How Much Margin? The 2023 Edition

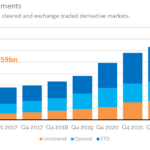

Initial Margin ISDA have just published the latest edition of the “ISDA Year-End Margin Survey”: We have covered previous versions of this survey, which are always worth a re-read because you can laugh at any predictions we made in the past! Sifting through all of those reveals that between $650-800bn in extra IM was anticipated by ISDA as a […]

All You Need To Know To Avoid The Trade Execution Requirement?

What is a MAT trade? A MAT filing, or “Made Available to Trade” determination, is when a trading venue (SEF) submits a proposal to the CFTC stating that they deem certain swaps to be liquid enough to have an execution mandate applied to them. Basically, a SEF says “I think these swaps should only be traded on SEFs in […]

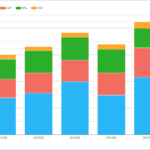

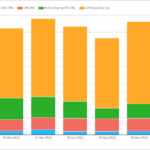

1Q24 CCP Volumes and Share in IRD

This is an article about CCP volumes and market share in the IRD. It discusses volumes for major currencies and regions. It also details CCP market share. USD OIS swaps are the highest on record. EUR OIS volumes are also at a record high. The combined EUR IRS and OIS volume is almost equal to the USD OIS volume. AUD swaps are down from a year earlier. CCP market share is dominated by LCH with some exceptions.

What’s New in JPY Swaps in 2024?

Covering; ISDA AGM in Tokyo I thought I would try to be helpful with the timing of this blog. The ISDA AGM is due to take place April 16-18 in Tokyo: Most delegates will take time to also see Tokyo-based clients, and will therefore be discussing the JPY swap market whilst doing so. So consider […]

Retail brokers in Europe poised to expand derivatives as regulatory challenges mount

Potential restrictions on Contract for Differences (CFD) markets are leading retail brokers to evaluate a shift towards institutional markets and listed futures and options. Bruce Roberts and Chris Brown cover the details on the ION Markets Blog.

RFR Adoption Update

We have had a number of people reach out and ask when the RFR Adoption Indicator will next be updated. It is a great vindication of all of the hard work that has gone on over the past 4 years (and even longer when you consider the wider work on LIBOR cessation, Fallbacks and Benchmark […]

€STR Volumes and Market Share

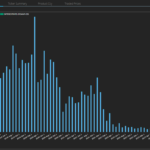

Very occasionally, the data writes a blog for me. This is one of those times, with three particular highlights: €STR Futures I have slightly tweaked our €STR Dashboard, which summarises key liquidity attributes in this growing market: Showing; The really large volume days at Eurex have not materially added to the Open Interest yet, where-as […]

SEC Clearing Mandate for US Treasuries

The SEC final rule on clearing of US Treasury Securities was published on March 18, 2024. Now that the scope and timelines are known, the challenges in implementation are becoming apparent. We cover the details on the ION Markets Blog.

Mechanics and Definitions of the ISDA Credit Support Annex (CSA)

Credit Support Annexes used to be the dullest of the dull. A “back-office”, operational necessity that helped reduce counterparty exposures. Now, they are intrinsic to the functioning of modern day derivatives markets and have blossomed in both number and potential complexity as a result of the Uncleared Margin Rules. If you don’t have a CSA, […]

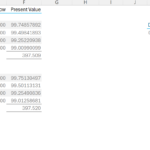

What’s New in CCP Disclosures – 4Q23?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more. CCPView has over 8 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep […]