Over the past couple months we’ve been documenting the CME-LCH basis trade including:

- How it’s come about

- Looked at clearing data for evidence of any movements between venues

- Looked at SEF data for which SEFs are seeing these flows

- The implied forward rates in the basis

- Downstream impacts to the CME convexity trade.

Many newcomers to the topic have asked us to explain why this pricing differential exists. A cornerstone of finance tells us that if a price difference exists, it will be arbitraged away. I demonstrated a couple weeks ago that arbitraging the spread is not readily possible given overhead costs associated with transaction OTC swaps. The spread would need to be roughly 4 basis points (in the 5YR) before you’d start to make money after paying the required execution and clearing fees.

RECAP

Amir explained it well in his May blog. In a nutshell:

- Legacy swap clearing was done at LCH, where legacy dealer portfolios still exist

- Large proportion of swap participants at CME are clients

- Clients are primarily looking to pay fixed (be it speculators or bondholders)

- Dealers need to hedge their CME receiver swaps with another dealer by paying fixed themselves

- As “all” dealers are primarily the same net direction at CME, incremental receiver swaps are margin-additive and hence funding cost-additive

- Dealers need to receive a premium on receivers at CME to cover this cost

WHERE ARE THE CLIENTS LOOKING TO RECEIVE FIXED?

A foundation to this justification for the CME-LCH basis is that clients are primarily payers of fixed. Let’s think about this across the two types of clients I reference:

- Speculators. To say speculators and other alpha firms are payers of fixed is probably an incorrect blanket statement. The theory is that in a low-rate environment, things can only go up (+ve for payers of fixed). We have managed to prove that theory wrong over the past few years as USD rates continued to slide through January 2015 until finally finding some recent volatility. Of course we’ve also seen rates overseas go negative. I would guess speculators are on balance speculating in both directions.

- Bondholders. Probably fair to say these natural fixed-rate receivers are indeed driving the demand at CME for paying fixed.

So where are the clients looking to receive fixed?

The missing client type above are the bond issuers. Firms that are paying fixed on their bond issues but preferring to have a floating rate obligation. These firms are generally exempt from clearing (end user exemption) as the swaps can be directly attributable as a hedge.

But do these firms exercise their clearing exemption? To corroborate this, I checked out some recent bond issues:

- AT&T’s April 2015 fixed notes (~17bn)

- Apple’s February 2015 fixed notes (~6bn)

- Abbott Lab’s March 2015 fixed notes (~2.5bn)

- Microsoft’s February 2015 fixed notes (~11bn)

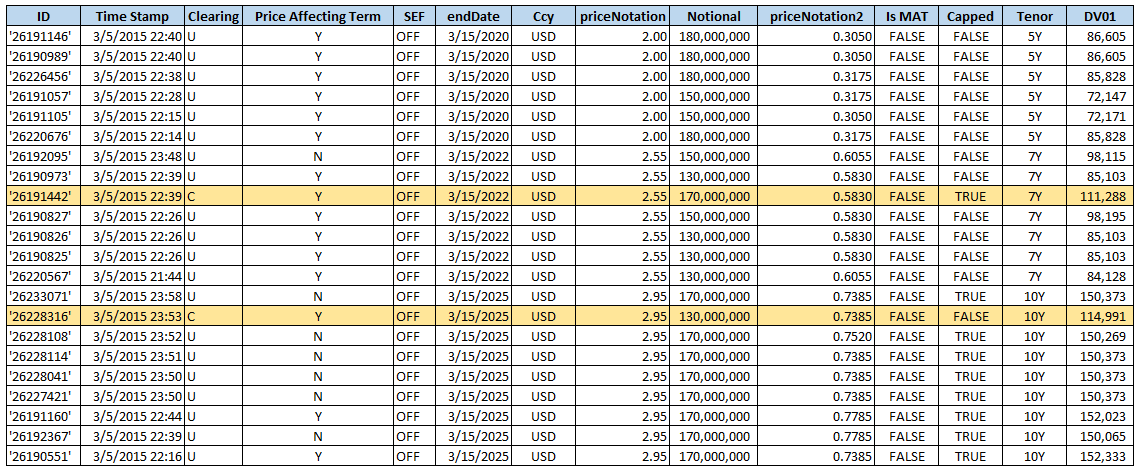

I then went looking for evidence of these firms entering swaps on the issuance date to convert their fixed obligations into float. In 3 of the 4 cases it was quite easy to find evidence with the expected hallmarks:

- Non-spot starting swaps with maturity dates matching the bond

- Often block-sized

- Sometimes with fixed coupons matching the bond coupon (but with fees or “price effecting terms”)

- End User Exemption flag set to “Yes”

- Uncleared

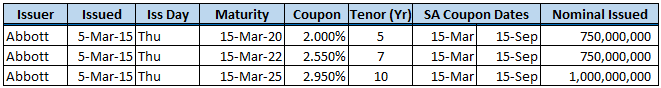

I’ll pick on Abbott Labs as it was the easiest to spot. Here are the bonds they issued in March:

I then exported the trades from SDRView for the issuance date and filtered on the maturity date of the 3 issued bonds. In total, I found 22 trades in the SDR ticker for this day with matching parameters, suggesting that many of them would be the issuer swapping into float. Out of the 22 trades, 20 of them were bilateral, and only 2 were cleared, generally corroborating my intuition.

It would take a considerable effort for me to go through many more bond issues to confirm what it would seem dealers and salespeople on the street already know – that many of these firms elect not to clear.

SHOULD THESE FIRMS CLEAR?

My first instinct tells me that these firms elect not to clear because it is economically favorable to trade bilaterally.

But hold on a second. Presumably these firms are now trading bilaterally (receiving fixed) at the (less favorable) LCH swap rate. Should they not be inclined to now take advantage of the basis and start clearing these trades?

It would seem there is a balance between bilateral and cleared:

- Bilateral trades

- The Good:

- Do not require Initial margin

- Do not require Variation margin (for most credit worthy firms) at least for a couple years

- Do not require FCM relationships and associated costs

- The absence of the above gives some stable certainty

- The Bad:

- Price of the swap would have to include dealer-computed CVA & FVA

- The Good:

- Cleared trades

- The Good:

- Could benefit (currently up to 2bp) on receiving fixed at CME

- Is free of dealer CVA/FVA

- The Bad:

- The cost and hassle of cleared margins

- The Good:

With bilateral OTC margin requirements being phased in over the next few years, and as the dealer cost of warehousing these trades increases, the “good” side of bilateral trading starts to get whittled away. In theory, there will come a point where these bond issuers see value in clearing their swaps. And when they do, the imbalance of demand at CME should ease, and the basis reduce.

The trick would be in calculating these costs to make an informed decision, which of course we at Clarus can help out with. But that is a story for another day. And if you manage swaps at Abbott, give us a call, we’ll do this for you.

SUMMARY

- The CME LCH Basis exists because of an inbalance of client demand, and subsequent directional positioning of dealers.

- Bond Issuers would seem positioned to be able to fill that demand imbalance and at the same time enjoy a premium on their receiving swaps if only they chose to clear

- They have apparently not yet done that. Not clear yet if its simply the economics not working out in their favor or not.

Very nice. Thank you Todd. It seems to me that in the end these exempt natural recievers of fixed are the missing piece and the main impetus behind the imbalances causing the basis spread.