Covering;

- JPY TIBOR cessation.

- LCH SwapClear and JSCC market share of cleared swaps.

- LCH-JSCC Basis updates.

- JPY TONA Futures.

ISDA AGM in Tokyo

I thought I would try to be helpful with the timing of this blog. The ISDA AGM is due to take place April 16-18 in Tokyo:

Most delegates will take time to also see Tokyo-based clients, and will therefore be discussing the JPY swap market whilst doing so.

So consider this your reading material for the plane trip, wherever you may be travelling to Tokyo from!

Mechanics of JPY Interest Rates

Japan completed the move to Risk Free Rates in 2021 following JPY LIBOR cessation, with OIS (Overnight Index Swaps) versus TONA the main derivatives instrument traded in 2024.

A (small) Interest Rate Swap market has continued versus TIBOR term rates. There are two different TIBORs:

- Japanese Yen TIBOR (DTIBOR) representing onshore unsecured lending in JPY.

- Euroyen TIBOR (ZTIBOR) representing offshore unsecured lending in JPY.

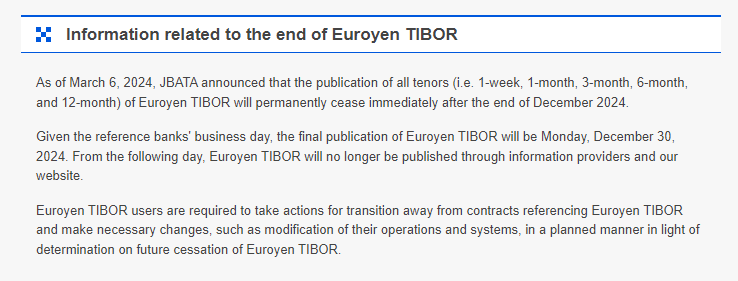

The cessation of Euroyen TIBOR (ZTIBOR) was announced on 6th March 2024, whilst Japanese Yen TIBOR will continue for now. (This provides a good overview of JPY interest rate indices in case you are getting confused!).

CCPView data shows that IRS referencing TIBORs have accounted for less than 1% of JPY Rates risk traded in 2024. Looking into the details, most of the continuing TIBOR volume is versus DTIBOR, although some very small volumes in ZTIBOR are still being reported.

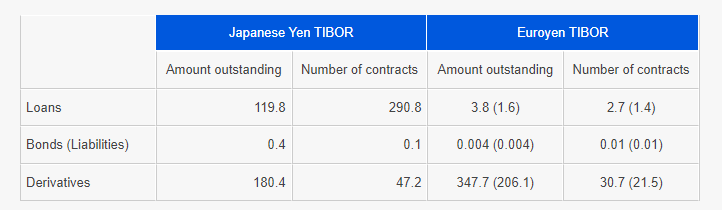

The trusty TIBOR reference page suggests it will mainly be legacy Interest Rate Swaps impacted by the upcoming Euroyen/ZTIBOR cessation, which is actually larger than the Japanese Yen/DTIBOR stock of trades:

There Are Two CCPs in JPY Swaps

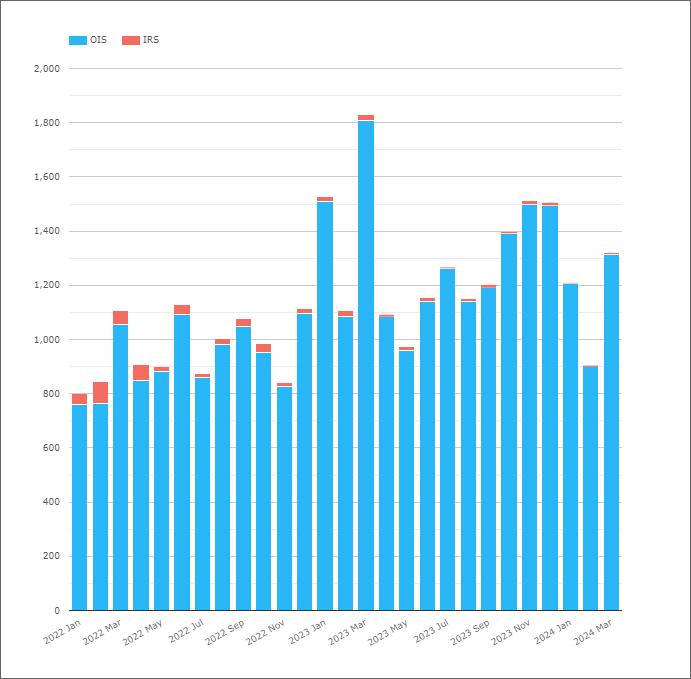

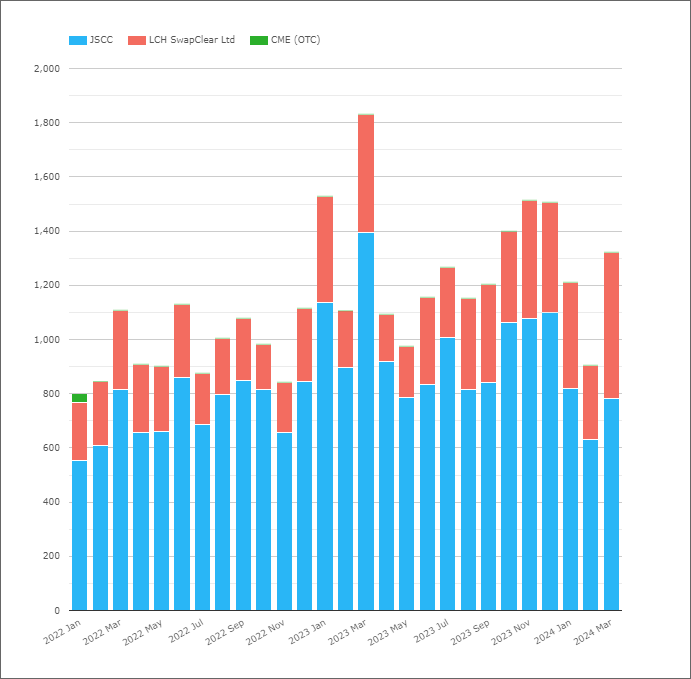

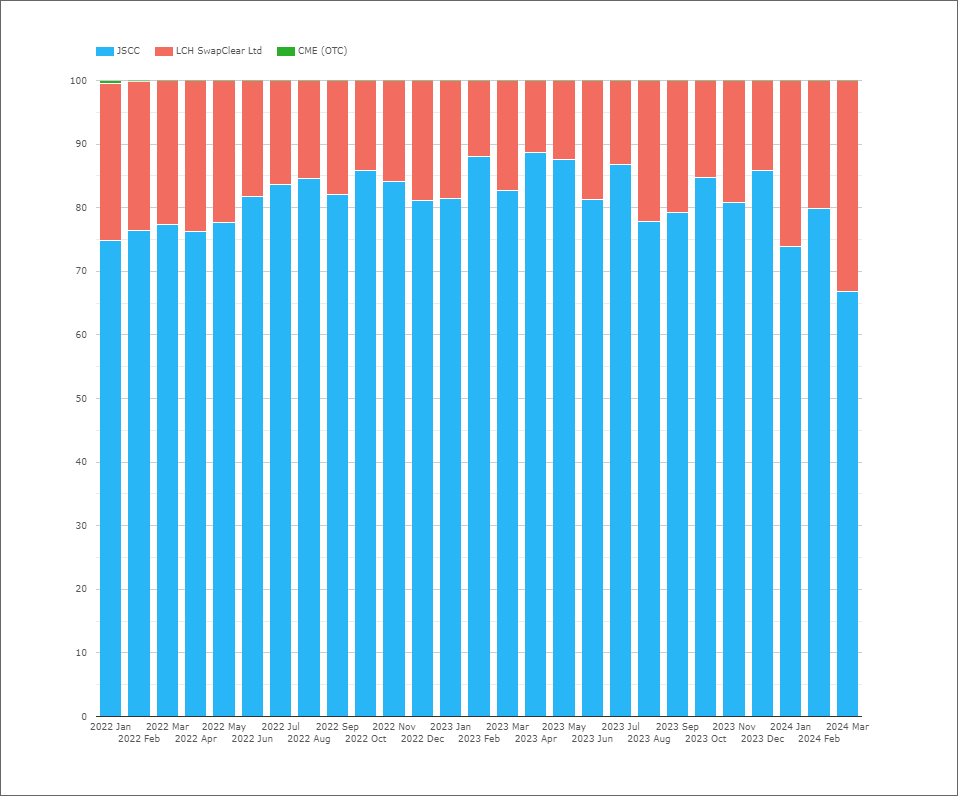

It would be interesting to learn what is top of Japanese bank priorities right now – the aforementioned ZTIBOR cessation or the on-going bifurcation of Swaps volumes across JSCC (“onshore”) and LCH SwapClear (“offshore”). The chart below shows this very well:

Showing;

- Three CCPs active in JPY swaps. JSCC has the largest market share, followed by LCH SwapClear. CME sees some sporadic volumes.

