- CHF OIS and swap markets have transitioned from TOIS to SARON.

- TOIS will cease to exist from the end of this year.

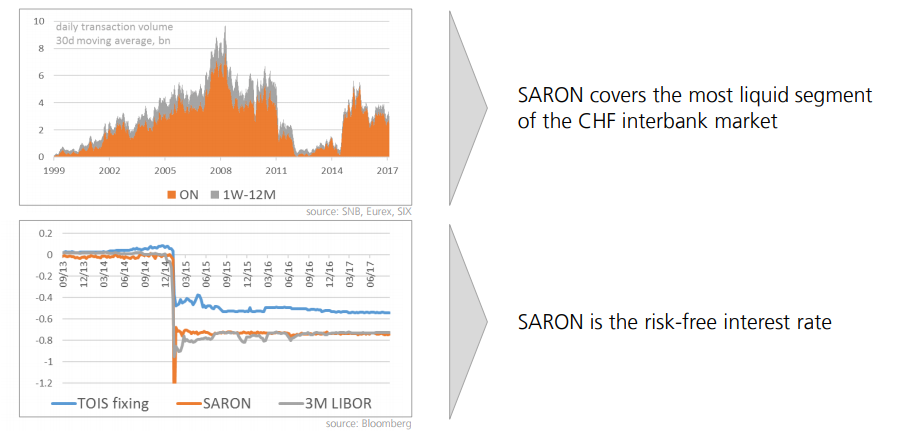

- SARON is the new “Risk Free Rate”.

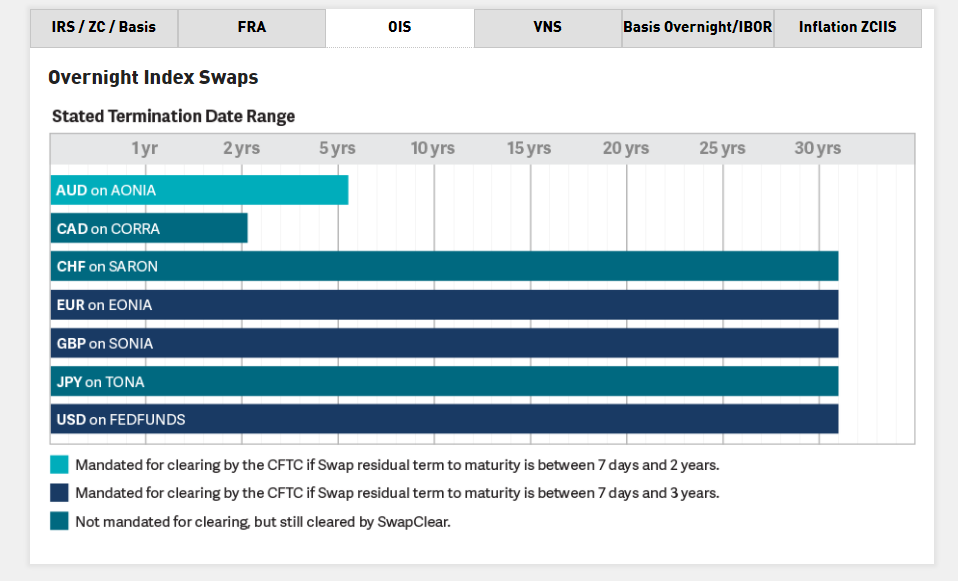

- LCH SwapClear now clear SARON swaps.

- We can see some activity in the data.

What is Going On?

According to Gottex Brokers;

“The ability to clear SARON swaps via LCH saw a flurry of activity in durations from 1 month out to 10 years. The initial trading highlighted the different customer requirements, while paying and receiving was fairly balanced. Interest was also marked in SARON/Bor basis swaps, whose points were quickly revised before settling at current levels.

Most banks now seem to have the ability to trade SARON swaps and there is an established active market.”

CHF OIS Markets

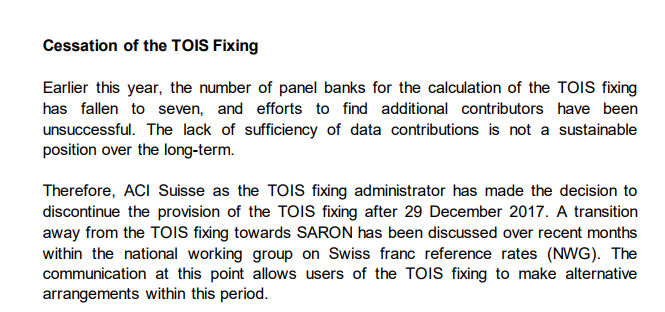

Scene set, let’s start with a (very brief) history of CHF OIS markets. The TOIS fixing has been on its’ last legs since 2013. The benchmark administrator, ACI Suisse, has tried several times to reform the process, the panel etc. But there just weren’t sufficient volumes in tom-next unsecured products for banks to feel comfortable submitting rates. As a result, ACI announced in November 2016 that TOIS would be discontinued at the end of 2017:

As we wrote in September, the SNB has been actively involved in arranging the working group to aid the market transition away from TOIS.

