MIFID II and Transparency for Swaps: What You Need to Know

Today ESMA published its Final Report on Regulatory Technical Standards for MiFID II. A process that started in May 2014 with a Discussion Paper and then two Consultation Papers, is now nearing completion. For this article I have read as many of the 577 pages as possible, to try and understand what MiFID II will mean […]

AUD Cross Currency Swaps

Clarus explores the AUD/USD Cross Currency Swaps market. We find that our SDR data covers over 20% of the market – both for dealer-to-dealer and dealer-to-client flows. SEF-trading has seen an impressive uptake, with an average daily volume over $500m. The off-SEF market remains important – not surprising, given a lack of clearing or execution […]

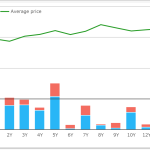

Swap Market Behavior on Fed-Day

Like many of you, I was tuned into CNBC last Tuesday to keep an eye on what the Fed decided to do with rates. Perhaps like many others, I also had SDRView Professional up and running on my desktop to see how the swap market was behaving. Here is what the 5YR USD swap was doing […]

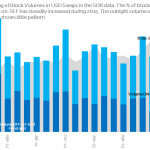

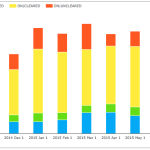

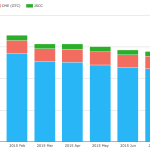

What’s the story behind Tradeweb block trading?

Tradeweb appear to have a 75% market share for Dealer-to-Customer Block trading which has increased substantially since the early days of SEF trading This is against a backdrop of fairly stable overall block activity… …but more and more block trades are being done on-SEF rather than off-SEF. Sadly, this may raise a question over good ol’ voice broking… […]

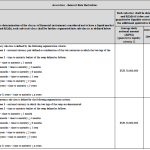

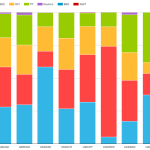

Basis Swap Volumes

For a while I have wanted to look into more detail at Interest Rate Basis Swaps, which are an important but little noted product type. So in this article I will look at what the data shows in terms of volume and trends. First the highlights: Basis Swaps are the fifth-largest USD IR product $230 billion […]

FX Options Trading On SEFs

In this article I will look at FX Options trade volumes as reported to US Swap Data Repositories and volumes published by US Swap Execution Facilities. This analysis highlights the following: Vanilla FX Option volume averages 24,000 trades a month in the largest 10 currency pairs EUR/USD is the most active pair with up to […]

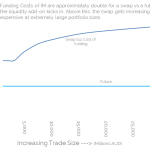

AUD swap market: Concentration risks from the Clearing Mandate

We present a uniquely Clarus view of the AUD IRS markets Our analysis of the regulatory landscape, bond issuance data and swap market flows suggests that many Swap Dealers will end-up in Add-On territory for OTC swaps clearing at CCPs This means that swaps become incrementally ever more expensive to trade relative to futures From a liquidity point of view, […]

TriOptima Compression at CME

CME recently put out a press release on their first TriOptima multi-lateral compression cycle, stating $2.2 trillion in gross notional reductions with 44,933 line items removed. (The full press release is here). So I thought it would be interesting to look at the significance of this. CME IRS Open Interest Using CCPView, we can look at CME […]

SEFs in Japan: ETP Data

Japan has joined the SEF party with their own flavor of trading venues known as Electronic Trading Platforms (ETP’s). ETP’s launched last week on Tuesday, September 1st. Amir had written about them back in April. Some rules have since been tweaked, and of course we now have some data. Lets have a look at everything. […]

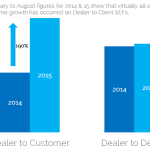

Is an All-to-All SEF Market about to arrive?

We combine SEFView and SDRView to strip out Compression flows from D2C SEFs. This allows us to make interesting comparisons between the Dealer to Client (D2C) and Dealer to Dealer (D2D) markets. D2D USD volumes have stagnated year-on-year. D2C volumes have exploded higher by 190%. This is before we even start talking about EUR swaps…. […]