- The BIS publish Semiannual OTC Derivatives Surveys which are complemented by a broad-ranging Trienniel Survey

- Clarus data, available daily, reconciles to within 2% of these BIS Surveys

- Our explanation of the data methodology will help anyone interested in market volumes

- The BIS have a broad-based and narrow list of reporting dealers which can affect the interpretation of data

- Depending on the BIS data, the notional of a cleared trade may be double-counted

- Some BIS measures exclude inter-affiliate trades whilst others include inter-affiliate trades

- The BIS data is a vital source of transparency for our markets therefore it is important to understand it

Data Comprehension

We think data is important at Clarus. We believe that data should be easy to consume – both in terms of accessibility and comprehensibility. It is because of this that we spend our time looking at data and reconciling different sources.

One such source of data is the BIS. They provide a lot of data on Interest Rate Derivatives, covering both Cleared and Uncleared markets. Their website provides easily digestible statistical summaries, a statistics explorer and a statistics data warehouse. These tools are vital to improving transparency in our markets.

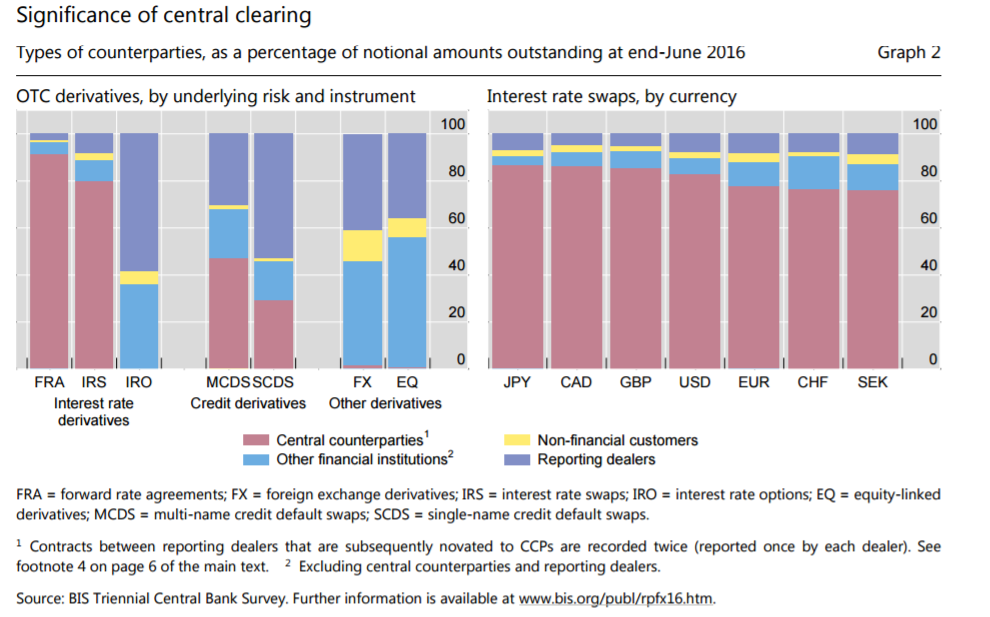

In June 2016 the BIS collected data for the first time concerning positions facing Central Counterparties (CCPs) for all OTC derivatives. This means that we can use the BIS Notional Outstanding data to gain a snap-shot of the state of the cleared and uncleared markets.

Explaining the BIS data

The Clarus data sources are well-known to our regular readers. They are summarised below:

- CCPView. Global Cleared Derivatives volumes, currency and product level as reported publicly by the CCPs.

- SDRView. Trade level, US Person activity. (CFTC Part 43 data)

- SEFView. SEF-executed activity. (CFTC Part 16 data)

BIS data is more difficult to summarise. But here are the key components:

The Triennial Survey

- Central banks and other authorities collect data from banks and other derivatives dealers headquartered in their jurisdictions and report national aggregates to the BIS, which then calculate global aggregates.

- Covers a wide diversity of dealers, including dealers active in smaller markets who may not be active in the major derivatives markets.

- Includes both Turnover and Notional Outstanding data.

- The turnover part of the Triennial Survey is reported by the sales desks of reporting dealers located in participating countries, on an unconsolidated basis.

- Reporting dealers include trades between their own branches, subsidiaries and affiliated firms.

- Cleared trades are reported on a pre-novation basis in the turnover part of the survey (i.e. with the original execution counterpart as counterparty).

- Dealers located in 52 countries participated in the turnover part of the 2016 Triennial Survey.

- This list of reporting dealers stretches to 1283 institutions for Turnover data.

- Full guidelines are here for the Turnover and here for the Notional Outstanding parts of the survey.

The Semiannual Survey

- Includes only Notional Outstanding data.

- The reporting of notional outstanding is on a consolidated basis (i.e. only the parent institution reports via the head office).

- Deals between affiliates (i.e. branches and subsidiaries) of the same institution must not be reported.

- When reporting dealers clear through CCPs, the post-novation contracts should be captured.

