Central Counterparties published their new CPMI-IOSCO Quantitative Disclosures, so we now have four sets of disclosures covering a whole year. Lets look at trends in the data, similar to my article on 1Q 2016 trends.

Background

Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more are published each quarter with a quarterly lag.

CCPView now has four sets of disclosures; for 30 Sep 2015, 31 Dec 2015, 31 Mar 2016 and 30 Jun 2016.

Allowing us to both observe trends over time at one CCP and compare CCPs.

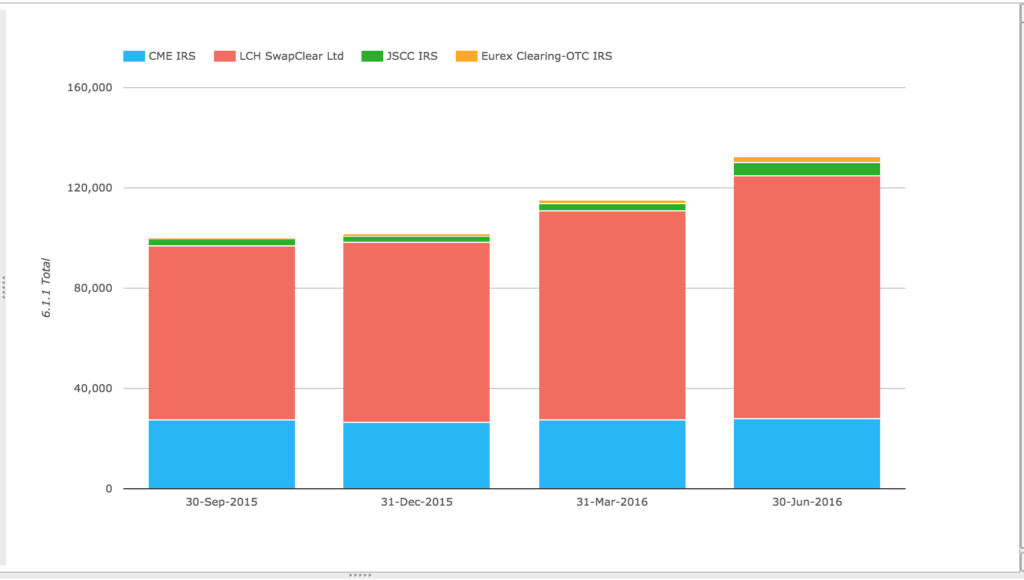

Initial Margin for IRS

Lets start with Initial Margin for Interest Rate Swaps.

Showing that:

- Total IM for these four CCPs is $132.5 billion

- LCH SwapClear is by far the largest with $97 billion as of 30 Jun 2016

- Up 17% from 31 Mar 2016, which itself was up 15% from prior

- CME IRS is next with $27.8 billion as of 30 Jun 2016, up 2%

- JSCC IRS with $5.5 billion as of 30 Jun 2016, up 80% in dollar terms

- Eurex Clearing OTC IRS with $2.2 billion as of 30 Jun 2016, up 54% in dollar terms

While Initial Margin at a single point in time is influenced by many factors in the period (new volume, compression, volatility), it is a good measure of the relative size and systemic importance of a CCP.

There is further detail in terms of the breakdown between House and Client Margin and the growth in each, but in the interests of time, will leave that to those of you interested to see for yourself in CCPView.

