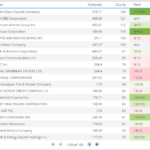

Aggregate views, charts, tables

Filtering by product/currency and drill-down to the trade details

Real-time intraday views

Single day view or a range of historical days view

Sources Rates, Credit and FX trades from the DTCC US DDR and Bloomberg SDR

Sources indicative mid prices from ICAP’s global brokerage operations

Data available via REST API

For more details, see SDRView Researcher and SDRView Professional. For our Terms of Service

Latest Posts

-

Nov, 29

Time Series of Swap Prices and Volumes

Analysing existing datasets in new and novel ways, often throws up interesting insights and questions which help with our understanding of the real world and in turn help us to make better decisions. Today I wanted to showcase a new feature in SDRView, that demonstrates this, the Ticker Summary View. SDRView has transaction level data […]

Read more -

Nov, 22

Swaption Volumes by Strike Q3 2023

Sometimes this blog would benefit from another Chris Barnes or Amir Khwaja! It has taken me until the tail-end of 2023 to revisit one of the most popular topics on the Clarus blog – Swaptions: I do not know which of the ~85 blogs I should not have written since I last wrote about Swaptions, […]

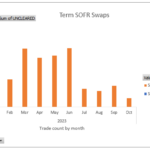

Read moreOct, 24Term SOFR and BSBY Volumes – October 2023

I last looked at Term SOFR and BSBY Volumes in May2023, so today I will look at the YTD 2023 data trends for these indices, and as before seperate Term SOFR (published by CME) from Average SOFR (NY Fed). A one-sentence summary is that “Term SOFR Swap volumes are down, though still far higher than Average […]

Read more -

Sep, 12

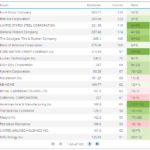

Most Active Names in Credit and Equity Derivatives – August 2023

I last looked at the most active trading names in CDS and TRS in May 2023, so today I will look at August 2023 data from US SEC Securities Based Data Repositorys (SBSDRs). CDS on Sovereigns Using SBSDRView, we can find the most active sovereigns for CDS trades in August 2023. The above list was a […]

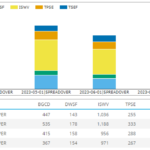

Read moreAug, 1SOFR Swaps Volumes and Share – July 2023

Let’s update my blog on IDB Market Share in SOFR Swaps with the most recent data and expand the coverage to also include D2C venues. Types of SOFR Swaps SOFR Swaps in the IDB (inter-dealer broker, D2D) market trade primarily as Spreadovers to US Treasuries. This is by far the most frequent trade type in […]

Read more -

Jun, 20

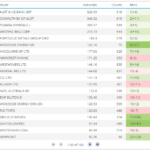

Most Active Names in Credit and Equity Derivatives – May 2023

Last month I looked at the most active trading names in CDS and TRS in April 2023, so today I will update that for May 2023. This data is from U.S. SEC Securities Based Swap Data Repositorys (SBSDRs). CDS on Sovereigns Using SBSDRView, we can find the most active sovereigns for CDS trades in May 2023. […]

Read moreMay, 17Most Active Names in Credit and Equity Derivatives – April 2023

I last looked at the most active trading names in CDS and TRS in January 2023, so today I will update that for April 2023 data. This data is from U.S. SEC Securities Based Swap Data Repositorys (SBSDRs). CDS on Sovereigns Using SBSDRView, we can find the most active sovereigns for Credit Derivatives trades in April […]

Read more