SA CCR for Excel

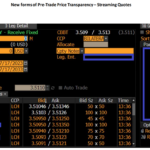

Access the power of cloud-hosted SA-CCR analytics directly from spreadsheets

For financial firms using SA CCR, we offer a free trial

CLARUS Excel Workbook or Add-in

Standardized Approach to Counterparty Credit risk

What-if analysis

Easy to Trial, Purchase and Start Using

Learn about SA CCR

Latest Posts

-

Jul, 26

FSB Paper on Liquidity in Core Government Bond Markets

I recently took a first look at Central Clearing of Bonds and Repos and in that blog I mentioned a Financial Statility Board (FSB) paper on Liquidity in Core Government Bond Markets. This paper analyses the liquidity, structure and resilience of government bond markets, with a focus on the events of March 2020; characterised as […]

Read more -

Jul, 25

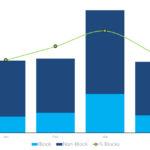

Even More on Blocks and new rules for FX

CFTC Global Markets Advisory Committee Following up on my blog last week, there is now the recording of the CFTC’s Global Markets Advisory Committee (GMAC) available on youtube: There are some interesting take-aways: Showing; Elsewhere, Tradeweb and Bloomberg provided insights into the RFQ1 vs RFQ-to-many split amongst large trades. This is some really interesting data. […]

Read moreJul, 19New Block Trading Rules Will Now Start in December 2023

Those of you with long memories will recall a particular blog I wrote about Block Trading and new rules that were going to come into play: Those new rules could have come into play as early as March 2023, but they have been delayed until December 2023. As a result, we have just seen learnt […]

Read more -

Jul, 21

Clearing Mandates and new Trading Obligations – regulatory change is happening.

The UK and Europe are currently consulting on both the Derivatives Clearing and Trading Obligations. Clarus are worried that the UK consultations risks a significant loss of transparency to markets. Particularly for USD. There appears to have been silence out of the CFTC on these important subjects. Europe has proposed covering some RFRs in the […]

Read moreJan, 12Cessation of LIBOR: Why is so much new risk still being transacted?

Q4 2020 saw $7.0bn DV01 of new USD-LIBOR* linked activity written in OTC derivatives markets. It is a similar story in GBP ($4.5bn DV01), JPY and CHF markets. Why is so much new risk being written against these indices when they are due to cease imminently? Responses to the IBA consultation on a possible cessation […]

Read more -

Sep, 30

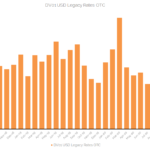

New Block Trading Rules for Derivatives

Amended 7th October 2020 to correct the changes to block and cap thresholds to 67% and 75% respectively. The block threshold for Swaps, and all other OTC derivatives, is changing. The thresholds for trades qualifying for block status and the reporting cap for notional amounts are also diverging. This will substantially increase transparency in the […]

Read moreMay, 12CFTC Block Trading Consultation May 2020

Our analysis shows that more blocks transacted than ever before in March 2020. More volume traded as a block on-SEF in March. There is no difference in Price Dispersion between block and non-block trades during both normal and stressed market conditions. The current 15 minute delay in reporting for block trades has no negative impact […]

Read more -

Jun, 26

Giancarlo looks to rescind CFTC Cross-border overreach

Following on from his Cross Border Swaps Regulation 2.0 whitepaper from last October, CFTC Chairman Giancarlo gave some updates in his speech at the recent FIA IDX in London . He is leaving the SEF cross-border proposals to be turned into proposed rules and voted on by his successor as Chairman – Heath Tarbert. On […]

Read moreMar, 27Incentives for Central Clearing and the Evolution of OTC Derivatives

We summarise the recent CCP12 report “Incentives for Central Clearing”. This report looks at the current state of play in Cleared FX, Interest Rates and Credit. It analyses particular niches in clearing, including Latam Rates and NDFs. It concludes that clearing has increased for Linear products, but Option markets remain uncleared. Further studies on legacy […]

Read more