Market Agreed Coupon (MAC) Swaps were created by SIFMA & ISDA as contracts with pre-defined standard terms. They start on IMM dates and the fixed rate is pre-determined in 0.25 increments (e.g. 5Y in USD is 2.25%). For further details see SIFMA. USD MAC Swaps are MAT (first two IMM dates) and so are required to be traded On SEF.

TradeWeb SEF has recently been reporting high volumes of MAC Swaps, so I decided to look into this.

USD MAC Volumes

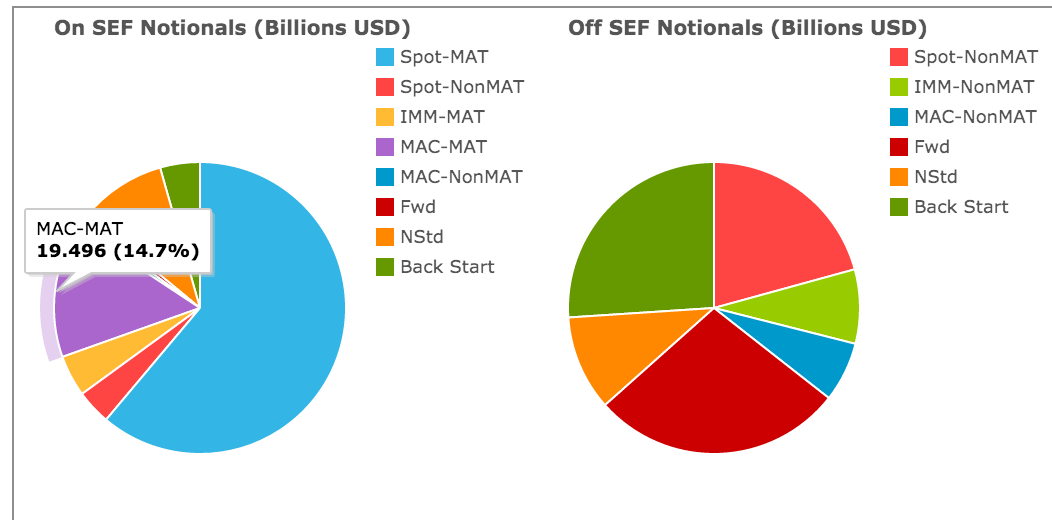

Lets start with SDRView Res and a chart from the new Swaps Subtype view:

This shows the cumulative gross notional traded on Sep 8 and Sep 9 and we can see that:

- For On SEF, MAC volume is >$19b and 15% of all On SEF volume

- (In trade count terms, 177 trades or 11%)

- Which is the largest segment after Spot Swaps

- And certainly more than IMM, which are 6%

- For Off SEF, MAC volume is >$8.5b or 7%

- (In trade count it is 820 trades or 37% as a large number of $1m notional trades!)

Sep/Dec Rolls

A reason for such higher volumes of MAC Swaps is likely to be rolling from the Sep contract into the Dec one as the Sep nears expiry on Sep 17, 2014, in much the same way as a Futures position would be rolled.

