- HKD Interest Rate Derivatives are the 5th most traded APAC currency.

- They trade in a range of maturities out to 30 years, but the block thresholds and lack of SEF market prevent us seeing the true size of trades.

- USDHKD FX Options are at least a $750bn per month market.

- Transparency in this market also suffers from a block threshold that appears to be set way too low.

When we write articles like “What You Need to Know About MXN Swaps” and “Block Trading“, we love it when our readers reach out to us. Some will want us to follow up and write a similar article on e.g. CNY markets, whilst others will ask about block trades in other currencies or asset classes. This kind of interaction keeps our blog fresh, saves us wasting time coming up with pointless blog articles (!) and helps us understand our readership better. So please, if you ever read something on here and want to follow up, don’t hesitate to reach out to us.

This week I will therefore take the opportunity to combine those two previous articles and take a broad look at HKD markets across both Interest Rate Derivatives and FX (NDFs and FX Options).

HKD Cleared Interest Rate Swaps

Even 7 years after trade reporting began, I really enjoy the novel feeling of being able to log-in to Clarus data and educate myself about a market I know little about.

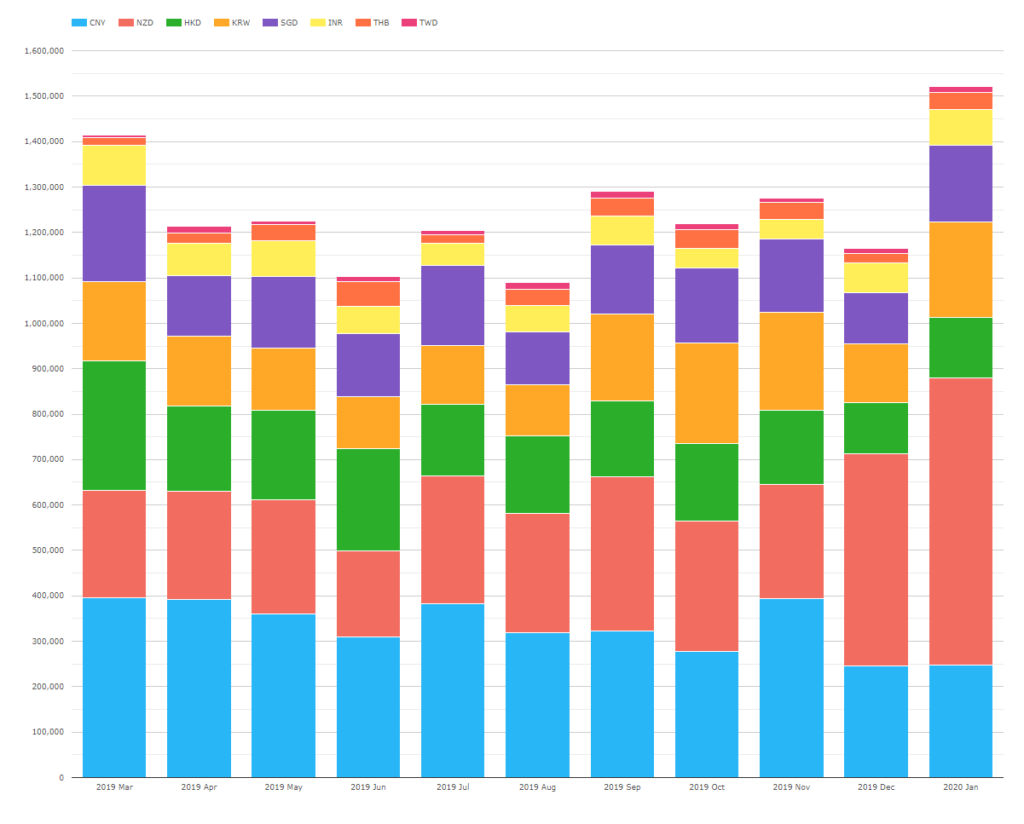

The data shows that HKD Interest Rate Swaps are the fifth most traded APAC currency. We’ve excluded AUD and JPY from the below graph to help with the scale:

Showing;

- Volumes of cleared Interest Rate Swaps (including non-deliverables) in millions of USD equivalent.

