FSB Paper on Liquidity in Core Government Bond Markets

I recently took a first look at Central Clearing of Bonds and Repos and in that blog I mentioned a Financial Statility Board (FSB) paper on Liquidity in Core Government Bond Markets. This paper analyses the liquidity, structure and resilience of government bond markets, with a focus on the events of March 2020; characterised as […]

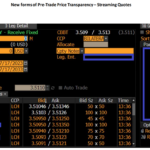

Even More on Blocks and new rules for FX

CFTC Global Markets Advisory Committee Following up on my blog last week, there is now the recording of the CFTC’s Global Markets Advisory Committee (GMAC) available on youtube: There are some interesting take-aways: Showing; Elsewhere, Tradeweb and Bloomberg provided insights into the RFQ1 vs RFQ-to-many split amongst large trades. This is some really interesting data. […]

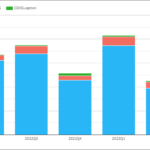

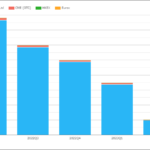

2Q23 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2Q 2023. All the charts and detail from CCPView. USD CDX, CDS and Swaptions CDX volumes significantly down compared to all the prior quarters shown. Market Share of USD CDX The upcoming ICE Clear Europe shutdown later in 2023, resulting in […]

New Block Trading Rules Will Now Start in December 2023

Those of you with long memories will recall a particular blog I wrote about Block Trading and new rules that were going to come into play: Those new rules could have come into play as early as March 2023, but they have been delayed until December 2023. As a result, we have just seen learnt […]

We Need to Talk About the Clarus API

Most of our readers come to the Clarus blog to receive new information from us. Whether that be on the data side (such as the monthly RFR Adoption Indicator) or about new regulations (such as Central Clearing of Bonds and Repos). But do our readers ever stop to consider which tools we use to deliver […]

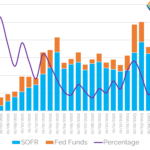

2Q23 CCP Volumes and Share in IRD

Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons of volumes. Today we look at 2Q23 Volume and market share in IRD for: Onto the charts, data and details. Volumes and Market Share For major currencies and regions, vanilla swaps referencing IBORs and OIS […]