Guest Blog Series

Guest Blogger Profile: Interest Rate Swaps trader. 12+ years’ experience, European and cross markets focused.

When Amir approached me to guest write for the blog, I thought I would use the data to shine a light on the daily peaks and troughs of a swaps trader. After a few years trading, market participants get a feel for the daily and monthly rhythm of the markets, and I wondered if some of this might show up in the data. I traded EUR swaps, and ECB meeting days were typically associated with plenty of shouting, plenty of excitement and pretty wild price swings. However, actual trading volumes always seemed quite lacklustre. Does the data therefore back up the fact that, on ECB days, many Swaps traders simply sit back and watch their screens – or maybe even take an extended lunch?

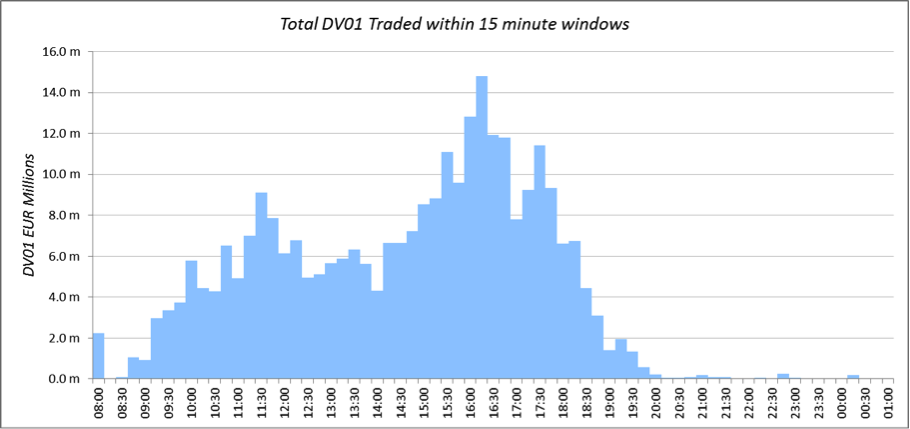

First off – the analysis. Using the historic export functionality in SDRView, it is easy to build up a database of all EUR Fixed-Float swaps for a given time period. I chose May 1 to June 10, so that we encompass two ECB meeting dates. For personal preference, I prefer to look at the DV01 (i.e. the amount of risk), therefore I used a simple conversion to estimate a DV01 for each reported swap based on the length of the contract. This then allows us to display the DV01 that trades within 15 minute intervals throughout the trading session:

Times are all CET. Immediate observations:

- Trading begins around 8:00 CET and ends 11 hours later at 19:00.

- Trading volumes are largest when the crossover between European and American working days is greatest. This is mirrored to some extent with the crossover between European and Asian hours, although it is surprising volumes are not greater earlier in the day.

- European Swaps traders certainly enjoy a lunchtime lull – more of this later!

- €172k was the average DV01 reported in a 15 minute session during the 28 trading day sample – equivalent to almost €175m 10 years (This is an approximate figure as the data includes block trades, with a capped reported notional)

- The peak time slot for trading is between 16:00 – 16:15 CET when over 3 times as much risk typically changes hands.

