If you’re like me, you’ve read the news on negative swap spreads and tried to sift through the reasons behind it. On the surface, it seems such a basic premise that swap spreads need to be positive – surely there is an arbitrage out there.

So I set out to understand it better by seeing how I would arb this apparent misbalance, in much the same way that I had attempted to understand the CME/LCH basis by trying to arb that market.

Fundamentals

The CME/LCH basis arb was straightforward – buy a swap (pay fixed) at LCH, sell it (receive fixed) for a higher price at CME, and finance your broker margin calls. It broke down when you discover that financing the initial margin with your broker eats up all the gain on the swap positions (at least at the prevailing rates at the time).

The swap spread “arb” is also fairly simple. Buy a bond (receive fixed) and buy a swap (pay fixed). The swap has a natural funding leg where you receive float, and naturally you would pay for the bond (finance it) by pledging it for repo where you pay interest.

And if you need a refresher on the basics of swap spreads before we begin, look no further than Chris’s article.

Overly Simplified Example

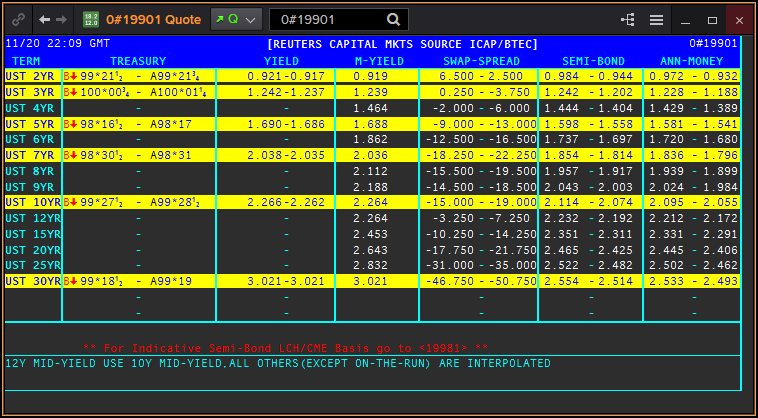

Let’s consider a simple example with some market prices, courtesy of the ICAP screen below:

Let’s take the 5 year. The logical play here is to:

- Buy the bond yielding 1.688% at mid (receive 1.688% semi-annually)

- Enter into the swap at 1.578% at mid (pay 1.578% semi-annually)

- This locks in +11bp. Happy days.

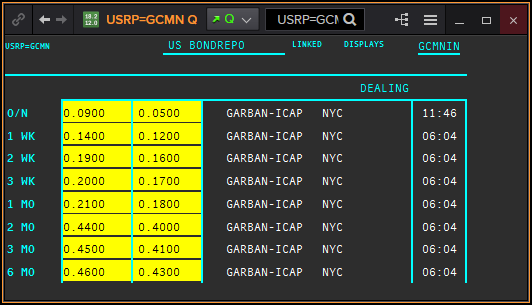

Of course we’d have to come up with the cash to finance the purchase of the bond. Let’s bring up another ICAP page to see what it would cost:

Assuming we were playing with $100m principal of the bond, at current prices we’d need ~ $98.5m in cash. And if I wanted to stick to 3 month funding (to nicely match up with the swap), and crossing the spread, that would be 45 basis points (paying interest on $98.5m at 0.45%).

And herein lies the rub. Continuing with overly simplistic math:

- I’d be funding this position at 45 basis points (paying the 3month repo rate every quarter)

- My swap funding leg (receiving LIBOR floating every quarter) most recently (on 20-Nov) settled at ~34 basis points.

- -11 bp gone

The Solution (Or the Joke?)

In that example, I’ve locked in 5 years of fixed interest rate payments and receipts for +11bp. However I only got as far as securing the first 3 months on the funding legs, but already it appears a disaster.

If only there was a cheaper way to fund this bond purchase; perhaps some uncollateralized borrowing I could tap into.

Of course the logical answer would be to borrow at LIBOR. If we could borrow at LIBOR, the funding legs in our math above would truly offset, leaving us with the string of fixed payments where we are collecting the +11bp spread.

Suffice to say that firms have considered this. It raises the question: what is LIBOR, if it’s not the rate that banks can borrow from each other at?

That’s a topic best explored by better academics than I.

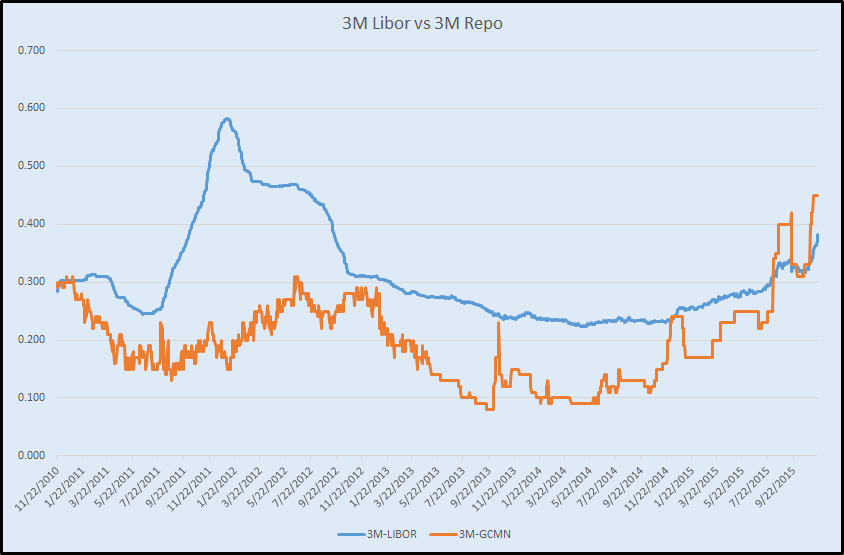

Repo vs LIBOR

To see why this is a recent phenomenon, look no further than 3M Libor vs Repo rates, as in the chart below. This nicely shows borrowing at 3M repo rates now (orange) more expensive than 3M Libor (blue). So when you hear that secured borrowing against government securities (orange) is more pricey than a simple promise (blue), this is it:

A More Detailed Analysis

My objective here was to truly try and run all of the numbers as if I were to arb this position. However it became evident very quickly what the problem is. Not that it can’t be done, but it would very much depend on:

- Your ability to borrow

- The amount of capital you would need to set aside for taking on leveraged positions

Further, I should point out that I only got as far as an overly simplistic example. To make it more realistic, I would need to:

- Account for securities haircuts in my repo (would reduce the amount of funding I could get)

- I used the YTM (1.69%) for the bond in my fixed rate calculations which gave me +11bp income. With the bond trading at a discount, I’d have to account for the fact the current yield is much less – the current bond pays only a 1.375% coupon – so this would increase my funding until the bond matures.

- I considered the 3M term repo rate, which is likely nowhere near as liquid as overnight repo

- My horizon didn’t go past the first 3M funding horizon – the real play on the swap spread is to then roll the repo every 3 months. Any spread should equate to the strip of 3M repos. (For which I could start looking at products like repo futures traded at ICE). Alas I gave up when non-collateralized funding proved cheaper.

- I didn’t get to play with CHARM to find out how much it would cost to finance the swap margins at my clearing broker

- I didn’t consider any other overheads

Summary

Something very odd is indeed afoot. Whether its balance sheet pressures driving the re-pricing of repo, fire-sales of bonds or lack of interest to purchase them, short covering of positions, etc, etc, at least now you can see how these elements start to impact the pricing of the swap spread.