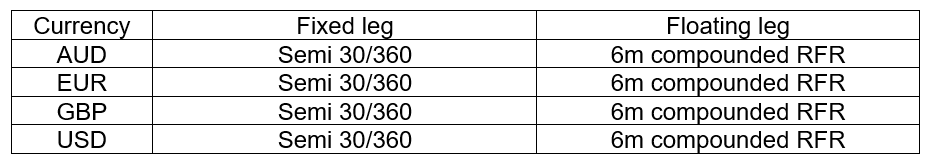

Example conventions post Libor

The table above could be greatly simplified if consistent conventions are adopted.

These are only examples of how markets could create more consistent definitions but it will be completely in the hands of individual markets to create their currency conventions.

Perhaps something like this table could evolve:

How Microservices can help transition decisions from Libor to RFRs

Once the new definitions are clear and hopefully consistent across markets and currencies, market participants can start to use RFRs instead of Libor.

My recent blog looked at how end users (buy side) participants can be prepared for the transition from Libor to RFRs. This, I believe, will start in earnest in 2020 and transparency will be critical to a smooth process before 2022.

Clarus Microservices are a very useful tool to assist with decisions for new and existing trades. The transition from LIBOR to RFRs either directly or via a fallback mechanism can be complex, which is where Microservices can help.

And not only that they can implement existing and new conventions and following the “write once and use everywhere” principle they can be invoked from anyone around the globe with access to a web browser and ability to call web apis.

Summary

As markets start to more fully adopt trading in RFRs to replace Libor, swap markets have an excellent opportunity to create more consistent definitions.

A more consistent set of conventions allows, for example:

- More transparent market rates which can be readily compared across tenors and currencies;

- Easier access for end users to price trades; and

- Fewer

variants in fixed and floating legs allowing for:

- Simpler booking processes;

- Fewer booking system variants; and

- Potential for more efficient processes.

This opportunity to simplify markets and create efficiencies in systems and processes should be seriously considered by markets and end users.

John, just to reinforce the complex nature of various conventions in IBOR swaps … I believe you should have 3M as the convention for the float leg in USD swaps.

Great spot Matthew, thanks for pointing it out. Now updated!