- We’ve recently added Margin Valuation Adjustment analysis into CHARM.

- As we’ve talked about in the past (here and here), MVA is a cost to the business because Initial Margin has to be funded for the holding period of a trade.

- This blog considers FVA – Funding Valuation Adjustment – caused by the Variation Margin of trades.

- All Swaps impart a funding profile on the contract counterparties. Increasingly, this funding is being charged at a spread to OIS.

- Whilst it is debatable whether FVA should be applied to all trades, it is valuable to have the analytics in place to manage these additional costs across a portfolio.

Price Adjustments

MVA is concerned with Initial Margin pricing adjustments. What about pricing impacts from Variation Margin? This is where FVA, a Funding Valuation Adjustment, comes into play.

Consider an at-market swap between a client and dealer. The client does not want to post daily margin against this position, therefore there is no CSA in place. The dealer will still have to hedge this trade with a cleared swap (due to liquidity), requiring daily margin posted against it. The swap dealer is now posting collateral every day against the mark-to-market to the Clearing House.

Today’s blog is concerned with looking at the pricing implications from this.

The Clearing House will pay PAI (Price Alignment Interest) at OIS on this collateral. So are we okay to also price the client trade at the risk-neutral discount rate – typically OIS? The answer is – it depends!

If we consider the cleared swap, what will the swap dealer do with the collateral paid/received each day? Typically on a swaps desk, this will be funded with an internal Treasury desk (who will then amalgamate all of the firm’s positions and actually receive/post the collateral for the firm). Will the Treasury desk fund the swaps desk at OIS or OIS plus/minus a spread? Sadly, the Treasury desk does not provide their services for free, so they will charge a spread. Essentially, the swap dealer has committed to the following:

Receiving/paying overnight collateral for the life of the swap on a variable mark-to-market amount. This will be funded with the Treasury desk at a (variable) spread to OIS.

That doesn’t sound like a great trade, right? Those are two large unknowns – how much collateral will the swap dealer fund as the mark to market of the swap varies, and what rate will the internal desk charge to manage this collateral.

So, should that cost be passed onto the client? That’s a tricky one, and one that we’ll revisit at the end of today’s blog.

Cleared At-Market Swaps

Taking this concept even further, we can look at FVA for any type of swap. The fundamentals are as follows:

- I cannot manage my collateral friction-free.

- Any cash that I receive, I will be charged a spread to e.g. OIS to deposit with my collateral management/Treasury guys.

- Any cash that I have to pay-out, I will be charged a funding spread to e.g. OIS to borrow off my collateral management/Treasury guys.

- For a cleared swap, I will receive (pay) PAI, Price Alignment Interest from the CCP, on the collateral amounts that I post or receive. However, this will be calculated at OIS flat.

- FVA arises due to the difference between this theoretical OIS flat funding rate and the one that I am actually able to achieve in the market (OIS plus or minus a spread).

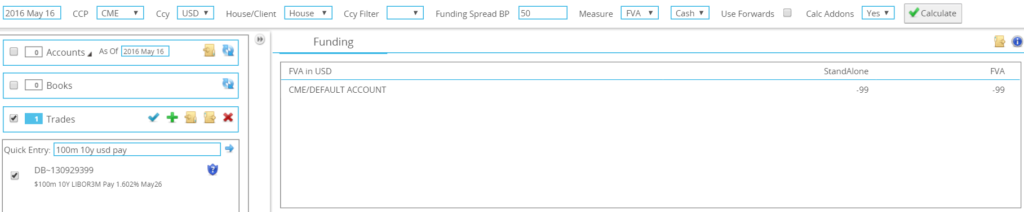

Taking these funding spreads into account for a swap raises some interesting questions. Take for example an at-market swap with zero mark to market. If we calculate a “vanilla” FVA amount for this swap in CHARM, we see a zero value, as expected:

Showing;

- A pay-fixed 10y USD Swap in $100m at 1.602%

- The mark-to-market is close to zero (-$99)

- We present the FVA amount in USD terms in the screen above. If we changed the measure to Basis Points, we would see that this amount equates to 0.00 basis points – i.e. there is no discernible impact on the price of the swap.