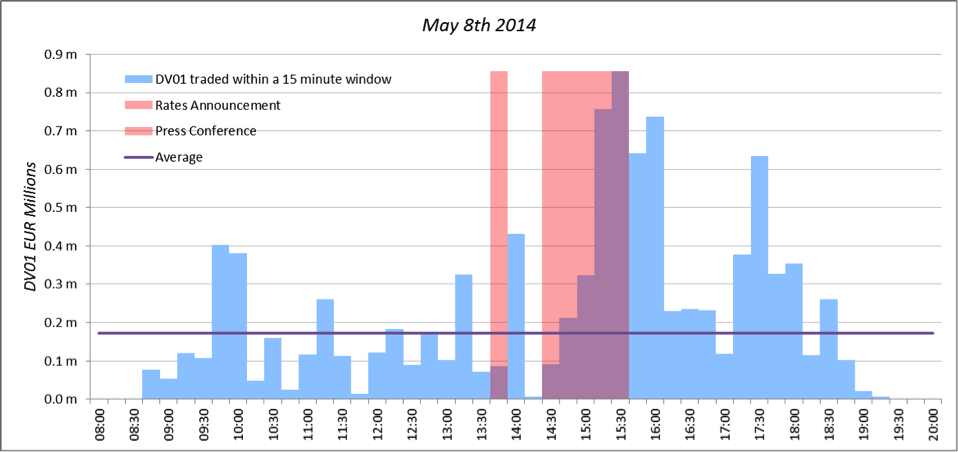

We’ve had two fairly monumental ECB meetings within the sample period. Whilst rates stayed unchanged on May 8, Draghi’s remark “that the Governing Council is comfortable with acting next time” was a surprisingly firm pre-commitment from a Central Banker. From the data, we see that these remarks ignited a burst of activity in EUR Swaps trading:

- Following the pre-commitment, all but one of the 15 minute intervals had above average activity until the 18:00 “close”.

- Trading activity was 5 times greater than average as the press conference came to an end.

- Pitiful volumes are seen around the actual rates decision.

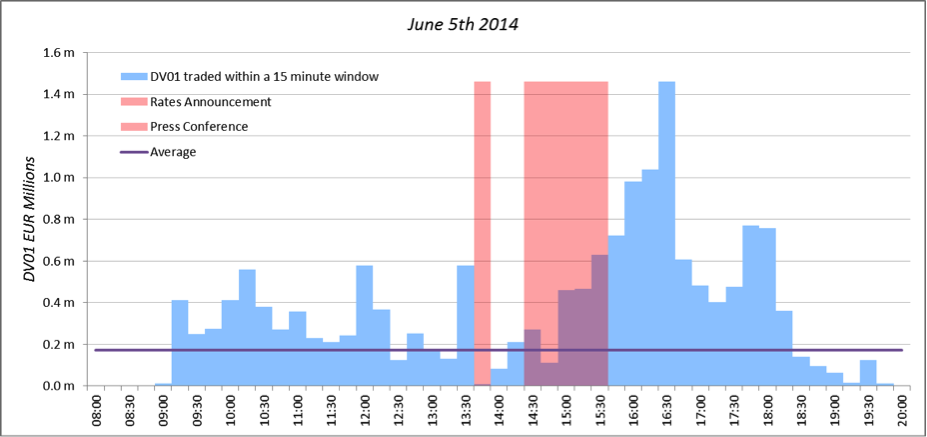

If we now jump forward to this month’s meeting, it looks like much of the EUR Swaps market was out to lunch….

- Despite the lengthy raft of policies announced the swaps market struggled to digest the measures[1]. Volumes did not peak until 2 hours after Draghi started speaking.

- Nonetheless, peak volumes were remarkably high – 8.5 times higher than average during the popular 16:15-16:30 time slot.

[1] Indigestion after a long-lunch…? To recap, the measures included a negative deposit rate, a €400bn 4 year Targeted LTRO, a suspension of sterilisation operations and extension of Fixed Rate Full Allotment until December 2016, plus a readiness to buy Asset Backed Securities.

Relative to the historic measures being taken, the lack of activity during the June press conference is somewhat surprising, although it may highlight the telegraphed nature of policy announcements.