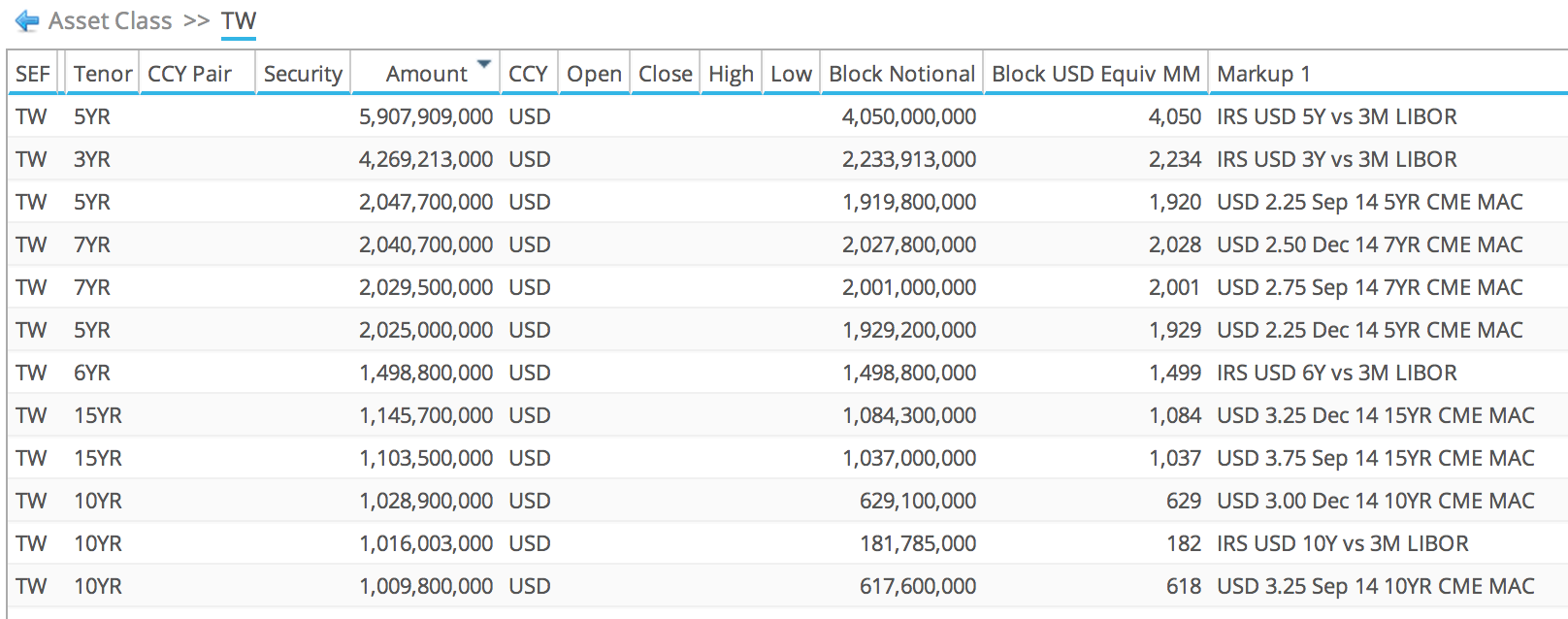

Using SEFView, lets drilling on TradeWeb volumes for Sep 8 and sort by largest USD Swaps:

Which shows that:

- 5Y spot start followed by 3Y spot start have the highest volume

- Next is $2 billion of Sep 14 5Y 2.25 MAC

- Further down $2 billion of Dec 14 5Y 2.25 MAC

- Both volumes mostly in Block size

- So clearly this is firms rolling their positions from Sep to Dec contracts

- The same pattern and similar volume can be seen in 7Y MAC, 10Y MAC, 15Y MAC

- In-fact $13b or 44% of TW gross volume on this day is MAC

Bloomberg is the other SEF with reasonable volume in MAC Swaps, however on Sep 8, we do not find much roll volume, but we do find IMM Sep to Dec roll trades.

Also looking at TradeWeb figures for earlier business days, Sep 5 and Sep 4, we do not see any significant roll activity.

From SDRView, we can see that for the week ending 5 Sep, 205 trades of >$11b notional of MAC Swaps were traded On SEF. While on the two business days this week the figure is 177 trades of > $19b notional. So clearly more than double the usual volume will trade, predominately due to the Sep/Dec roll.

Costs of rolling

Given that we would expect rolling to the next contract to introduce some frictional costs, I wanted to see whether these were material.

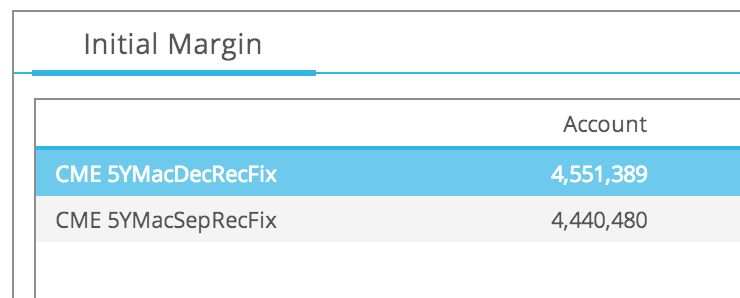

As Initial Margin is a topic I regularly write about, I decided to look into the impact of a position rolling from a Sep to Dec.

Taking a 5Y $200 million trade, I used CHARM to estimate the CME Margin on 8 Sep:

Which shows a small increase from $4.44 million to $4.55 million, so a figure of $110,000 which is not material.

This increase can be explained by the fact that for the Sep trade which matures 17 Sep 2019, the DV01 is mostly in the 5Y tenor bucket of 8 Sep 2019,. However as the Dec trade matures on 17 Dec 2019, a significant chunk of its DV01 is also in the 6Y tenor bucket.

Summary

Tradeweb SEF reported high volumes of USD MAC trades this week; $13 billion in 2 days.

This volume is due to clients rolling from the Sep contract to the Dec one.

MAC volume reported to SDRs is much higher this week for the same reason.

In the next few days leading up to Sep 17, it will be interesting to see how much cumulative volume is rolled.

As this will give a good estimate of the size of firms positions in MAC swaps.

From SDRView we can see that last week an average of 40 USD MAC Swap trades were reported On SEF per day.

This week it is almost 90 trades a day and a large number of these are in block size.

The cost of rolling in margin terms is not significant.