- Volumes increased throughout 2023, with Q1 and Q4 notably strong. February 2024 was a very quiet month for volumes!

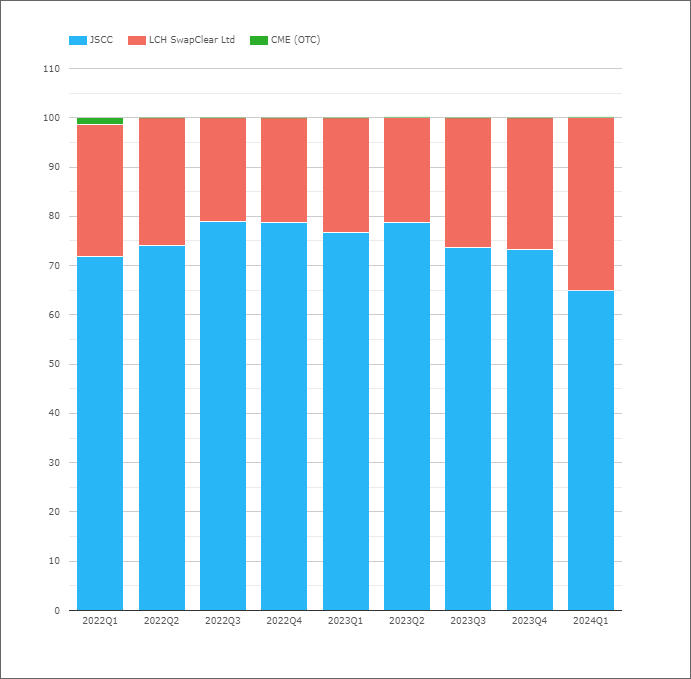

The quarterly evolution of market share per CCP makes for an interesting chart:

Showing;

- JSCC with a market share up to 78%.

- LCH SwapClear with a market share reaching 35% so far in March 2024.

- LCH SwapClear have seen a steady increase in their market share over the past 12 months, from a low of 21%.

Market Share Varies by Tenor

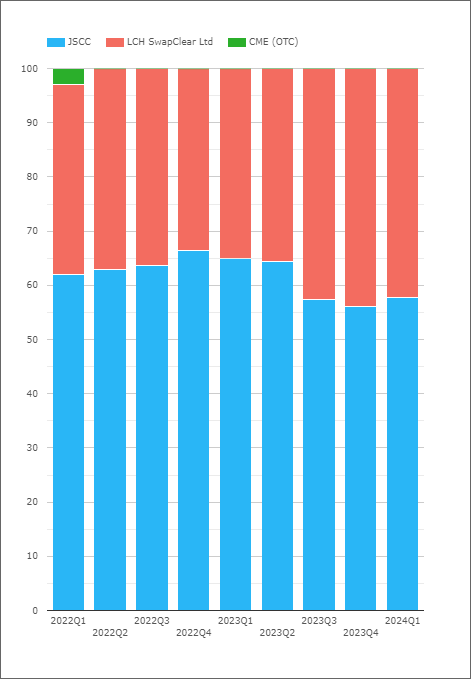

The above chart looks very similar for Tenors 10Y and longer. However, if we re-run the same data and look at only maturities up to (and including) 9Y:

Showing;

- The market share is more like a 60/40 split in shorter maturities.

- JSCC is still the largest CCP

- I noted this feature of JPY CCP market share in an earlier blog (way back in 2019: JPY Swaps – A Market Overview)

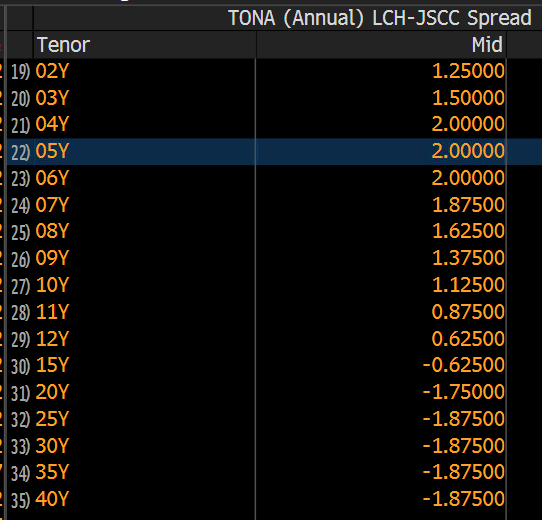

And We Have to Mention CCP Basis

A popular blog at Clarus has been Amir’s LCH-JSCC Basis in JPY Swaps, with the price differential between LCH and JSCC cleared swaps consistently volatile. As a reminder, historically this basis has reflected higher fixed rates at LCH with the predominantly domestic client base at JSCC more likely to be receivers. Historically, the basis has been positive – e.g. +2 in 5 years means that fixed rates at LCH are 2 basis points higher than at JSCC.