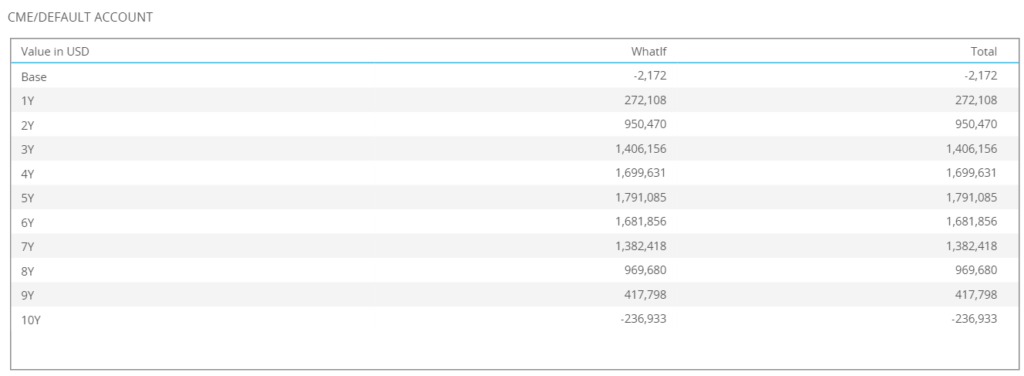

What happens if we now roll our curve forward to annual points in time? By realising the forwards on the curve, we can simulate where interest rates are expected to be in the future and hence calculate the expected mark to market of the swap at different points in time:

Showing;

- An initial mark to market of close to zero, because no cash-flows have taken place.

- Within one year, the mark to market has increased to +$272,108.

- After five years, it is at +$1,791,085

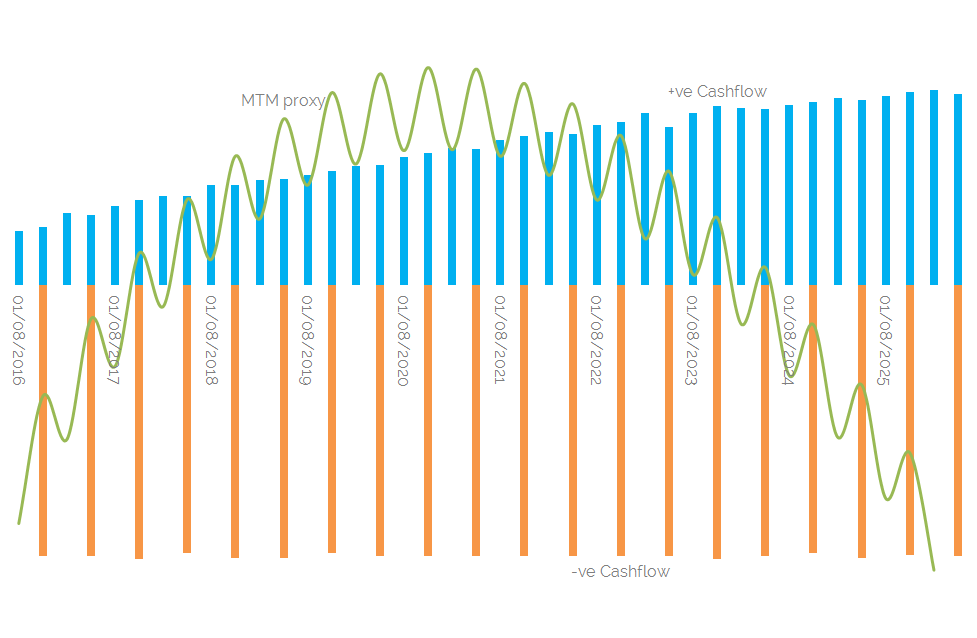

It may not be intuitive why the mark-to-market of an at-market swap is changing like this. But when we drill-down into the cash-flows of the swap, we can see that this is due to the timing difference of the cash-flows:

Showing:

- The cash-flows of a vanilla 10y USD Swap, Semi-Bond versus 3m Libor.

- The fixed semi-annual cash-flows are the negative, orange bars

- The expected floating quarterly cash-flows are the positive, blue bars

- A rough proxy for the Mark to Market at each point in time as shown by the green line. It jumps on every interest payment date.

