- LCH ForexClear continues to dominate the cleared NDF market.

- CME have recently announced that 7 market participants intend to clear NDFs across their service next year.

- We look at the CME’s existing volumes in FX futures.

FX NDF Clearing Update

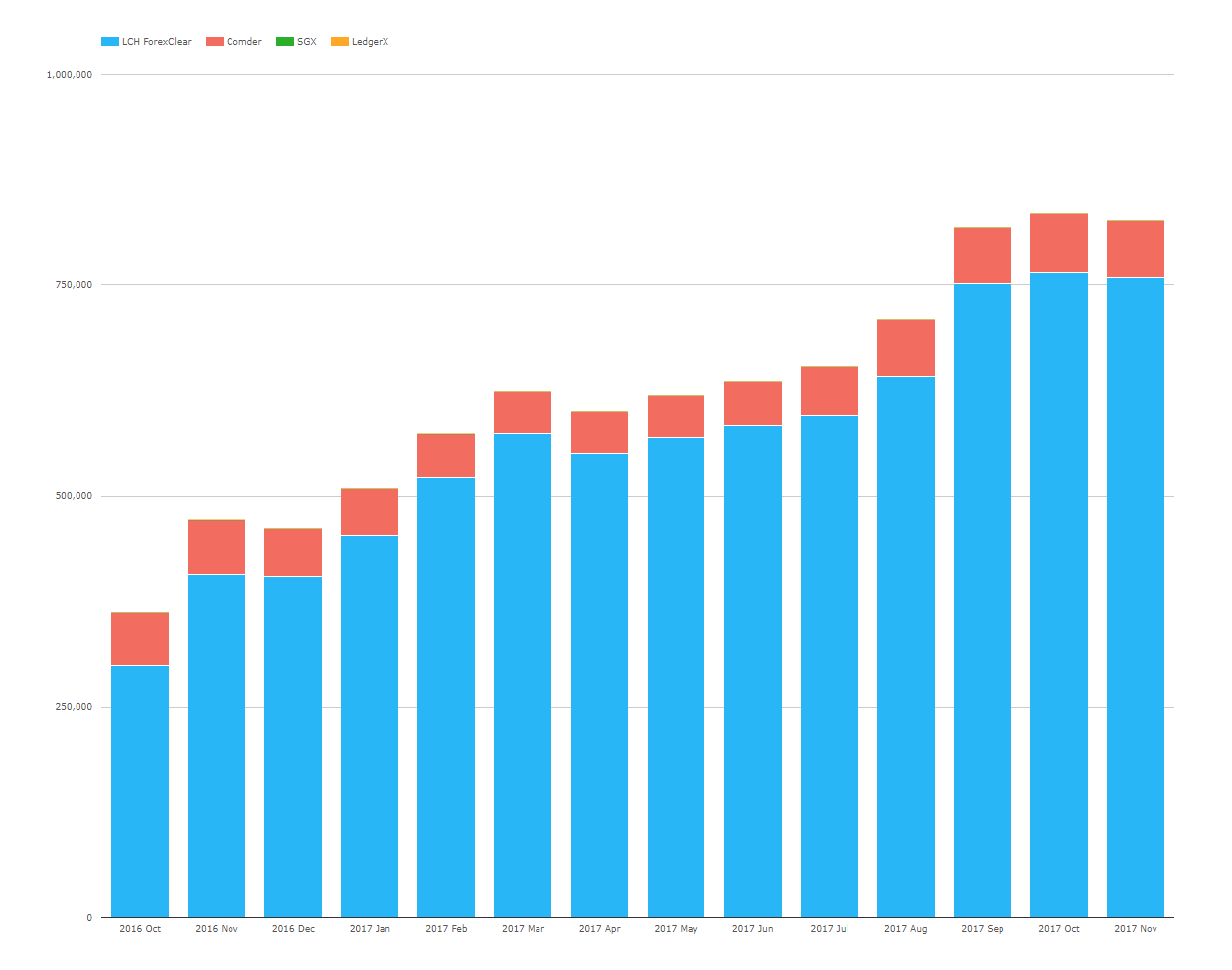

When we last looked at NDF Clearing in June 2017, we saw that LCH were dominating volumes. Open Interest had risen to $600bn+ and monthly volumes were up over $400bn, with March 2017 pushing $500bn. Has anything changed since? Amir provided an update for September, and bringing this up-to-date via CCPView shows:

Showing;

- LCH ForexClear continues to dominate NDF clearing. 92% of notional outstanding is at LCH.

