It is now more than two months since European EMIR Trade Reporting came into operation. Time to see whether teething problems have been solved and look at what the public data shows.

Those of you that read my articles on Swap Data Repositories will know that I am a great proponent of the value of the CFTC regulated real-time public dissemination feeds available in the US. So it was with great interest and anticipation that I went to the European Trade Repository websites. I knew that current EMIR trade reporting regulation is not real-time but T+1 and the public data is to be published weekly. Despite this I expected to find interesting and valuable information.

Lets start with the three major trade repositories; DTCC, UnaVista and Regis-TR.

And focus on two Asset Classes: Interest Rate and Credit.

DTCC Repository

The DTCC Derivatives Repository Limited Public Data can be found here.

What does it show?

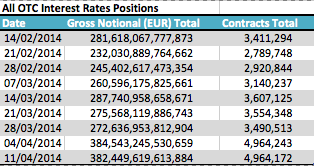

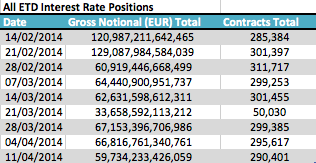

Firstly for each Asset Class and split for OTC and ETD there are weekly reports of Outstanding positions and number of contracts.

These start from 14 Feb 2014 (the commencement of EMIR reporting) and the last one is for the week ending 11 April 2014, so two weeks old.

Lets show the Interest Rate data from each weeks Table 1 report.

From which we can see that:

- OTC Interest Rates positions are €382 trillion in the week ending 11 April

- These consist of almost 5 million trades (contracts)

- Giving an average contract size of €77 million

- There is a large increase in the week ending 4 April

- 1.5 million trades or €112 trillion!

- While I would like to believe this is year end relate volume

- Given the huge numbers that is not possible

- Much more likely to be reporting coming on stream that was not present before

- ETD Interest Rate positions are €60 trillion in the week ending 11 April

- These consist of 290,000 contract positions

- Volumes in the week ending 21 March look suspicious

- But may be down to the IMM date when volumes rolls to the next contract

- ETD gross notional is 16% of OTC gross notional

- Or put another way the OTC Interest rate market is more than 5 times as large as the ETD one

- (Based on figures reported to DTCC, which is not the whole European picture)

Now aggregate totals for outstanding notional and number of trades is of limited value.

Even comparing the weekly changes is fraught with difficulties; maturing trades, terminations, new trades etc.

What we need is not only outstanding volumes by currency, product, maturity but also the new transactions in the same period by currency, product and maturity.

Unfortunately while there are place holders on the DTCC page for such reports, there is no data.

We cannot see currency, product, maturity.

The data currently available is only of passing academic interest.

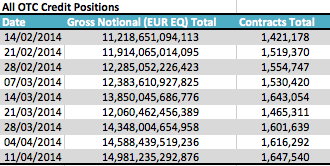

So I will show a table of Credit Volumes and move swiftly on.

UnaVista Trade Repository

What can we get from the LSE UnaVista Repository?

The public data is available here (registration required).

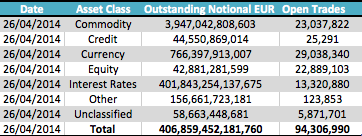

After registration, the only data I was able to see is the following:

- No weekly history

- No OTC or ETD Breakdown!

- No Currency, Product or Maturity

- No new transactions

- Oh well, underwhelming to say the least

- What can we see from this?

- The Interest Rates gross notional is €402 trillion

- Similar to DTCC

- And not surprising as we know that LCH SwapClear reports to UnaVista

- (We know SwapClear shows $400 trillion outstanding)

- While major Swap Dealers report to DTCC

- (Don’t forget that in Europe both sides to a trade are required to report)

- So we may assume that the €402 trillion at UnaVista and the €382 trillion at DTCC are the same trades

- Super 🙁

- Open Trades at 13 million cannot just be OTC, in-fact must largely be ETD

- (As SwapClear has @ 2 million trades)

- Can we really add OTC trades and ETD trades and expect any meaningful figure?

- I think not.

