For Clearing Members, Swap Dealers, Clients

LCH/CME/ASX/EUREX/SIMM

Default Management Fire-drills

Initial Margin, What-If and Optimise

Attribution of IM and Margin Valuation Adjustment

CCP Switch and Optimise Clearing Broker

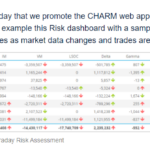

Client Clearing – Funding and intra-day monitoring

Capital, SA-CCR, FRTB SA, FRTB IMA

Web Apps and AWS Cloud

Latest Posts

-

Apr, 24

How Much Margin? The 2023 Edition

Initial Margin ISDA have just published the latest edition of the “ISDA Year-End Margin Survey”: We have covered previous versions of this survey, which are always worth a re-read because you can laugh at any predictions we made in the past! Sifting through all of those reveals that between $650-800bn in extra IM was anticipated by ISDA as a […]

Read moreMar, 13Mechanics and Definitions of the ISDA Credit Support Annex (CSA)

Credit Support Annexes used to be the dullest of the dull. A “back-office”, operational necessity that helped reduce counterparty exposures. Now, they are intrinsic to the functioning of modern day derivatives markets and have blossomed in both number and potential complexity as a result of the Uncleared Margin Rules. If you don’t have a CSA, […]

Read more -

Feb, 21

Best Practices for Variation Margin

No one wants to be called in default by a CCP during stressed markets as a result of operational complexity/failures – much as ICE & Citi stated regarding March 2020: So today I follow up on our Clarus blogs (and podcast!) regarding members requirements at CCPs. For example, you can take a look at the […]

Read moreNov, 14Default Simulation Exercises by CCPs

In June 2019, I wrote a blog titled, CCP Default Management Auctions, in which I covered the BIS CPMI-IOSCO “Discussion paper on central counterparty default management auctions” and explained how Clarus CHARM helps clearing members with their default management obligations, both actual and firedrill tests. One of the points in the discussion paper was on […]

Read more -

May, 10

Is Now The Time to Optimise Your Initial Margin?

Initial Margin ISDA have just published the latest edition of the “ISDA Year-End Margin Survey”: We have covered previous versions of this survey, which are always worth a re-read because you can laugh at any predictions we made in the past! Sifting through all of those reveals that between $650-800bn in extra IM was anticipated by ISDA […]

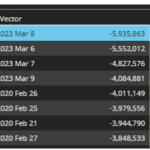

Read moreMar, 22USD Swaps Margin Calls in March 2023

I know our readers will have followed the events of the last two weeks, covering Silicon Valley Bank (SVB), First Republic Bank(FRC) and Credit Suisse (CS). Each different institutions, but each faced with massive depositor withdrawals caused by a loss of trust in the soundness of their business. At the start of 2023, who would […]

Read more -

Nov, 21

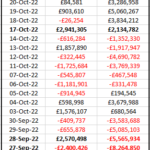

GBP Swaps variation margin in a financial crisis

We covered the significant increase in initial margin for cleared GBP Swaps in two recent blogs; How Kwasi Kwarteng has increased your IM and Rishi Sunak and the impact on GBP Swaps IM. In the first of those blogs, Chris added a brief section towards the end on variation margin and I wanted to take […]

Read moreNov, 9Rishi Sunak and the impact on GBP Swaps Initial Margin

In early October we wrote about How Kwasi Kwarteng has increased your Inital Margin, given that so much has happened in the past month, I wanted to update the GBP Swaps initial margin figures in that article. Before we start, two general points, very nicely illustrated by two The Economist covers. On the left, “Reasons […]

Read more -

Oct, 5

How Kwasi Kwarteng Has Increased Your Initial Margin

Initial Margin for GBP swaps has increased by up to 65% due to the mini-budget. 5 of the 6 largest ever moves in GBP rates have occurred during September 2022, since the mini-budget. We look at Initial Margin models and how IM has changed over time. It is fair to say that GBP Swap markets […]

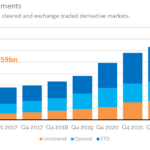

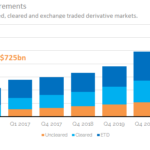

Read moreMay, 25For the first time, we see over $1Trn in Initial Margin

Total Initial Margin across the industry has now topped $1trn for the first time. Initial Margin requirements across the industry have increased by $725bn since 2016. This drives the need for more optimisation. We look at the data and benchmark the ISDA projections from way back in 2015. Capitolis First this week, a recommendation. No […]

Read more