- CNY and NZD lead the way in this area of “non-major” Asian currencies with 27% and 25% of volumes respectively (and hence why a CNY blog is in the works).

- HKD is a significant chunk of the volumes at 14%, along with SGD and KRW.

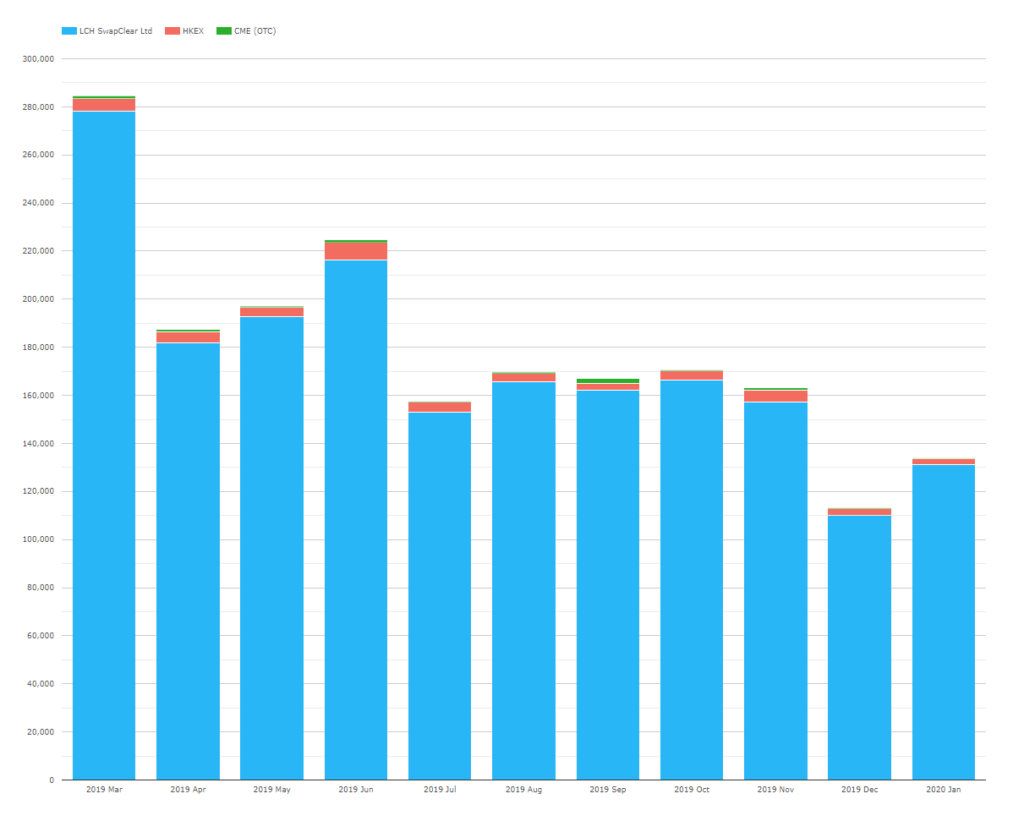

Looking at just HKD, we see that LCH SwapClear is the dominant CCP:

From that data we also know that:

- Virtually all volumes are in IRS. There is a tiny Basis market, but looks like no OIS market.

- Monthly average cleared volumes are in the region of $175-200bn per month.

- January and March 2019 really stand out as unusually high volume months with volumes of $310bn and $285bn respectively.

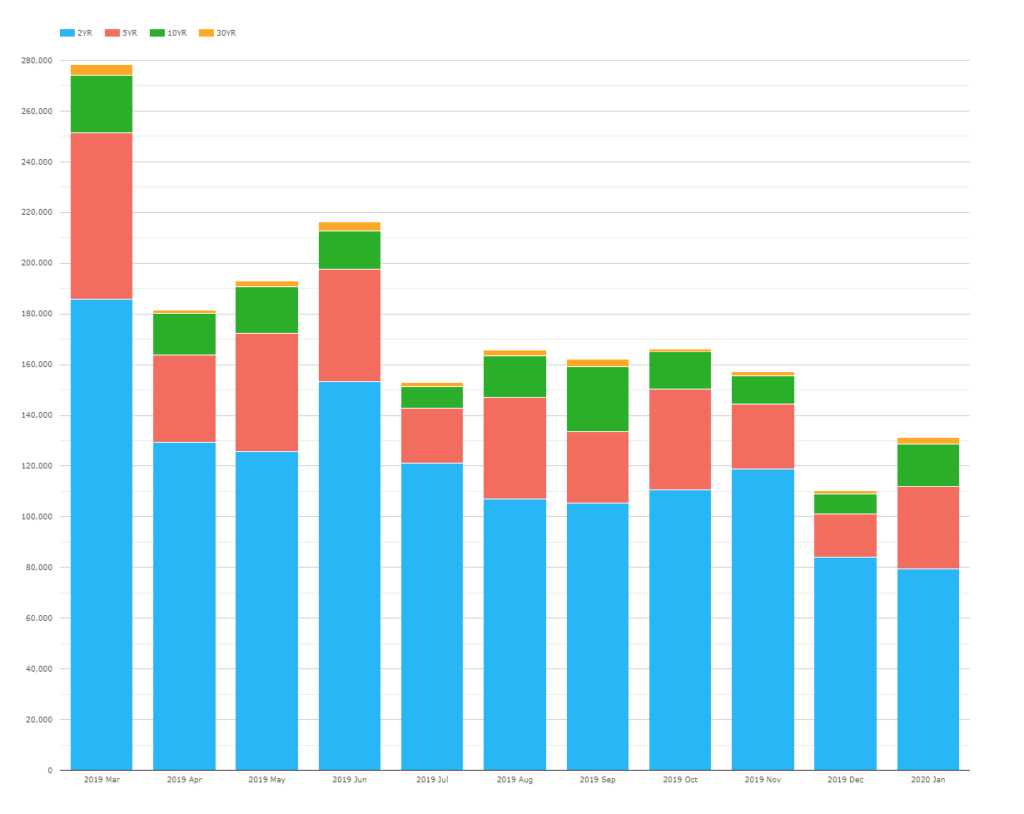

Looking at the tenor profile of swaps traded;

- The chart above shows notional amounts of HKD swaps traded in each tenor bucket.

- Even without correcting for DV01, we can see that activity is really well balanced across the curve.

- When balanced for DV01, we find that 39% of activity is in 2Y, 28% in 5Y, 24% in 10Y and 9% in 30Y.

- Impressive that 30Y swaps consistently trade every month and account for nearly 10% of the cleared market.

SDR Data

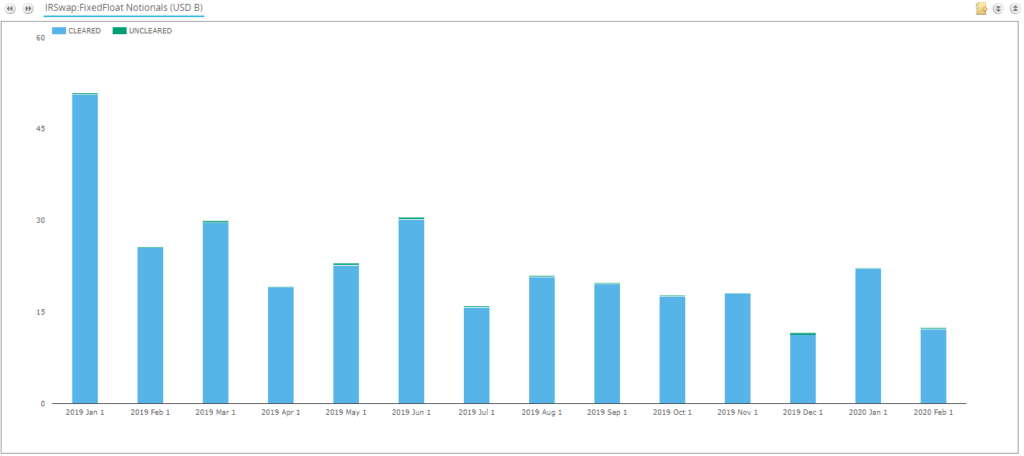

Turning to SDRView, we find that all HKD IRS is cleared:

