Latest Posts

-

Jul, 2

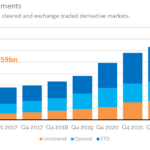

How much margin? The 2024 edition

This blog covers the 2024 edition of the “ISDA Year-End Margin Survey”, published on 14 May 2025, which covers over-the-counter (OTC) derivatives uncleared initial margin (IM) and variation margin (VM) for all asset classes, and cleared IM for interest rate derivatives (IRD) and credit derivatives (CRD) only. We combine the ISDA survey data with more […]

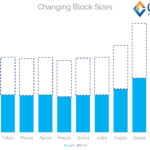

Read moreDec, 3New: Kids on the Block (Sizes)

The new block sizes in SDR data make trends in the data more difficult to identify – because now only 25% of notional should be “dark” (i.e. above the capped thresholds), down from 50%. More transparency is good, but we need to be careful when looking at data from before and after the new block […]

Read more -

Nov, 13

We Have New Block Sizes

Block Calibration It has been a long journey to finally arrive at the “go-live” for new block thresholds on October 4th 2024. I covered it here on the blog, so rather than re-hash what has happened, please refer to the old posts linked below: Suffice to say that there have been more than a few […]

Read moreOct, 8Pre-Hedging in Swaps

FMSB The FICC Markets Standard Board (see my 200th Clarus blog), known as the FMSB, recently published the paper “Spotlight Review on Pre-Hedging“. It makes great reading for anyone involved in Swaps markets – dealers, sales, trading, buyside. Read it! What is “Pre-Hedging”? According to the FMSB report, pre-hedging is the act of a dealer […]

Read more -

Aug, 20

Monitoring of Hedge Funds

Hedge funds are frequently in the financial news, which is not at all surprising given the size of the sector and the public profile and wealth of the founders. So it is good to see that a Hedge Fund Monitor has been released by the Office of Financial Research of the U.S. Department of the […]

Read moreMay, 14Using AI for Market Abuse Surveillance

The EU Market Abuse Regulation (MAR) requires institutions to monitor transactions and develop specific algorithms to check for possible abuse covering insider dealing, market manipulation and other categories. One of the challenges is that calibrated monitoring thresholds tend to be conservative and consquently produce a high number of false positives. These must then be manually […]

Read more -

Apr, 29

Regulating the transformative power of AI in Asset management

Artificial Intelligence (AI) is a transformative technology and this article covers a number of key regulatory areas for asset management including the recent EU AI Act, bias, transparency and security. Please read on the ION Markets Blog.

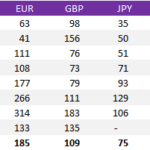

Read moreApr, 24How Much Margin? The 2023 Edition

Initial Margin ISDA have just published the latest edition of the “ISDA Year-End Margin Survey”: We have covered previous versions of this survey, which are always worth a re-read because you can laugh at any predictions we made in the past! Sifting through all of those reveals that between $650-800bn in extra IM was anticipated by ISDA as a […]

Read more -

Mar, 13

Mechanics and Definitions of the ISDA Credit Support Annex (CSA)

Credit Support Annexes used to be the dullest of the dull. A “back-office”, operational necessity that helped reduce counterparty exposures. Now, they are intrinsic to the functioning of modern day derivatives markets and have blossomed in both number and potential complexity as a result of the Uncleared Margin Rules. If you don’t have a CSA, […]

Read moreFeb, 21Best Practices for Variation Margin

No one wants to be called in default by a CCP during stressed markets as a result of operational complexity/failures – much as ICE & Citi stated regarding March 2020: So today I follow up on our Clarus blogs (and podcast!) regarding members requirements at CCPs. For example, you can take a look at the […]

Read more