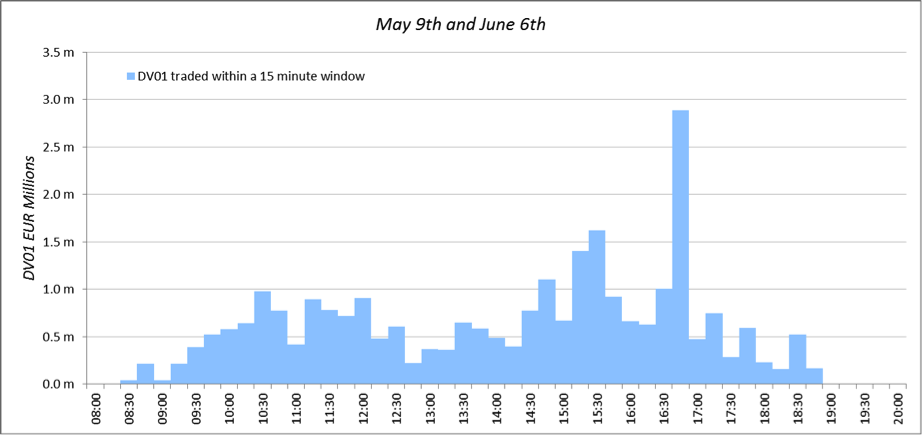

If EUR swaps traders could afford to take it easy during this month’s press conference, they were certainly at their stations the day after the ECB meetings (May 9 and June 6 respectively):

The data shows that a total of €27.1m DV01 traded on the two days following an ECB meeting, compared to a daily average of €10.1m. €2.9m DV01 traded in the two 16:45-17:00 time windows alone. It would appear that both European and American accounts prefer to trade only after pondering the ECB’s policy manoeuvres for quite some time – they then take action to reposition portfolios accordingly.

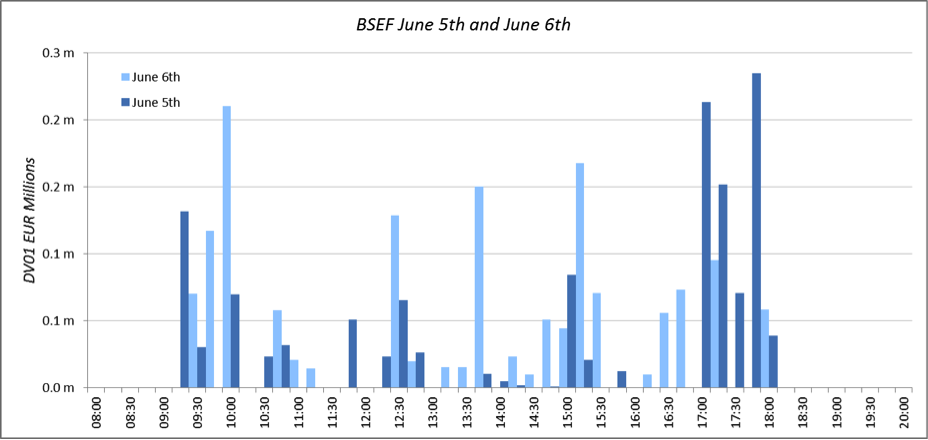

Approaching the analysis from another angle, we can look at client flows on the BSEF versus what the inter-dealer community is doing on the DTCC flows. The data shows a different behaviour within the client flows:

- Over 50% of flows on BSEF occur during the 17:00-18:00 window on the day of the ECB meeting (June 5, dark blue bars).

- Flows are evenly distributed though-out the following day. Interestingly, the peak is seen in the morning session at 10:00 (June 6, light blue bars).

Do we therefore see a dichotomy in the behaviour of market participants? Do clients rush to reposition portfolios as soon as liquidity is available from dealers? Are dealers so busy hedging customer flows, pricing customer structures and shouting at colleagues that they need to wait until the Friday close to reposition themselves? Time will tell, but for now we only have one ECB meeting to compare as BSEF did not come on-line until 12 May.

Either way, the data explodes a couple of myths about the trading floor:

- The trader’s lunch is alive and well. If you want to take a trader for lunch, arrange it over an ECB Rates announcement.

- For trader’s seeking a work-life balance, it pays to stay late on the day after ECB rate meetings.

And just one final thought – is it possible that the Non Farm Payrolls announcement on Friday afternoons is actually a bigger driver of European Swaps markets than ECB policy? I’ll leave the analysis of USD Swaps markets to the users of Clarus to make a judgement call on that one.