Looking at the ICAP screen in Bloomberg, this has recently changed in longer tenors:

The LCH-JSCC basis appears to have headed deeply negative around year-end. Those with Risk.net subscriptions can read some of the potential drivers below (more receivers at LCH and more payers at JSCC than normal 😛 )

Safe to say that this basis will continue to be (surprisingly?) volatile as the market grapples with any changes in BoJ monetary policy.

Is there an obvious link between CCP market share and the level of the CCP Basis? If so, it is not immediately obvious. However, we noted above that LCH market share recently reached 35% in March 2024, and this is even more obvious when looking at the DV01 in tenors of 20Y and longer:

Is this negative basis proving to be a positive for LCH then? I personally want to wait for more data – certainly worth monitoring.

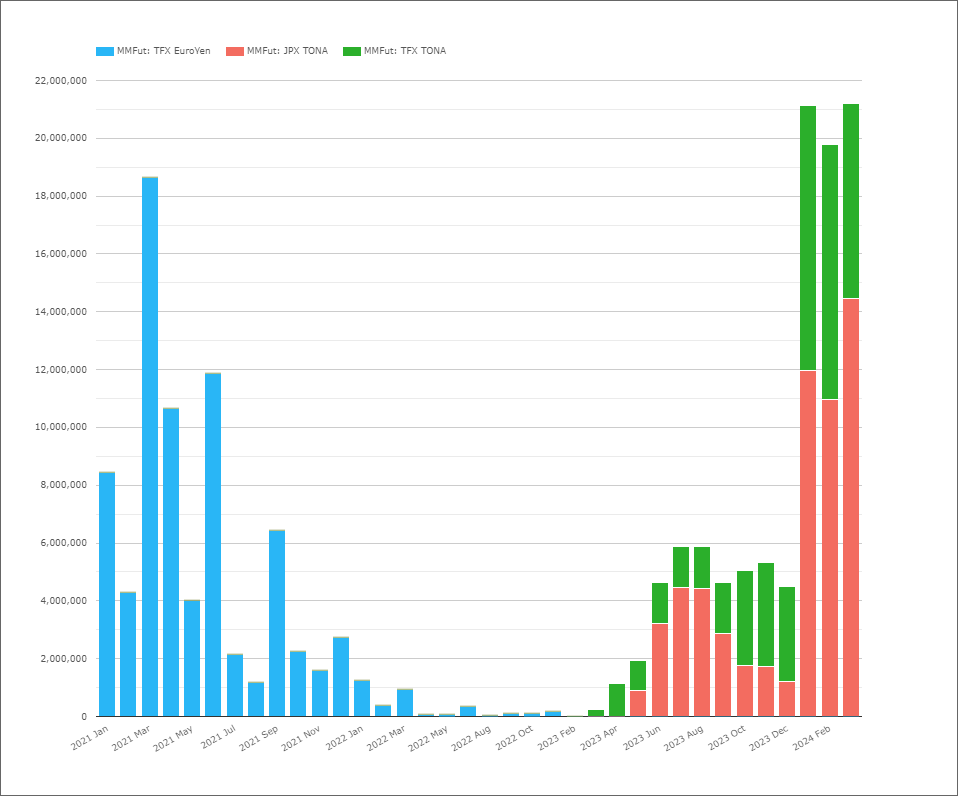

TONA Futures

Elsewhere, and rather excitingly, I am pleased to see some real life in TONA futures. Volumes have sky-rocketed in 2024 to levels not seen since 2021 when the (now suspended) ZTIBOR-based Euroyen contract was still trading:

Market share has moved closer to a 50/50 market share between TFX and JPX amidst the volume explosion in 2024. Again, one to monitor.

In Summary

- The JPY Swaps market is relatively complex with two CCPs competing for market share.

- Volumes have grown consistently in JPY Swaps since LIBOR cessation in 2021, no doubt helped by changes in BoJ monetary policy.

- There has been a recent cessation announcement for offshore Euroyen ZTIBOR.

- The price basis between LCH and JSCC has been very volatile, reaching negative levels in long tenors recently.

- Volumes in TONA futures have skyrocketed so far this year.