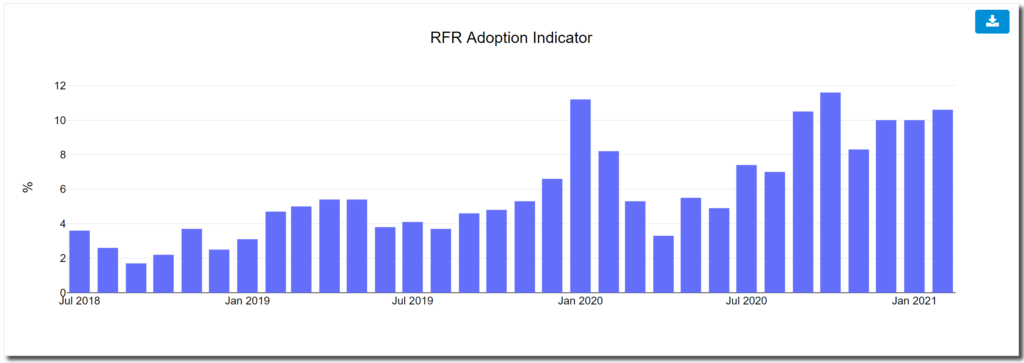

- February 2021 saw 10.6% of all derivatives risk traded versus an RFR.

- This has now been stable around 10% for some time.

- We cover the pre-cessation announcements concerning LIBOR and the historic spread calibration that took place last week.

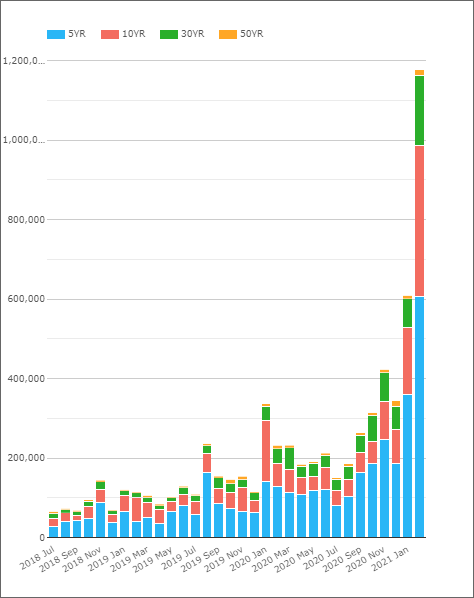

- There has also been a sharp move higher in the amount of long-dated SONIA risk being traded.

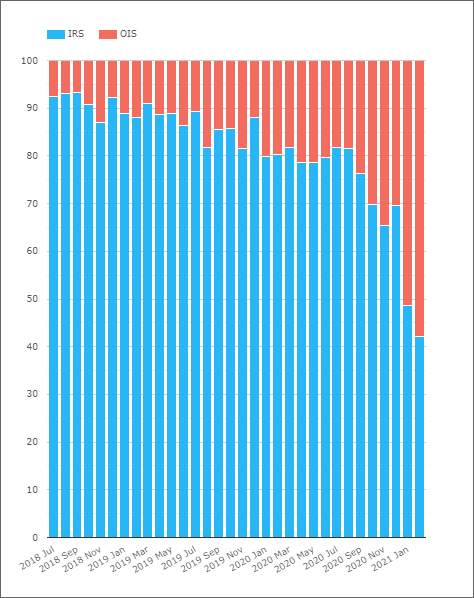

- The change in market composition for SONIA markets is exactly the type of change the Indicators are designed to monitor.

- We are now expecting these changes across all of the currencies subject to LIBOR pre-cessation announcements (CHF, JPY and USD we are talking about you!).

