Recreating the RFR Adoption Indicator

This blog is unashamedly targeted at our data subscribers. Specifically, those of you interested to replicate our RFR Adoption Indicator. Read on for your “cut out and keep” guide to RFR data. A Bit of History Clarus and ISDA teamed up way back in 2020 to “help derivatives market participants keep tabs on progress to […]

RFR Adoption Q3 2024

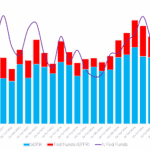

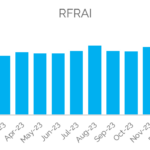

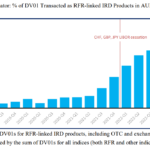

Time for a quarterly check-in on RFR trading. The data provides a high-level overview of trading activity across all Rates products. Clarus API – CCPView As a reminder from previous blogs, Clarus microservices allow me to query numerous volume measures from CCPView. That means I have rebuilt the RFR Adoption Indicator using just two queries to pull in DV01s traded across all products […]

RFR Adoption Q2 2024

Time for a quarterly check-in on RFR trading. The data provides a high-level overview of trading activity across all Rates products. Clarus API – CCPView As a reminder from the previous blog, Clarus microservices allow me to query numerous volume measures from CCPView. That means I have rebuilt the RFR Adoption Indicator using just two queries to […]

RFR Adoption Update

We have had a number of people reach out and ask when the RFR Adoption Indicator will next be updated. It is a great vindication of all of the hard work that has gone on over the past 4 years (and even longer when you consider the wider work on LIBOR cessation, Fallbacks and Benchmark […]

RFR Adoption Review 2023

Now seems like the right time to call an end to the regular series of blogs that we have been writing about the ISDA-Clarus RFR Adoption Indicator. Consider today’s blog your “cut-out and keep” guide to one of the biggest changes the derivatives industry has ever witnessed. A Brief History The Indicator was first published […]

A Final Check-In On RFRs For The Year

This is my final blog for the year, but the 2023 retrospectives will have to wait for January once all of the data is in. However, as the year draws to a close, I doubt 2023 will be remembered as the year that USD LIBOR finally ceased. That has to be considered a good thing. […]

New Musings on RFRs

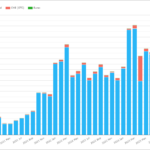

This week I will start with a chart – the DV01 traded in USD OIS per month over the past three years: Showing; For the second chart today, consider the same data, but split by OIS Index – SOFR or Fed Funds: Showing; Overall, 26% of OTC OIS risk was traded versus Fed Funds – […]

Is volatility in RFR Adoption here to stay?

Volatility in Rates markets has been elevated this year. However, I cannot remember a year when we haven’t said similar by October! It is very likely that the human-bias is innately more sensitive to change than stasis, which then leads inquisitive minds to work out what is causing the change. But one thing that is […]

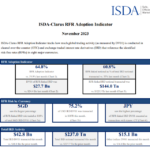

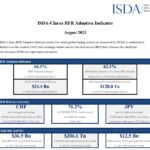

RFR Trading Is Now Back on Track – August 2023

The ISDA-Clarus RFR Adoption Indicator for August 2023 has now been published. Showing; Highlights Can the narrative cloud the facts? I feel like that is the case with RFR Trading. Look at headline adoption of RFRs in 2023: Plus; This is against a backdrop on the Clarus blog, whereby we have noted: The August 2023 ISDA-Clarus […]

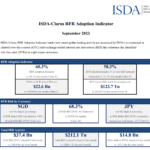

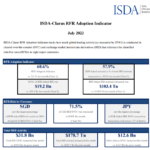

RFR Adoption July 2023

RFR Adoption is Increasing Again The latest edition of the ISDA-Clarus RFR Adoption Indicator was published earlier this week. You can find the full report over on the ISDA website here. As always, we provide a look into the data: Showing; SOFR Trading Increases As long-time readers well know by now, USD markets (and hence […]