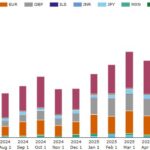

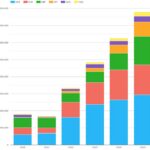

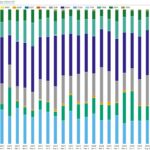

This blog expands to the whole of 2025 the blog we published last September covering H1 2025 SDR-reported IR compression. Key takeaways For 2025 as a whole: Background SDR-reported IR compression volumes include SEF compression and bilateral compression but exclude the following: As well as the prior blog linked above, further background on SDR-reported IR […]

Read more

Our Technology

- Browser-based, nothing to install

- Simple APIs, integrate in Days

- Secure & Scaleable Cloud Hosting

- Built-in Connectivity to Data Sources

- High Volume and Super Fast Performance

- Highly Reliable Processing

- Full Production in Weeks not Years

- Monthly Subscription, No Upfront License fees