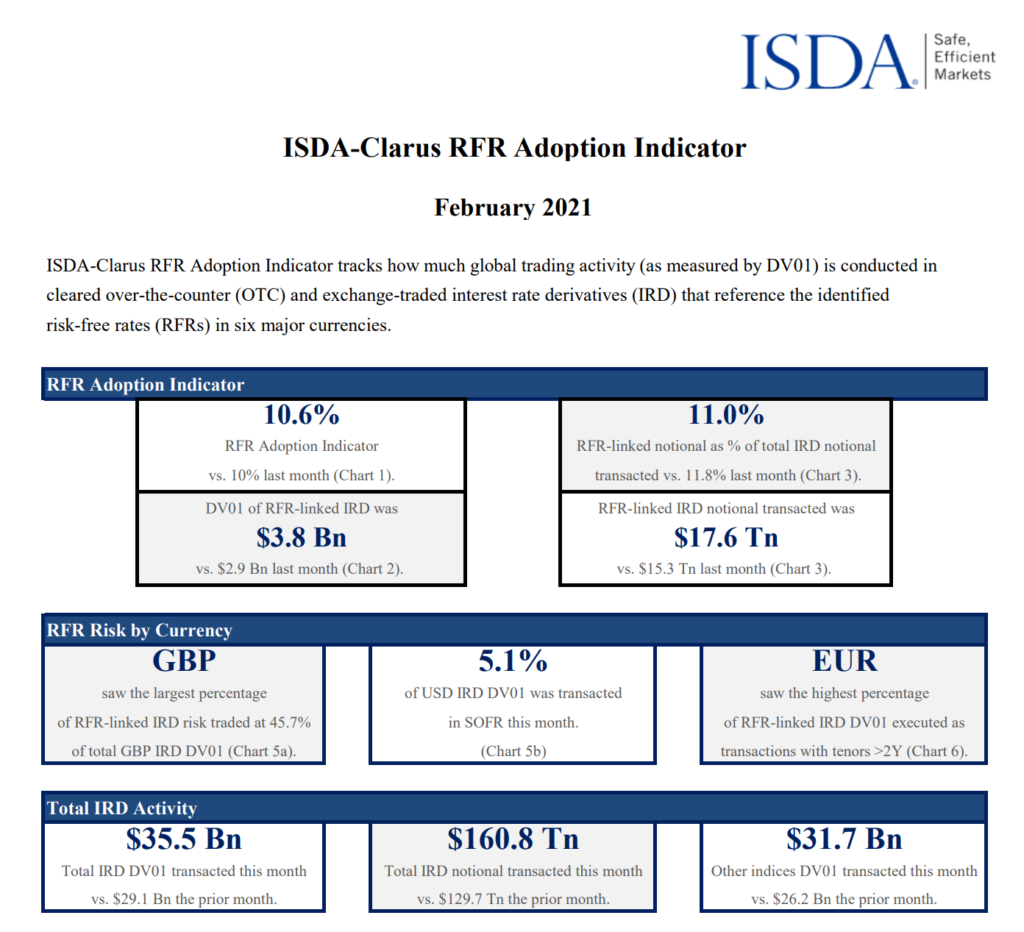

The latest ISDA-Clarus RFR Adoption Indicator has just been published for February 2021. It saw a small increase, but has been stable around 10% for a few months.

- The overall Adoption Indicator was at 10.6%, marginally higher than the 10.0% readings of the prior two months.

The BIG News is the LIBOR pre-cessation announcement

The RFR Adoption Indicator published today is based upon February 2021 trading data. This means that the data does not yet take into account the impact of the LIBOR pre-cessation announcement that occurred on Friday March 5th.

Talking of which, let’s run through what happened on Friday:

- IBA published the responses to their November consultations on their intention to cease publication of most LIBORs at the end of 2021, with some USD rates still being published until June 2023.

- The Clarus response to this consultation can be found here on the ICE website, and we covered the consultation and some data in a previous blog here.

- At the same time, the FCA made “Announcements on the end of LIBOR“, setting in stone the dates for when the rates will cease:

- 31 December 2021, in the case of all GBP, CHF and JPY fixings.

- 30 June 2023 for USD.

- ISDA then clarified that this crystallised the calculations for the Fallback spreads.

- Bloomberg then published the exact Fallback Spreads that will apply to any LIBOR-referencing derivatives remaining in place after the cessation of LIBOR. The major tenors are shown below:

| USD1M | 11.448 basis points |

| USD3M | 26.161 bp |

| USD6M | 42.826 bp |

| USD12M | 71.513 bp |

| GBP1M | 3.26 bp |

| GBP3M | 11.93 bp |

| GBP6M | 27.66 bp |

| GBP12M | 46.44 bp |

| JPY1M | -2.923 bp |

| JPY3M | 0.835 bp |

| JPY6M | 5.809 bp |

| JPY12M | 16.6 bp |

| CHF1M | -5.71 bp |

| CHF3M | 0.31 bp |

| CHF6M | 7.41 bp |

| CHF12M | 20.48 bp |

Overall, we have now moved into a world where a lot of “known unknowns” have now become “known knowns“. With the exact calibration of the historic spreads, firms can make an accurate judgement as to whether restructuring or relying on Fallbacks is preferable.

It will be important over the coming months to stay on top of the data to see what trends now follow. Restructuring or relying on Fallbacks? Stay tuned to find out.

First, a summary of February 2021.

ISDA-Clarus RFR Adoption Indicator at 10.6%

- Following on from the pre-cessation announcements on Friday, it is worth dwelling on the fact that only around 10% of all of the derivatives Rates risk transacted is currently versus a Risk Free Rate. The rest was transacted versus legacy rates, mainly LIBORs which are now known to cease at the end of this year (or 2023 for USD).

- February 2021 was generally a big month for interest rate risk traded. The broad sell-off in Fixed Income contributed to this, as we saw for USD markets in last week’s blog. This was reflected across our indicator data, where large amounts of risk (and notional) were traded in both RFRs and legacy rates.

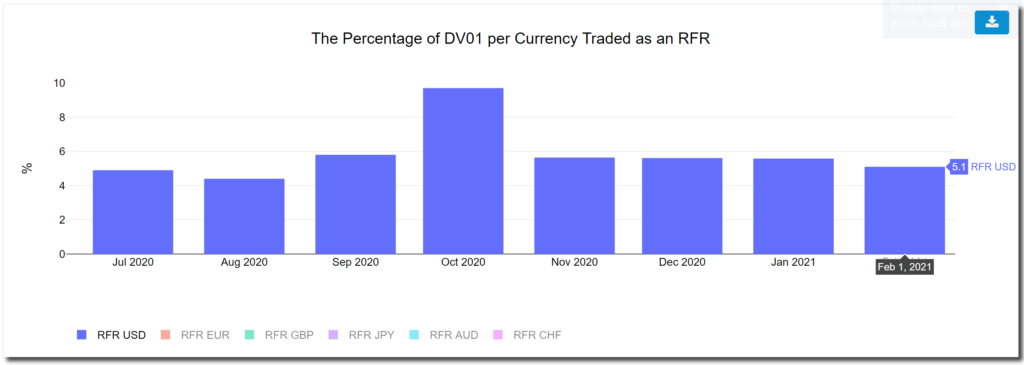

- For the fourth month running, ~5% of total USD risk was transacted versus SOFR. Four months in a row now!

- CHF SARON markets reached a new high at 8.5% whilst JPY TONA is still down at 3.5%. The low level of activity in these two currencies is concerning from a transition perspective (as we highlighted in our response to the IBA LIBOR consultation).

GBP SONIA Shows the Biggest Moves

We argued in our IBA consultation response that it would probably take regulatory action to significantly increase the amount of RFR trading. The action taken in the UK, with the FCA setting out the roadmap for benchmark reform and requesting for the interbank standard to move to SONIA, certainly seems to be taking effect.

For GBP markets, this is best shown by the increase in long-dated SONIA activity. First, the amount of SONIA notional traded in tenors longer than 2Y hit a new record by a huge amount:

And secondly, there was more long-dated SONIA traded than LIBOR, in notional terms during February 2021:

These are the real signs of benchmark reform that we have been looking for from these indicators and is a very positive sign.

SOFR Saw A Small Increase

As Amir noted, we saw some records in cleared OTC SOFR risk in February 2021. The DV01 data doesn’t reveal much more, other than the fact that the small drop-off in SOFR futures activity somewhat offset the (larger) increase we saw in OTC SOFR risk traded.

However, the increases in LIBOR trading seen in USD markets more than offset this small increase in SOFR risk traded, hence a lower percentage overall was transacted in SOFR this month than last.

In Summary

- The long awaited pre-cessation announcements for LIBOR actually happened last week!

- These announcements may fundamentally change the level of the ISDA-Clarus RFR Adoption Indicators from next month.

- We have already seen regulatory action such as this take effect on the SONIA market.

- SONIA is now the most widely traded index in GBP Rates markets, and now makes up the majority of trading in long-dated derivatives.

- SONIA is now THE benchmark for GBP derivatives.

If there’s one message from this blog it is that we are waiting to see SONIA-esque moves in long-dated risk for CHF, JPY and eventually USD!

Stay tuned….