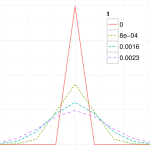

To solve the problem they focus on the probably density function, similar to the approach taken by Andreason and Huge, ZABR – Expansions for the Masses. They find a solution which agrees closely with the original SABR formula but corrects the possibility of negative probabilities. The solution however is not an analytic formula, but a one-dimensional PDE which can be solved numerically using finite difference techniques.

When implementing one will encounter two problems which can be resolved;

Problem 1

Crank-Nicolson can lead to spurious oscillation depending on the geometry of the finite difference grid (specifically the Courant Number).

A solution is to use alternative finite difference schemes, the TR-BDF2 and Lawson-Swayne schemes work well on this problem, and provide fast stable solutions.

Problem 2

The underlying rate variable \(F\) may require a large number of points in the discretisation for longer dated options. This problem is not new and can be remedied by a change variable, as suggested in the well-known Anderson-Piterbarg book (p. 292 section 7.4).

$$z(F)=\int\frac{dF’}{D(F’)}$$

These ideas have been written up in a more formal document, Finite Difference Techniques for Arbitrage Free SABR, Le Floch and Kennedy, Jan 2014.