Cable Cross Currency Swaps 2024

Issuance A particular headline in the FT recently piqued the interest of this blogger: Like a moth to a flame, I was drawn to the statement: The demand has helped push a number of continental European companies to issue sterling debt for the first time in recent months, including German real estate company Vonovia, German […]

T+1 and FX: The opportunities and challenges of a shorter settlement cycle

28 May 2024 is set to be a pivotal moment in the history of securities trading, as from this day, US trades in cash equities, corporate debt and unit investment trusts must settle T+1 instead of T+2. One of the challenges is cross-border trading and the implications for trades with a foreign currency component. Eugene […]

Cross Currency Swaps Review 2023

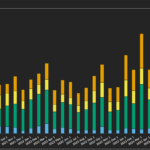

According to the FT, we need a dose of optimism at the beginning of 2024. What about these statistics to provide you with an uplifting outlook for the New Year? SDRView Volumes SDRView shows the monthly volumes transacted of Cross Currency Basis swaps. These are, on the whole, the vanilla interbank type of mark-to-market cross currency swaps. […]

Cross Currency Swap Review 2022

With Cross Currency Swap blogs continuing to perform well on the Clarus Blog each year, let’s take a look at what traded during 2022. SDRView Volumes SDRView shows the monthly volumes transacted of Cross Currency Basis swaps. These are, on the whole, the vanilla interbank type of mark-to-market cross currency swaps. Showing; SDRView also shows the DV01 […]

NDF Clearing – What’s New in 2022?

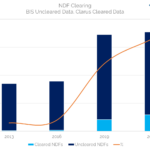

There is now over a $1Trn of cleared NDFs traded every month in 2022. March and September 2022 were particularly notable volume months. This is against a backdrop whereby the uncleared NDF market has not really grown. BIS data suggests that over 16% of total NDFs are now cleared across the whole market. This is […]

Cross Currency Volumes head to the moon!

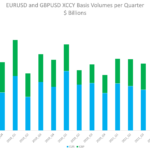

I keep a close eye on what is going on in Cross Currency Swaps, but somehow I missed quite how significant the past few quarters have been in terms of volumes traded. Let’s take a look. All-Time Record Volumes Taking a look in SDRView shows significant volumes in EURUSD and GBPUSD during 2022: The chart […]

Did You Know That SACCR Now Makes FX Trading More Expensive?

This week I want to pull together two of my recent blogs: FX Clearing 2022 Mechanics and Definitions of SACCR (part 3) I was fully expecting to see a “SACCR effect” on the amount of FX Clearing we see in 2022. Let’s look into the details below. Widening Spreads FX and SACCR have made the […]

FX Clearing 2022

We look at the growth in cleared volumes across FX products. NDFs now see over $1Trn cleared in a single month. Open Interest has grown significantly in the past two years. NDFs in 8 currency pairs dominate cleared OTC volumes. For those interested in uncleared markets, and particularly FX, it may be interesting to know […]

The First Cross Cryptocurrency Swap?

Well this is something! Babel Finance have not only completed what is maybe the first ever cross currency swap in cryptocurrencies, but they even chose to make it a mark-to-market swap! Let’s look into what this transaction is. Disclaimers I think this is my first blog on crypto/defi, so there may be some errors on […]

RUB NDF Trading Continues

Following on from our blog last week, RUB Derivatives are still trading, I wanted to take a deeper look at the data for USDRUB Non-Deliverable Fowards. SDRView In SDRView we can look at USD/RUB FX derivatives traded by US persons in the month of February 2022. NDF, by far the largest with 10,939 trades and […]