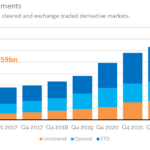

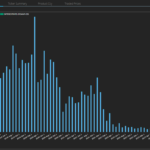

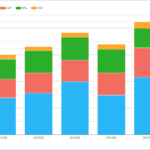

Initial Margin ISDA have just published the latest edition of the “ISDA Year-End Margin Survey”: We have covered previous versions of this survey, which are always worth a re-read because you can laugh at any predictions we made in the past! Sifting through all of those reveals that between $650-800bn in extra IM was anticipated by ISDA as a […]

Read more

Our Technology

- Browser-based, nothing to install

- Simple APIs, integrate in Days

- Secure & Scaleable Cloud Hosting

- Built-in Connectivity to Data Sources

- High Volume and Super Fast Performance

- Highly Reliable Processing

- Full Production in Weeks not Years

- Monthly Subscription, No Upfront License fees