- Which jurisdictions currently have Clearing Mandates in place for Interest Rate Derivatives?

- There are lots of articles and sources of information about upcoming mandates…

- …but finding what is already in force is more difficult.

- We therefore take this opportunity to summarise the Clearing Mandates that are now active across multiple jurisdictions.

Sources

Before we look at any details, it is worth taking a bit of time to point our readers to the original sources of information for this blog. I have mainly used three sources:

- FSB – OTC Derivatives Market Reforms (11th progress report)

- IOSCO Information Repository for Central Clearing Requirements

- CFTC Clearing Requirement Determination

Where possible, I have tried to reference back to the documentation of the jurisdiction itself. This can be somewhat difficult, either due to language or due to links changing over time.

The goal of this blog is to give our readers a resource that covers a number of different jurisdictions, with an exclusive focus on Clearing Mandates currently active in Interest Rate Derivatives.

The blog will help all of those poor internet users, asking Google, “Should I clear my swaps?” As we see from Google’s predictions, not many people are asking about Argentina, India or Korea:

Whilst researching and writing the blog, it strikes me that this type of research readily lends itself to a Microservice, much along the lines of our “SEFMandatory” requirement checker. It intrigues me to think just how many different teams across banks, vendors and regulators are all taking different approaches to stay on top of this same information. Industry utility anyone?

Argentina

Well, I didn’t expect to start a blog with a Clearing Mandate in Argentina. Despite having blogged for 3 years about market reforms, I honestly had no idea about the Argentinian clearing mandate. It’s not been on our radar before.

With all of the jurisdictions, we will simply list the instruments that have been mandated to clear in a succinct manner. Apologies for the lack of commentary that this will entail, but there is a lot of information to condense into a single blog.

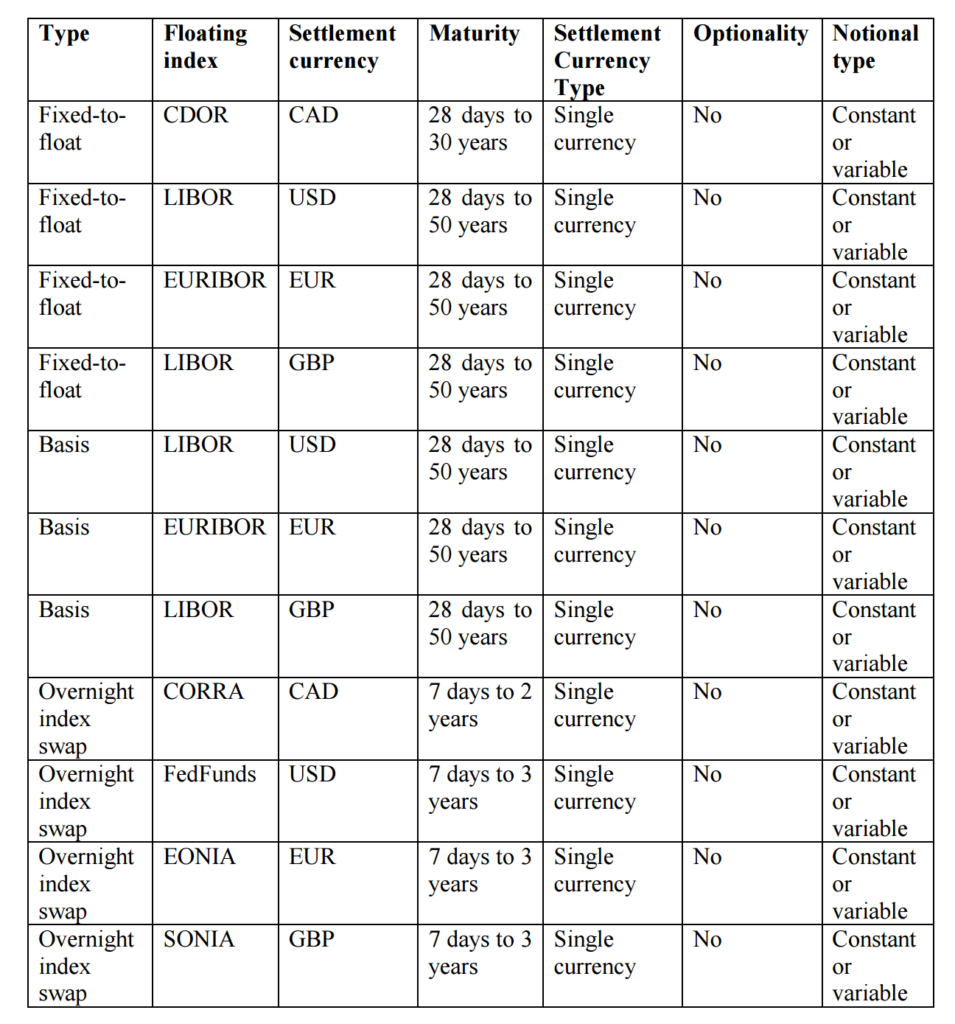

FRAs: ARS-denominated Floating Rate Agreements with a maturity up to 2 years, based on the BADLAR index.

Source: My Spanish is not good enough to go to the horse’s mouth on this one (http://www.mae.com.ar/default.aspx), therefore I have used IOSCO and FSB summaries.

Australia

Interest Rate Swaps: AUD, EUR, GBP, JPY and USD denominated swaps. Includes FRAs and single currency basis swaps.

Maturities: 50 years, except AUD and JPY (30 years).

OIS: AUD, EUR, GBP and USD (up to 2 years).

Clearing Threshold: $100 bn AUD notional outstanding.

Source: https://www.legislation.gov.au/Details/F2015L01960

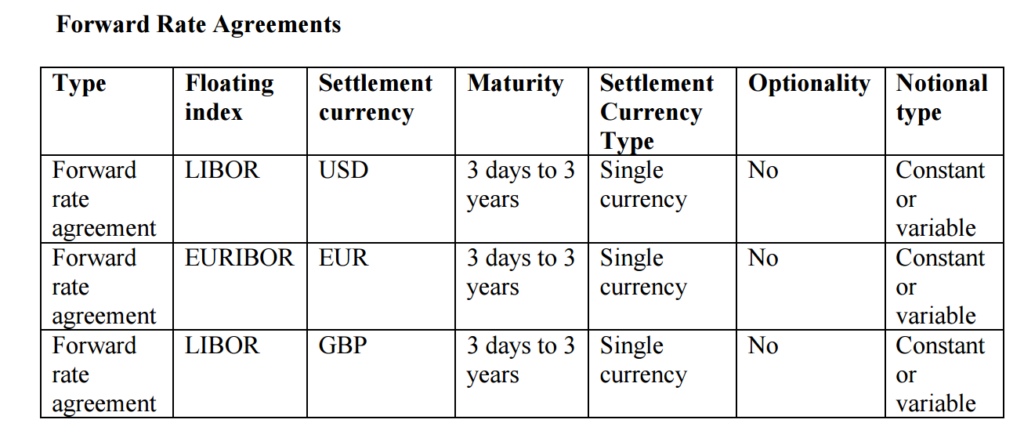

Canada

Interest Rate Swaps: CAD, EUR, GBP and USD denominated swaps. Includes FRAs and single currency basis swaps.

Maturities: 50 years, except CAD (30 years).

OIS: CAD, EUR, GBP and USD (up to 3 years, except CAD which is up to 2 years only).

Clearing Threshold: $500 bn CAD notional outstanding.

China

Interest Rate Swaps: CNY IRS versus both SHIBOR 3-month and Overnight (plus Index “FR007”?)

Maturities: up to 5 years.