- Credit is tiny at €44 billion compared to the €15 trillion at DTCC

- Presumably this is because LCH Clearnet Credit is reported to UnaVista while ICE is reported to DTCC

Overall the UnaVista public data is even more under-whelming than the DTCC public data.

Probably not even of passing academic interest.

Onward.

REGIS-TR Trade Repository

What can we get from REGIS-TR?

The public data is available here.

And there are two reports available; aggregate open positions and aggregate transaction volumes.

Both have weekly and monthly versions.

The Aggregate Open Positions at least has currency breakdowns.

However again there is no OTC and ETD breakdown!

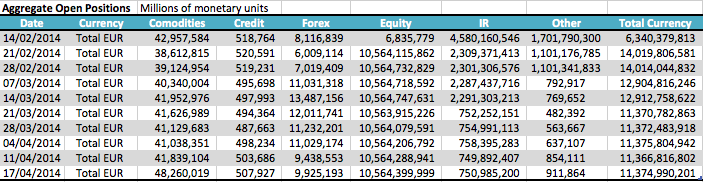

Lets take a look at the Aggregate Open Positions data.

- Interest Rates shows a €750 trillion open position!

- Mind you this is down from €2,291 trillion on 14 March!

- Even assuming Eurex Futures are here, I don’t know what to make of these figures

- (Eurex IRD Contracts Open Interest (on 28 Apr) is €703 billion)

- So the Interest Rates figures look too large

- (Perhaps the units are not millions as the report says but thousands)

- Credit shows €507 billion, which at least is believable

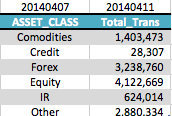

And the transaction volumes report?

The total transactions in the week of April 7-11, by Asset Class.

Presumably this includes both OTC and ETD trades making it much less useful.

So there you have it.

Summary

EMIR Trade repository public data reporting is now operational.

Aggregate weekly reports are being published.

The three main TRs; DTCC, UnaVista and REGIS-TR are publishing on their websites.

The data is very disappointing.

It has no real-world use.

EMIR regulations have failed so far to produce anything useful in terms of public data.

This is because:

- The public data is at too high an aggregate level.

- Aggregating across TRs is impossible.

- (Both parties reporting, possibly to different TRs, means we don’t know whether we are double-counting or not)

- (And the lack of a Unique Trade Identifier (UTI) in the public data, means we cannot address this).

- This means we cannot get an overview of the European market volume.

- Aggregating OTC & ETD trade counts and notionals is not useful.

- There is none (or little) currency and product detail available.

- The data is far from timely.

- First as it is only reported T+1 to TRs (and not real-time as it should)

- Secondly as it is being made public on a weekly basis with a lag of one or two weeks.

- There is no trade level data with prices and notionals.

What more can I say?

Some Thoughts

I really hope that the new MIFID II Directive provides some sanity and clarity to this.

Just following the CFTC Trade reporting regulations would produce a far far superior outcome.

Otherwise what is the point of all that investment in trade reporting?

No benefit is being realised in the transparency provided to the public.

Is some benefit being realised by regulators?

Your guess is as good as mine.

In the meantime, I would say to each of the Trade Repositories.

Please improve the granularity of your public data, as far as possible within the current regulations.

And there is a lot of room for improvement within these.

It is also incumbent on all of us in the industry to point out the failings in the regulations.

As European tax payers, we expect our politicians and institutions to create and implement effective regulations.

Anything less is a waste of time and money.

A missed opportunity.

Thanks Amir. Not really surprised that the output is not of great use from EMIR TRs. However, it reinforces the message to have you try to interpret it and really get not much out of it!

My prescription for fixing TRs and SDRs is at the bottom of the post at the link below.

The problem with this recipe is it is a change of premise at the very root of the rule making i.e. to separate responsibility for delivering data to the SDRs / TRs from the decision of which SDR / TR a participant or CCP wants their trades to come together at. Nonetheless the idea is simple despite the unravelling of rules which might be required to execute it.

http://www.theotcspace.com/2013/11/01/regulation-reflections-us-reporting-is-systemic-risk-being-de-prioritized