- It peaks at five years, just as we saw with the forward profile from CHARM.

Funding Value Adjustment

Due to this inherent variability of the mark-to-market (caused by cash-flow timing), any swap therefore imparts a funding obligation on the two counterparties. Because I don’t necessarily receive the same rate of interest on my realised cash-flows as I am charged to raise collateral, this friction may need to be added to my calculation of fair value for any swap. We therefore use CHARM to project the forward profile of the mark-to-market to calculate the theoretical FVA given a funding spread (expressed in basis points to the underlying OIS curve).

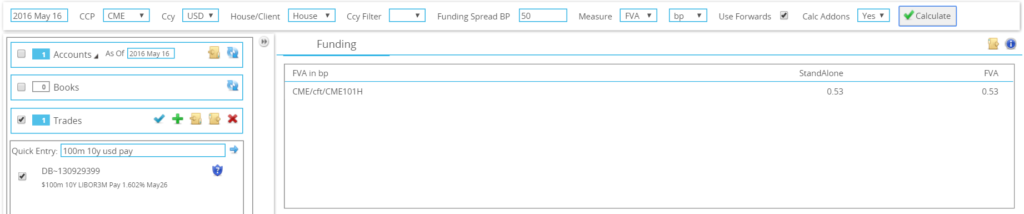

Showing;

- At a funding spread of 50 basis points over OIS, if I were to only transact a single pay fixed 10y USD Swap at market, this trade has a funding impact over the lifetime of the swap of over half a basis point.

- This is because I know I will have a positive mark to market as soon as I pay away my first fixed coupon in six months time – which is at a much higher rate than the first projected floating cash-flows. I am effectively lending that cash-flow against receiving it back at a later date.

It is important to note that I will still receive PAI, Price Alignment Interest, from the CCP on this collateral amount that I post or receive. However, this will be (typically) at OIS flat. FVA arises due to the difference between this theoretical OIS flat funding rate and the one that I am actually able to achieve in the market (OIS +/- a spread).

Should this be applied to all swaps?

There are many reasons why we refer to the above as a theoretical FVA:

- Incorporating an at-market-hedge (a “perfect” hedge) that is cleared at the same CCP, will collapse this down to zero. Therefore we don’t necessarily have to pass this charge onto a client.

- This cost (or benefit!) is highly dependent on the holding period of the swap (similar to MVA).

- Isn’t this really just the cost of “doing business” in the swaps market? Some would argue that the pre-existing bid-offer spread for a market maker already includes compensation for this type of friction.

- On the uncleared, uncollateralised client trade, my “credit charge” on the swap may already incorporate this type of future exposure.

- If a swaps desk has either a) a zero cost of funds or b) is allowed to use its’ retained profits/realised cash to fund its’ ongoing business activities, the effective funding spread should be much smaller than on a standalone basis. That is a pretty big “IF” if you work in a global bank and have to fund yourself by way of your internal Treasury desk.

But there are just as many reasons why this is a practical number as well:

- If I have to exit my swaps business tomorrow, I need to auction off the future cash-flows – be they cleared or uncleared. The funding profile of those cash-flows is relevant, as anyone bidding on that portfolio will not be able to rely upon the “realised” cash that is sat on my balance sheet.

- The cost of raising and managing collateral is real. This is why it is a centralised service per firm and why swaps desks don’t fund themselves .

- I cannot rely on “the next trade” to subsidise the trade I am pricing right now. Even a spot starting swap versus a one week forward will introduce a cash-flow imbalance onto the portfolio. These one-week gaps have to be funded for the life of the trade – at a cost.

In Summary

- FVA is a subjective pricing adjustment.

- Ignoring it will whittle away a swaps desk’s profitability over time.

- Ignoring it is akin to having a structural negative carry on your book (paying high interest now with the expectation to receive it back over time).

- We can help. CHARM shows you the funding profile to which you are committing – for a standalone swap or (more relevant) for a portfolio.

- We convert this funding profile into a cost of funds over the life of the trade.

- Relationships, variability in holding periods or simple competitive pressures mean that FVA will not be applied to every swap. But it remains a relevant pricing input.

- We believe it pays to have the data in front of you. It should form another key part of the decision-making process.