SARON

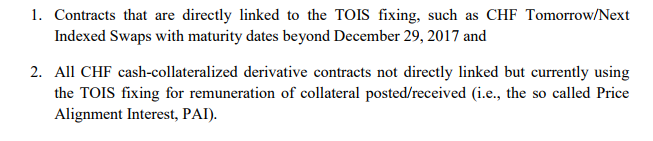

The market decided to transition to SARON, a secured overnight rate (i.e. based on Repo trades), that is administered by SIX.

As the SNB have highlighted, there are two impacts to swap markets from a transition:

Earlier this Summer, SIX arranged an excellent conference to discuss these changes with market participants. ZKB gave a thorough overview of the SARON market as part of this conference:

Helpfully, the SNB provide a template for confirming a SARON swap (using ISDA terms). Whilst we are honoured that market participants generally refer to our OIS Nuances blog for these terms (already updated with SARON), we hope that Libor reform will prompt all jurisdictions to follow in these steps of improved transparency for all market participants.

Trading

On October 18th, LCH announced that it had started clearing SARON swaps at SwapClear. This followed the announcement that PAI (i.e. the rate of interest paid on overnight Variation Margin of vanilla CHF IRS cleared at SwapClear) switched to SARON (from TOIS) on the 16th October. This effectively changes the market rate used to discount CHF IRS to SARON.

LCH stopped accepting new trades referencing TOIS on 2nd October 2017, therefore the following OIS indices are now eligible:

Remember that you can easily check Clearing Eligibility via our Clarus Microservices.

What happened to the old TOIS contracts?

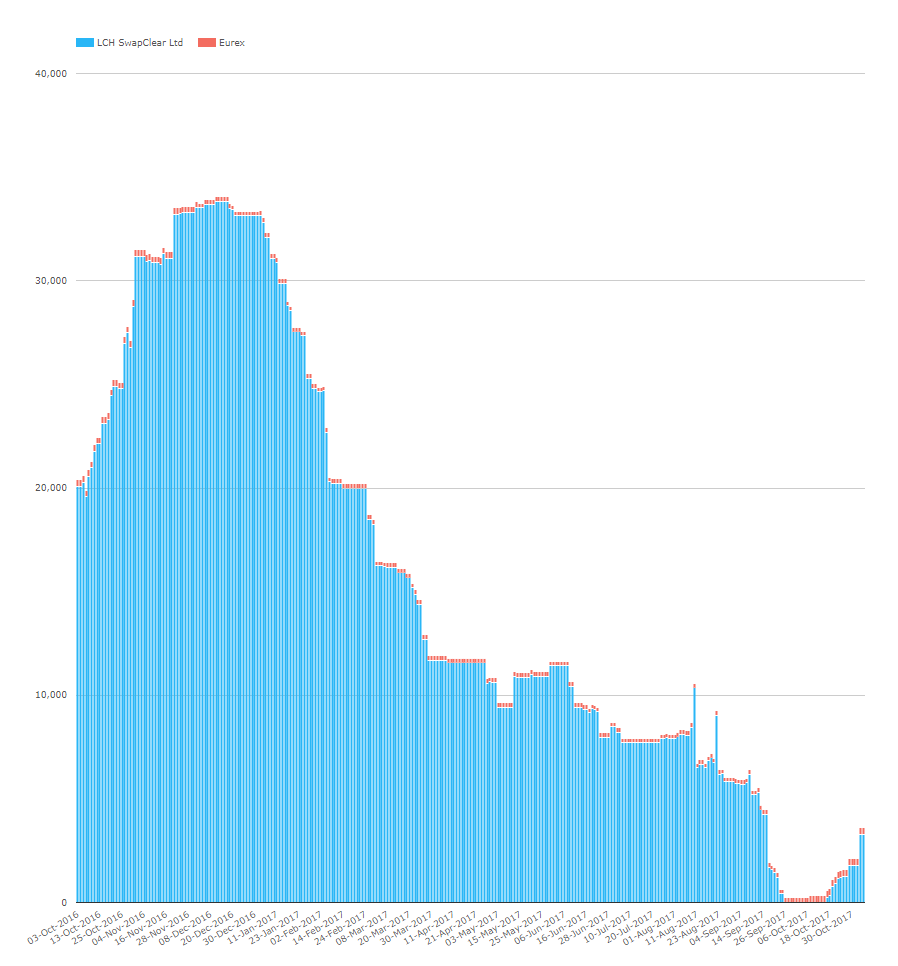

As per this announcement from LCH, there were no TOIS swaps outstanding at LCH by the beginning of October. From CCPView, we can see this in the data;

Showing;

- CHF OIS outstanding across all CCPs.

- Only LCH and Eurex have seen OIS volumes in CHF.

- Notional Outstanding at LCH reduced to zero on 26th September. Either the final CHF425m matured or was terminated on this date.

- There was no notional outstanding of TOIS swaps at LCH SwapClear until 17th October. This coincides nicely with the switch to PAI SARON discounting and the press releases, so we assume these swaps are now versus SARON. The first swap was probably CHF250m in size.