Source: http://www.iosco.org/publications/?subsection=information_repositories

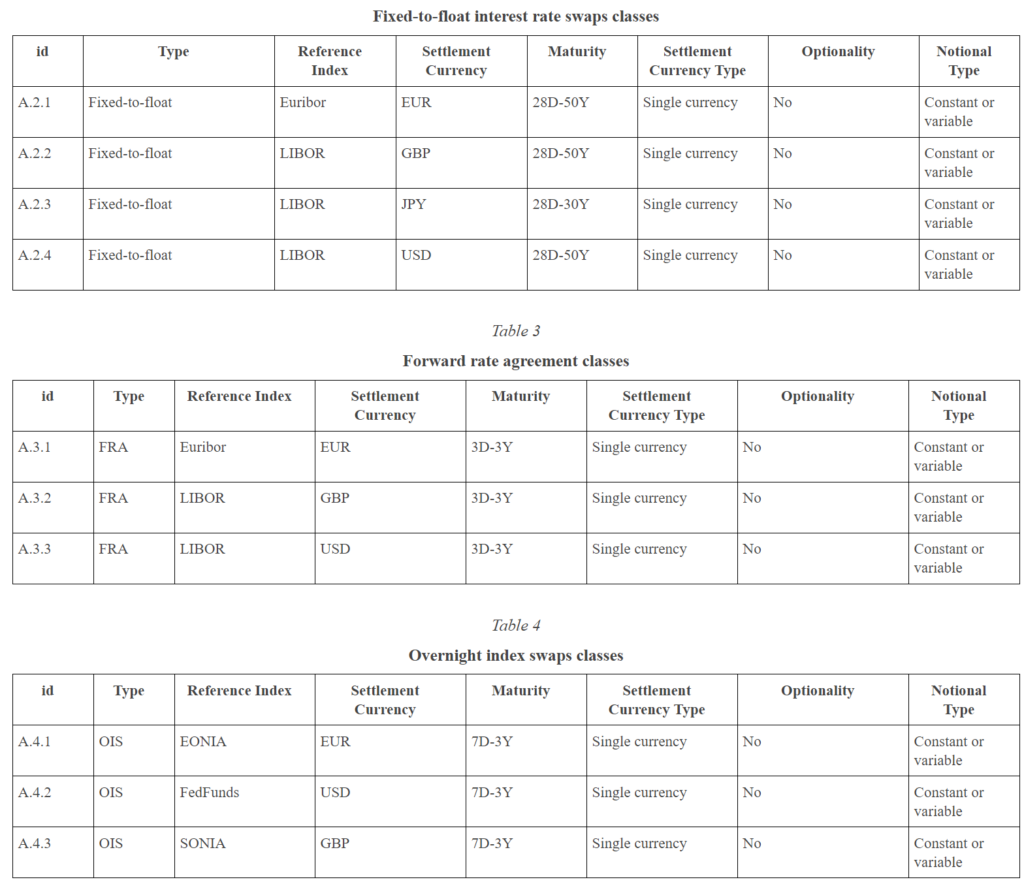

European Union

Interest Rate Swaps: EUR, GBP, JPY, NOK, PLN, SEK and USD denominated swaps. Includes FRAs and for USD, EUR, GBP, JPY also includes single currency basis swaps.

Maturities: 50 years for EUR, GBP and USD. 30 years for JPY. 15 years for SEK. 10 years for NOK and PLN. 3 years for FRAs (but only 2 years for NOK and PLN). I know, it’s not very clear for a clearing mandate (pardon the pun).

OIS: EUR, GBP and USD (up to 3 years).

Clearing Threshold: €3 bn notional outstanding of non hedging derivatives for non financial counterparties