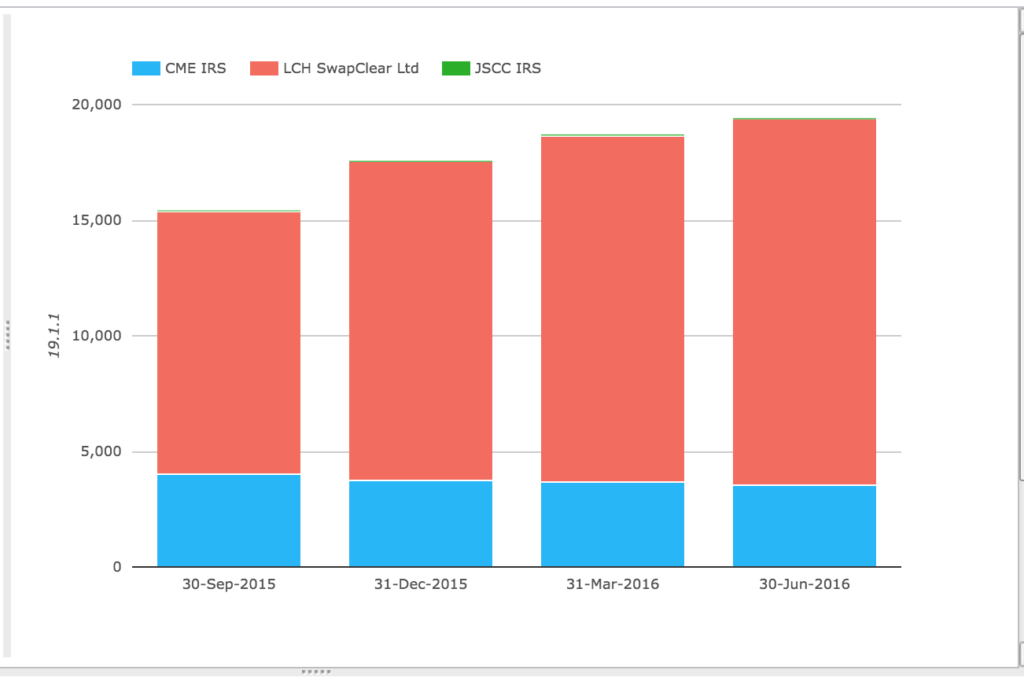

Number of Clients for IRS

Next lets look for any growth in the numbers of clients that are clearing at LCH and CME.

Showing:

- LCH SwapClear increasing Client Accounts by 6% to 15,840 as at 30 June 2016

- Similar to the 9% increase from 31 Dec 2015 to 31 Mar 2016

- CME IRS decreasing Client Accounts by 4% to 3,527

- JSCC IRS showing 56, up from 55 (this may be Clients rather than Accounts)

- Eurex Clearing do not break out the OTC IRS number

So the growth in Client Accounts and activity continues, particularly at LCH SwapClear and it will be interesting to see whether this trend holds in the 30 Sep 2016 figures.

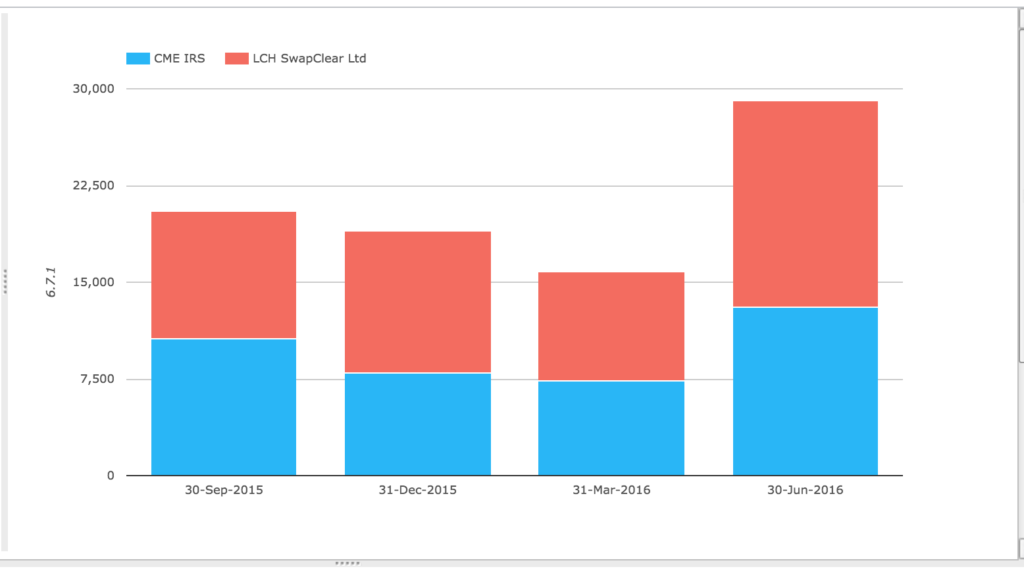

VM and IM Calls for IRS

Given the market volatility we saw in June, there must have been large VM and IM Calls in the quarter.

First the maximum total variation margin paid to the CCP on any business day:

Showing a big jump at both CME and LCH in the quarter ending 30 Jun 2016.

At LCH SwapClear the maximum VM paid to the CCP on any business day was a whopping $16 billion!

A big increase from the $8.5 billion in the prior quarter and the $11 billion before that.

While at CME IRS the maximum VM paid to the CCP was a whopping $13 billion, again a large increase from the $7.3 billion in the prior quarter.

Perhaps the $16 billion and the $13 billion were on the same day, most certainly the same week and gives an idea of the huge daily cash flows that can move back and forth between CCPs and their members.

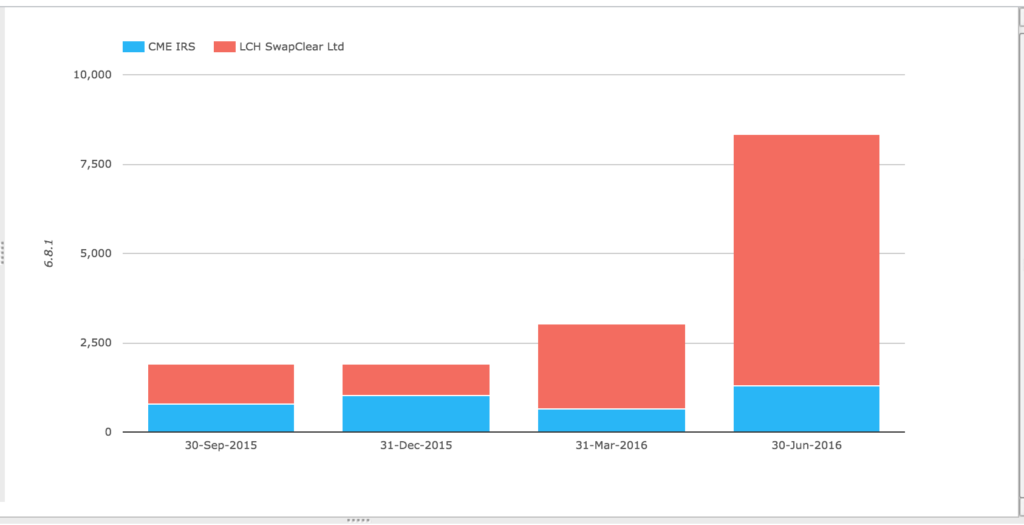

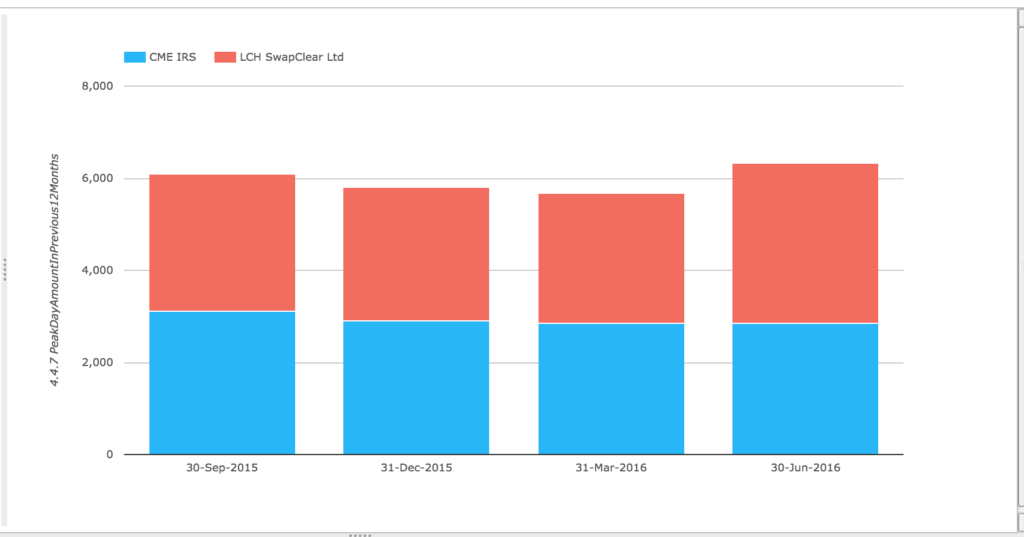

Next the maximum aggregate initial margin call on any business day over the period:

Showing an even more pronounced increase with LCH SwapClear showing $7 billion, up from $2.4 billion.

While CME IRS shows $1.3 billion up from $640 million.

Summing up the VMs and IMs above, $16b + $13b and $7b + $1b, gives a grand total of $37 billion!

A large amount that will have been transferred in the same week from Clearing Members to CME and LCH and showing the size of liquidity required to be active in Derivatives clearing.

Credit Risk for IRS

Given such volatility, lets look next at one of the important Credit Risk disclosures.

The estimated largest aggregate stress loss (in excess of initial margin) that would be caused by the default of any two participants in extreme but plausible market conditions in the previous 12 months.

Showing an increase at LCH SwapClear from $2.8 billion to $3.5 billion, while CME IRS is $2.8 billion.

No massive change there and these amounts are comfortably less than the CCPs Default Funds.

Lets end on that for IRS disclosures.

Disclosures for CDS and ETD

CCPView also has lots of CPMI-IOSCO Disclosures for Credit Derivatives (CDS) and Futures and Options (ETD), but time is short and that is an article for another day, or contact us for a CCPView subscription.

Futures and Options in particular are a very significant market, one with larger disclosures than IRS.

Final Thoughts

CPMI-IOSCO Public Quantitative Disclosures provide many useful insights.

The quarter ending 30 June 2016 was a significant one.

Many disclosures were significantly up from the prior quarter.

Reflecting higher market volatility and continued growth in clearing.

We look forward to what the next set of disclosures will show.