- Eurex still have CHF OIS notional outstanding which has increased by CHF115m in the past month. It has not followed LCH with a dip to zero.

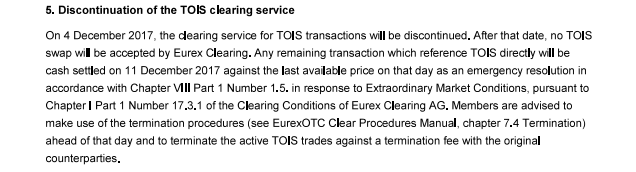

Eurex have seen CHF OIS volumes on only two days in the past year – October 9th and October 18th, totalling CHF115m. This added to Notional Outstanding, so was probably vs the SARON index. It is therefore fairly likely that CHF220m of the outstanding notional at Eurex references the old TOIS index. As per this Eurex announcement, market participants with outstanding positions should therefore be aware that:

It probably only applies to a single trade outstanding (which may even mature before the 4th Dec), and if so it may be due to operational reasons that some counterparties cannot yet book a SARON swap. Still, it will be interesting to monitor the data.

Current Volumes

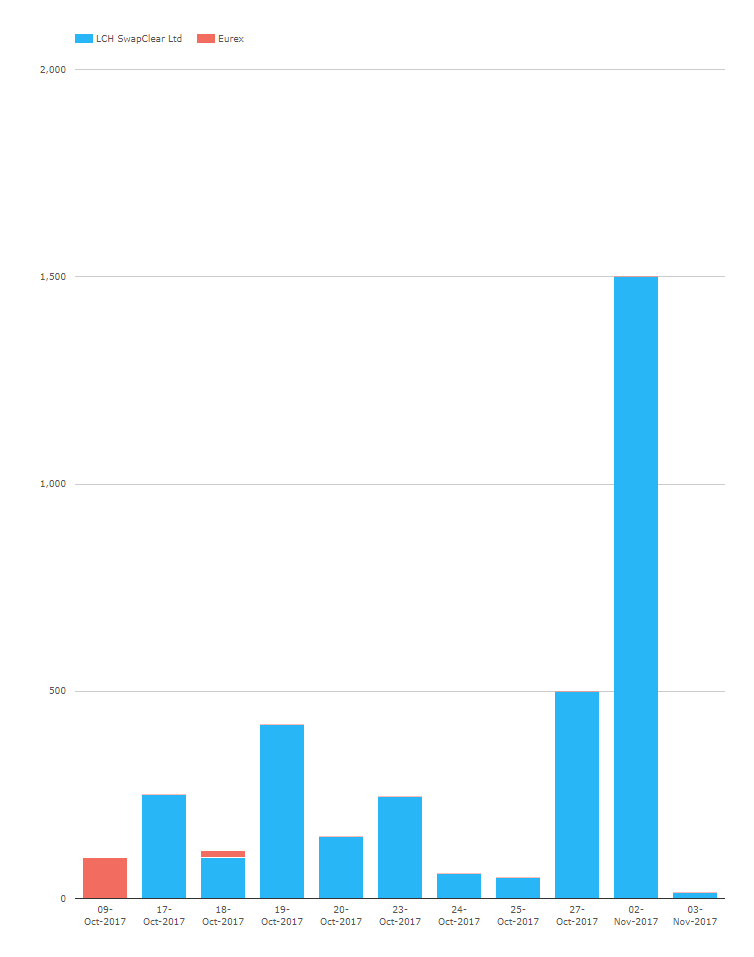

Remember that CHF OIS is not subject to a Clearing Mandate, so we only see a subset of trading volumes at the moment. Certainly, we see no volumes reported vs SARON to US SDRs (we have a neat way to split by index in SDRView). It’s hardly surprising that US person’s are not yet involved in this evolving market. However, it is worth looking at the global cleared volumes in the past month from CCPView:

Showing;

- Daily volumes in outright CHF OIS cleared swaps.

- A peak volume of CHF OIS of CHF1.5bn on 2nd November. This is versus SARON at LCH.

- We do not see daily activity yet – there was a six-day gap between 27th October and 2nd November between trades.

- Some test trades look to be going through – a CHF15m SARON swap is either a long-dated trade or (more likely?) a test trade of short maturity.

- LCH do not clear basis swaps of CHF Libor vs CHF SARON. Therefore we do not know what the volumes have been in the “SARON/Bor” basis market.

- As per the Notional Outstanding data at Eurex, it looks as if Eurex beat LCH to the chase with the first cleared SARON swap on 9th October? If this is true, I’m surprised there wasn’t more press about it!

So far, we know that Basler Kantonalbank, Credit Suisse and Zürcher Kantonalbank can trade SARON. It’s good to hear from Gottex that most banks are now operationally ready and we look forward to this coming through in terms of higher volumes in the future.

Monitor Volumes with Clarus

As with CCP Basis, NDF Clearing and UMRs we quickly see these changing market dynamics across our suite of Clarus data products. We’ll be keeping on top of this market shift just as we have done with previous market changes.

Subscribe to our data products now so that you don’t have to wait for me to write another blog on this to learn what is going on!