GBP swaps – what’s new?

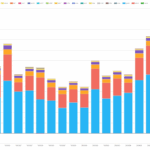

Today, we look at the GBP rates derivatives markets, which we do about once a year. The last time was a blog in July 2024. Summary Cleared GBP derivatives market size and share The total DV01 traded in cleared GBP cleared rates derivatives (swaps and futures) has broken recent records, as CCPView shows. Chart 1: […]

Q2 2025 CCP volumes and share in CRD and FXD

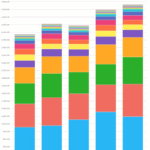

This blog reviews central counterparty (CCP) volumes and market share for cleared credit derivatives (CRD) and FX derivatives (FXD) in Q2 2025. For all-currency CRD, comparing Q2 2025 with Q2 2024, we see 45 percent volume increases, with indexes up 46 percent, single-names up 11 percent, and swaptions up 152 percent. Analyzing by currency shows that: […]

FX IM optimization

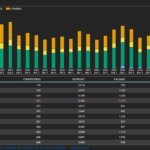

I wanted to do a long-overdue follow-up on a blog I wrote in 2019, ISDA SIMM FX Optimization and NDFs. That blog outlined the growth of G10 NDFs in response to the initial phases of UMR go-live from 2016 onwards, hypothesizing that multilateral FX IM optimization was driving the trend. (Note that another term was […]

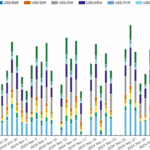

Swaption volumes by strike – Q2 2025

This post looks at USD swaptions activity in Q2 as part of our regular quarterly coverage, the most recent of which was Swaption Volumes by Strike – Q1 2024. We use SDRView data, which shows all trades reported by US financial firms to US SDRs. If you are new to swaptions, some basics are outlined […]