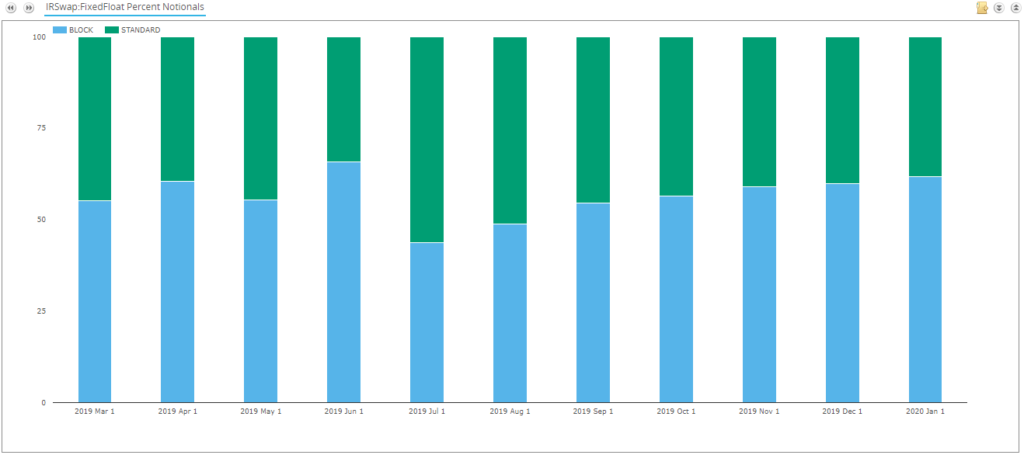

Average monthly notional amounts appear to be $21bn equivalent in the US market. However, we find that over 50% of volumes each month are reported as “Block” trades:

Typically, we would then refer to SEFView to estimate the true size of these block trades. Unfortunately, in the case of HKD IRS, there is almost no SEF market. Less than 2% of volumes are transacted on-SEF each month.

We therefore have no secondary layer of data to estimate the true size of these block trades and hence what proportion of the global market the US represents.

This analysis seems to strongly support the fact that the block threshold for HKD swaps is set way too low. Here is a reminder that it is at a very low level of just ~$54m even for 2 year swaps!

FX NDFs

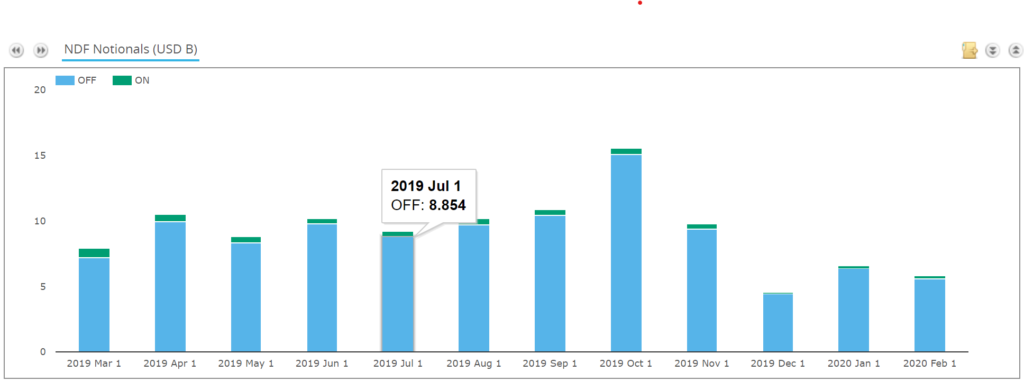

Despite HKD being a deliverable currency (and the IRS above is traded as a deliverable product), there are still several billion of NDFs in USDHKD reported each month to the US SDRs.

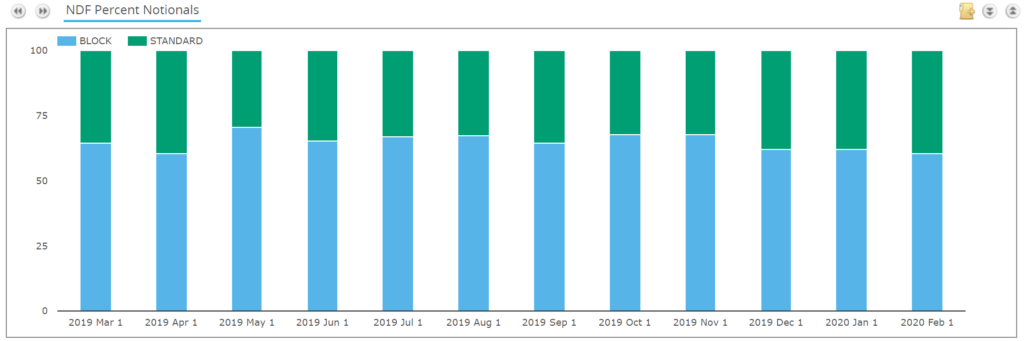

Looking at this data, we also discover that HKD NDFs predominantly trade off-SEF:

And that, just like IRDs, the block thresholds are poorly calibrated. Over 70% of trades in some months are block!

This means that we cannot really estimate the real size of these blocks, or the real size of the US market for HKD NDFs.

From a clearing perspective, USDHKD is offered as a deliverable FX product by HKEX (see here), but I do not see any volumes in the past year.

FX Options

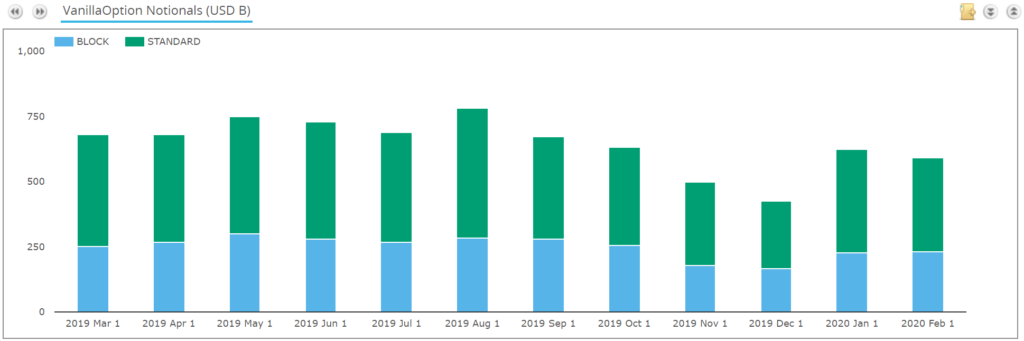

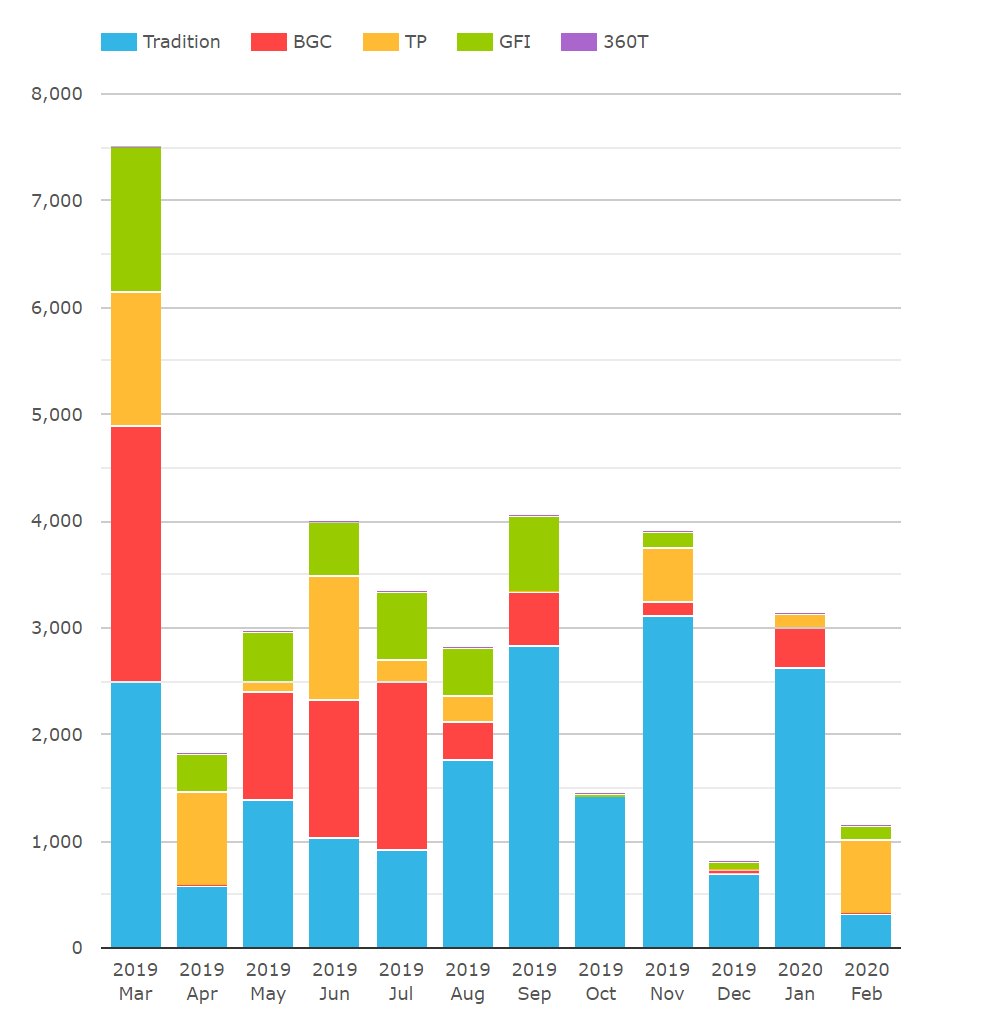

An area of the SDR data that we do not look at enough are FX Options. For a deliverable currency pair like USDHKD, there is a huge amount of activity each month:

Showing;

- Monthly volumes of USDHKD FX Options can be up to $750bn.

- Again (sorry for laboring the point) a huge percentage of these trades are “block”.

- Around 50% of the reported volumes are reported on-SEF.

- All of these volumes are executed on D2D SEFs. The volumes per SEF are broken down below from SEFView:

What does all of this mean for our understanding of the FX Options market in USDHKD?

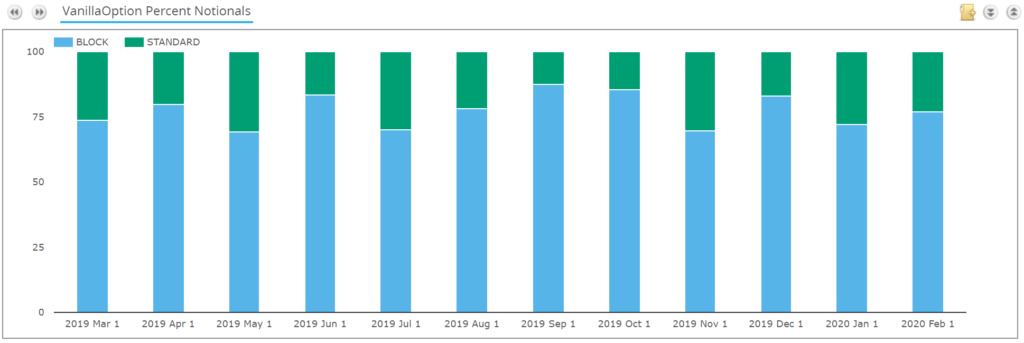

- Block trades are not executed on D2D SEFs, because they operate CLOBs. See our previous blogs here and here.

- This means that over 85% of off-SEF trades reported to SDRs are block trades!

Remember this 85% metric is measured at the reporting threshold. So the true size of the block trades is much higher, meaning that most off-SEF notional is being executed above the block-size.

There is clearly something wrong with the block thresholds for USDHKD FX Options!

Unfortunately, due to the fact that there are no block volumes reported on-SEF, we cannot follow our previous methodology to estimate their true size.

In Summary

- Cleared HKD IRS averages $175-200bn per month, making it the 5th most traded APAC currency.

- Interest Rate Derivatives regularly trade out to 30 years, with an even split of activity across the curve.

- There is almost no SEF market for HKD IRS, and over 50% of volume is reported as a Block Trade.

- In FX markets, we find that over 70% of USDHKD NDFs are block trades.

- SDR and SEF data provide important insights into the $750bn-per-month USD HKD FX Options market.

- However, in FX Options over 85% of off-SEF trades are above the block threshold.

- For this particular currency, the block thresholds really need calibrating upwards to provide more transparency.