Hong Kong

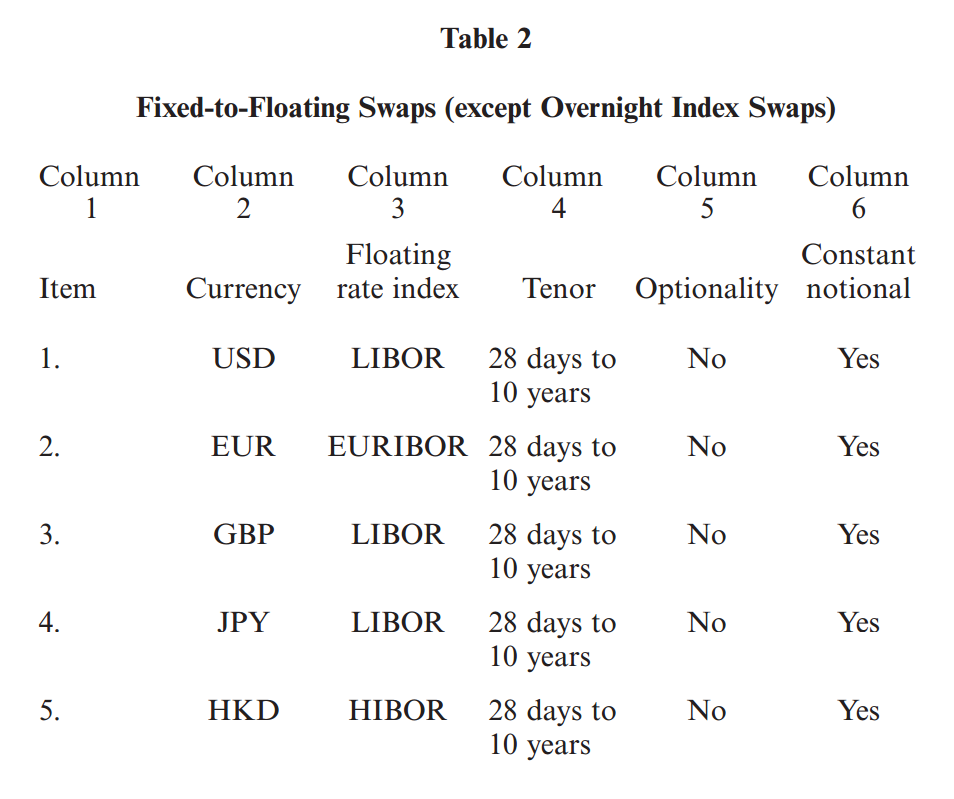

Interest Rate Swaps: EUR, GBP, HKD, JPY and USD denominated swaps. Includes single currency basis swaps.

Maturities: 10 years.

OIS: EUR, GBP, USD (up to 2 years).

Clearing Threshold: $20 bn (USD) notional outstanding.

Source: http://www.gld.gov.hk/egazette/pdf/20162005/es22016200528.pdf

India

I think only INR-USD Fx Forwards are under the Clearing Mandate. If our readers know or think otherwise, we will happily correct.

Indonesia

I think only Equity Derivatives are covered by the Clearing Mandate. If our readers know or think otherwise, we will happily correct.

Japan

Interest Rate Swaps: Fixed-float JPY Swaps, including basis swaps.

Maturities: Up to 30 years for Libor, and 10 years for Tibor swaps.

Sources: Amir’s blog, and IOSCO

Korea

Interest Rate Swaps: KRW denominated on-shore swaps at KRX

Maturities: Up to 20 years.

Source: http://global.krx.co.kr/contents/GLB/06/0601/0601000000/GLB0601000000.jsp# and IOSCO

Mexico

Interest Rate Swaps: Fixed-float MXN Swaps.

Maturities: Up to 30 years.

Source: http://www.banxico.org.mx/disposiciones/normativa/circular-4-2012/%7BF50E4EE6-3E7F-6BCB-0B82-A57D5487C3D2%7D.pdf and thank you Tod too!