- Total Notional Outstanding of cleared NDFs has now surpassed $750bn – both in total and at ForexClear alone.

- Growth since the beginning of 2017 has been impressive, with Open Interest basically doubling (it is 1.88 times higher now than end of December 2016).

And in terms of monthly volumes, October 2017 was near to the records set in September. The weekly time-series of volumes shows a steady upwards trend:

- The biggest week was the end of September, when $184bn cleared in total.

- There have now been four weeks when total clearing volumes have topped $150bn.

- Our disclosures data shows that the number of participants at LCH ForexClear have increased over the past year. We started at 25 in Dec 2016 (23 of whom were banks), and we were up to 27 as at end June 2017 (our latest data point).

As a reminder, this move to NDF Clearing appears to be a post-trade process. We still see less than 4% of volumes reported to SDRs flagged as “Cleared”. Actual market take-up is much larger than this (about 20% of the total market is cleared and 35% of D2D markets according to our last estimates) – but the trades are novated to clearing after trading, and hence do not appear to be cleared in public trade reports.

FX Futures

Elsewhere in FX markets, CME recently announced a new “FX Link” product:

This obviously piqued our interest at Clarus – we like innovation, we are keen followers of the FX market and we are continually looking at ways that volumes may move across OTC and Futures products. This new product ticks a lot of those boxes!

Add in the fact that EMIR brings VM to FX Forwards next year, and this product is one we will watch closely. If counterparties can bring in multilateral netting benefits of clearing to any of their OTC business, it may lessen the funding impacts from having to post VM on FX.

In terms of the product itself, I understand this to be the concurrent buy and sell of OTC Spot versus an FX Future at CME. As well as managing VM in a UMR world, this product offers the same exposures to risk factors as an OTC FX Forward – interest rate differentials between two currencies, very short dated cross currency basis exposure – but could allow users to manage OTC credit and settlement exposures by using a future for the long-leg.

For CME, I imagine transferring as much liquidity as possible from the OTC space to the futures space is important. Therefore, using Quandl, I had a look at FX futures volumes recently:

Showing;

- Number of contracts traded in the front EURUSD FX Futures contract every day since June.

- Volumes have been very stable.

- The rolling ten-day average (the orange line) shows anything between 150-250,000 contracts trade each day. Multiply by EUR125,000 notional value tells us we have a notional equivalent volume of around €25bn.

- Bloomberg frequently call the FX market a “$5 trillion” market:

- That number comes from the BIS Triennial Survey, which we’ve analysed in plenty of detail in the past.

- In that BIS survey, we see an average daily volume for EURUSD spot of ~$500bn. If we treat the CME future as a spot-like product (because it trades on an outright basis and I imagine is largely used for price risk transfer) then about 5% of spot-market equivalent volume occurs in futures markets.

It will be an interesting one to watch. Our chart suggests volumes in FX Futures have been fairly static recently. Will this new product shake things up?

NDF Clearing at CME

That was going to be that before I saw another release from CME this week:

I’ve not got too much to add to the press release apart from;

- Cross-margining versus Non Deliverable IRS will be offered. This is interesting as I do not think that LCH cross-margin ForexClear versus SwapClear (let me know if you think different in the comments). On the LCH 2017 roadmap, non deliverable swaps should soon be available at SwapClear (Q4 2017).

- It is not clear if these members are new members or are existing clearing members at CME. Our Disclosures data (identified as “CME IRS” ) shows that CME had 23 clearing participants at end June 2017.

We will be keeping a keen eye in Q1 2018 for these volumes coming through into the CME service. Make sure to subscribe to stay on top of these market trends.

In Summary

- Open Interest in Cleared NDFs has surpassed the $750bn mark.

- LCH dominate NDF clearing at the moment, with up to $150bn in notional volumes trading each week.

- CME will be bringing more competition to NDF clearing in 2018 with seven participants intending to clear.

- CME already have a successful FX franchise, with EURUSD FX Futures accounting for around 5% of spot market volumes.

- CME are introducing an FX Link product in 2018 which will combine OTC spot and Futures contracts into a single executable spread.

- Clarus data helps market participants stay on top of these trends by showing where volumes are traded.