- Therefore, the notional of a trade between two reporting dealers that is cleared at a CCP is counted twice in the data.

- The notional of a trade between a reporting dealer and a “client” that is cleared at a CCP is only counted once in the data.

- There are 74 institutions denoted as Reporting Dealers for the Notional Outstanding data.

- The Triennial and Semiannual surveys of April 2016 and June 2016 respectively are used to benchmark the global coverage of the Semiannual Survey. This information is used to scale up the amounts from the Semiannual Survey during periods between Triennial Surveys.

The Data

The BIS Semiannual survey shows that the uptake of Central Clearing has been very impressive in Interest Rate Derivatives, which garnered a few headlines last week.

This increase in Clearing also means that we can reconcile the BIS data versus Central Counterparties with the Clarus CCPView data as at the end of June 2016.

The Notional Outstanding numbers from the BIS equate with Open Interest in CCPView. For our users, you can follow the below process to reconcile for yourself:

The Notional Outstanding numbers from the BIS equate with Open Interest in CCPView. For our users, you can follow the below process to reconcile for yourself:

- Run Open Interest as at June 30th 2016 in CCPView and split by Currency and Activity

- Double all “Dealer” volumes from CCPView

- Add to this figure the single-counted “Client” volumes

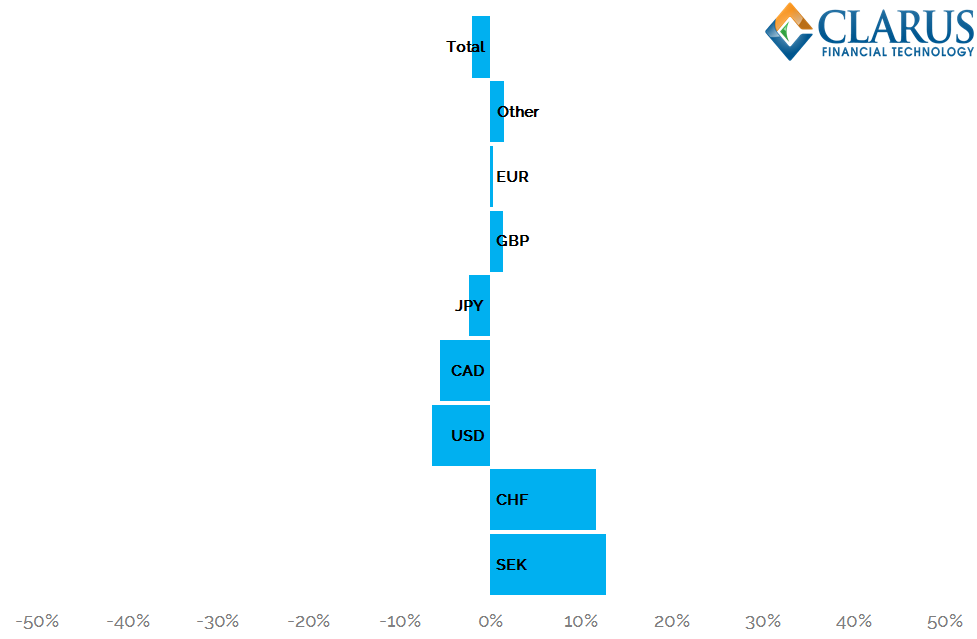

This process results in Open Interest figures from CCPView that are directly comparable with the BIS figures. The results of this reconciliation are shown below per currency:

Showing;

- CCPView Open Interest is within 2% for Interest Rate Swaps.

- The same applies for FRAs.

- On a currency-by-currency basis there are differences. For example we have a 12% higher notional outstanding in cleared CHF swaps than the BIS report. And a 15% higher number for GBP FRAs.

- These differences are somewhat strange. We need to cross check the 74 Reporting Dealers with the list of SwapClear Members here:

- Any SwapClear Members who are not a Reporting Dealer in the BIS survey will have their Notional Outstanding counted only once in the BIS report. However, we will have doubled their numbers in our reconciliation.

- Any Reporting Dealer who are not a SwapClear Member will have their Notional Outstanding counted twice in the BIS report. However, we will have only counted their numbers once in our reconciliation.

It is important to note that the overall impact on the data is very small, but with relatively large impacts in the lower volume currencies (on a percentage basis). This is because in these smaller markets there will be some active market participants who will not be a SwapClear Member/Reporting Dealer.

In light of this, please note:

- We believe in a single-counted methodology for cleared trades. A trade is a trade (not two!).

- A single-counted methodology makes it far easier to reconcile numbers (see above).

- As clearing mandates continue to come into force across different jurisdictions, CCPView will cover an increasing share of the whole market, further increasing transparency.

In Summary

- The BIS Notional Outstanding as at June 2016 reconciles to within 2% of Clarus CCPView.

- Market participants need to understand the BIS data because they provide a vital window of transparency onto OTC Derivatives volumes.

- Fortunately, the portion of the market for which CCPView provides transparency continues to increase as Clearing dominates OTC Derivative markets.