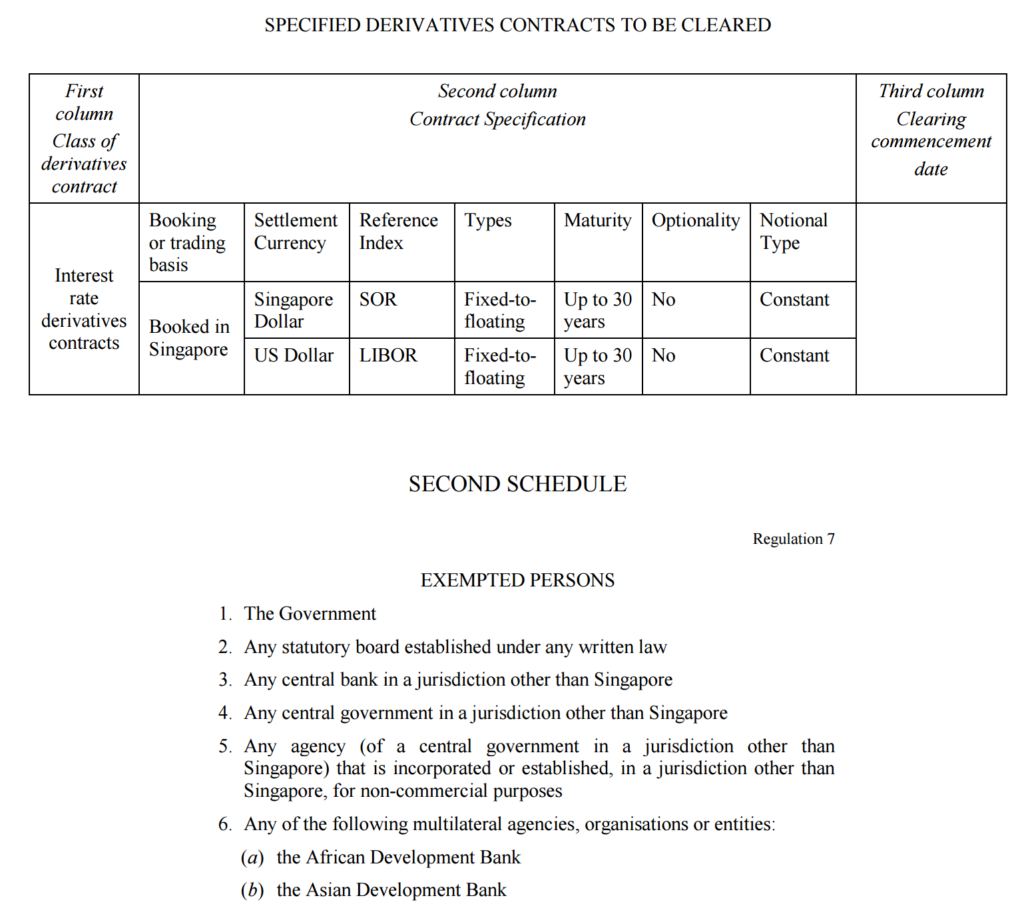

Singapore

The Clearing Mandate is not yet live in Singapore – this is still at the consultative stage (as of June 2017).

Interest Rate Swaps: SGD and USD denominated swaps versus SIBOR and LIBOR respectively.

Maturities: Up to 30 years.

Switzerland

Currently, I don’t believe that Switzerland have yet authorised or recognised a CCP:

The start of the clearing requirement depends on the authorisation or recognition of a CCP with a corresponding clearing offering in OTC derivatives transactions and subsequently on FINMA’s definition and publication of derivatives categories which are subject to the clearing requirement (see section 7.3 below). This has not yet occurred.

Therefore, “Annex 1” of the FMIO-FINMA currently still sits empty. In the future, this will define the derivatives falling under the Clearing Mandate:

Sources: https://www.admin.ch/opc/en/classified-compilation/20151784/index.html and https://www.finma.ch/en/supervision/financial-market-infrastructures/

United States

Interest Rate Swaps: Fixed-float swaps in AUD, CAD, CHF, EUR, GBP, HKD, JPY, MXN, NOK, PLN, SEK, SGD and USD denominated swaps.

FRAs: EUR, GBP, JPY, NOK, PLN, SEK and USD.

EUR, GBP, JPY and USD also includes single currency basis swaps.

Maturities: These vary by currency pair. I would encourage you to download the IOSCO spreadsheet for the complete picture.

OIS: AUD, CAD, EUR, GBP and USD (up to 3 years, apart from AUD and CAD which only go up to 2 years).

Source: http://www.cftc.gov/PressRoom/PressReleases/pr7457-16

Summary

Before we end, it is worth noting that for those also interested in upcoming regulations, both ISDA and SwapClear provide comprehensive timelines on upcoming regulations.

- We review Clearing Mandates currently active for Interest Rate Derivatives around the globe.

- As of June 2017, we count 11 jurisdictions with active clearing mandates.

- There are a couple of dichotomies – for example, neither the EU nor Switzerland have mandated CHF IRS for clearing, but the CFTC have.

- Implementation timelines have varied, but we are beginning to see a more harmonised picture.

- The FSB provides an annual progress report. The next one will be published this Summer.

hi Chris

afaik Singapore does not have a clearing mandate yet – what you posted was the proposal in a consultation paper. I think they are looking to announce the final details and timeline some time later this year.

cheers

Mike

Many thanks, updated.