SEF Data Normalization & Aggregation

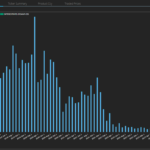

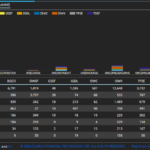

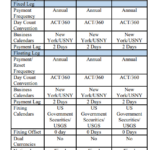

Drilldown into SEF Activity

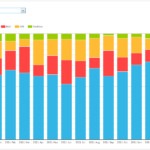

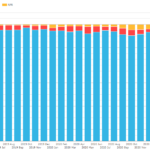

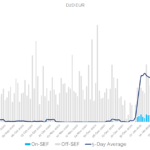

Report and Filter by Asset Class, Product, Currency, Security, Currency Pair, Tenor

Report on USD equivalent notionals, 5YR equivalents

Delineates Block vs Non-Block

Includes DCM Swap Futures, as well as Bond and MM Futures as a benchmark

Full History from SEF inception Oct 2, 2013

To see the past 5 days of data, please go to SEFView

For our Terms of Service

To gain access to full history, drilldowns and filters, please Contact Us.

Latest Posts

-

Apr, 16

All You Need To Know To Avoid The Trade Execution Requirement?

What is a MAT trade? A MAT filing, or “Made Available to Trade” determination, is when a trading venue (SEF) submits a proposal to the CFTC stating that they deem certain swaps to be liquid enough to have an execution mandate applied to them. Basically, a SEF says “I think these swaps should only be traded on SEFs in […]

Read moreFeb, 142023 SEF Volumes and Share in SOFR Swaps

Background In May 2023, I published a blog on IDB Market Share in SOFR Swaps, which used data we collect, filter and enhance in pur SDRView product. The blog looked at the type of SOFR Swaps that trade on Inter-Dealer Broker (IDB) SEF venues, also referred to as Dealer-to-Dealer (D2D venues); namely Spreadovers, Curves and […]

Read more -

Apr, 24

There is a new MAT Filing!

Made Available to Trade Let’s do a poll to kick things off. Before you clicked on this blog, did you know that there had been a new MAT filing? I’m betting that most of our readers were well aware. The MAT filing, from Tradeweb, received decent press coverage, including from Risk: What Is It? A […]

Read moreFeb, 1SOFR Swaps D2D Volumes and Share

SOFR Swap Volumes at D2D SEFs Volumes in SEFView reported by D2D SEFs under CFTC Part 16 regulations for last week. Showing that Tradition is the largest with $70 billion, followed by TP at $42 billion and IGDL(ICAP) at $32 billion. However we know that in terms of market share that represents revenue share, these […]

Read more -

Jan, 25

2021 SEF Volumes and Share – CRD and FXD

Today I review 2021 Swap Execution Facility (SEF) volumes and market share for both Credit Derivatives and Foreign Exchange Derivatives, in a similar format to my 2020 SEF Market Share Statistics article. Summary: CRD Index, Option and Tranche products Volume in USD of $7 trillion, down 8% from the prior year Volume in EUR of $4.3 […]

Read moreApr, 27You Need To See This SEF Liquidity In RFRs Now

USD SOFR trading on D2C SEFs is very small, and well behind the industry average. 72% of GBP risk was versus SONIA on D2D SEFs in April 2021. CHF SARON adoption has jumped to 15% on D2D SEFs this month. RFR Adoption Indicators In this blog I turn the RFR Adoption Indicator methodology onto SEF […]

Read more -

Apr, 21

Latest: More EUR Are Trading on-SEF than ever before

16% of the global EUR D2D swaps market is now on-SEF. This has recently increased above the levels we saw in January 2021. We do not know why there has been another increase in EUR SEF trading. But the data shows it is happening! US venues continue to be the main beneficiaries of Brexit in […]

Read moreFeb, 9US SEFs now have 20-40% of European Derivatives

Following up on our analysis of the Brexit effects on Rates markets and Credit markets we estimate how much of the swaps market is now executing on-SEF. The extent of the move varies from currency to currency and between Interbank markets and their Clients. We look at each market in turn. The Irony The laws […]

Read more