Running the Numbers on the European Active Account Requirement

27th January marked the deadline for the latest ESMA consultation on the European Active Account Requirement. Risk.net wrote a good summary of the requirements back in November when the consultation was first published: What has been proposed? The Active Account Requirement for OTC derivatives means the following trades must occur at a CCP located inside […]

EUR Rates – What’s New?

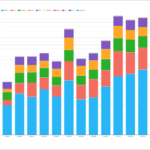

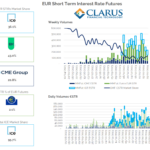

Time for another installment of my “What’s New” series, looking at dynamics (mainly volumes!) in different currencies. I follow EUR markets pretty closely, particularly through the lens of €STR futures market share and what is happening with EUR swaps. Today, I’ll take a look at most aspects of EUR trading. EUR Outright Volumes I like […]

Did we learn anything from the latest European announcements on clearing?

The Clarus blog covered Active Accounts back in December, and followed up with probably the first podcast in the world to cover Active Accounts: The European Parliament have followed this with an announcement this month that: The European Commission then provided the following details: For those of us who thrive on the details this looks […]

What is the latest European plan to onshore rates trading?

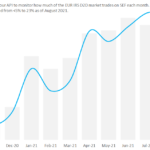

Almost exactly a year ago, the EU proposed requiring market participants subject to a clearing obligation to clear a portion of the products that have been identified by ESMA as of substantial systemic importance through active accounts at EU CCPs.

The unknown in the past 12 months has been how the EU will define the “Active Account Requirement (AAR)”. In the past few days […]

Brexit continues to impact EUR Swaps market share for CCPs and SEFs

It all started with a blog titled “Moving Euro Clearing out of the UK: the $77bn problem?“. Now, ISDA and other trade associations have published a statement on the “active account” requirement for Europeans: Which says; In case any of this is new to our readers, Brexit has resulted in a (political) desire in Europe […]

Latest EUR Swaps market share for CCPs and SEFs

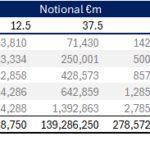

Eurex EUR share stands at 7-9% when measured by DV01. Globally, August 2021 saw the lowest EUR IRS volumes in the past 5 years. 23% of EUR IRS executes on-SEF. 60% of EUR CRD Index volumes now execute on-SEF. And we look at where clearing of EUR CRD Index trades is taking place. Now that […]

Using the Clarus API to monitor the latest Brexit impacts

After shouting “HopSchwiiz” in my adopted nation waaaaaay too much at the football last night, I needed a somewhat low-energy blog this morning. Step forward our easy-to-use API, which has recently been extended to include data from both CCPView and SEFView. Hopefully it’s not such a rollercoaster ride using the Clarus API 😛 Brexit Moves […]

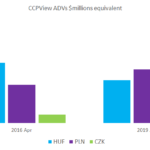

CE3 Currencies and Derivatives Clearing

Did you know that volumes in CZK interest rate derivatives have increased ten-fold in the past five years? CZK is now the largest Rates market amongst CE3 currencies. In the same time-period, HUF cleared markets have actually shrunk. PLN markets have grown by about 50%. Did the expiry of the Exchange Rate Commitment in CZK […]

The New Status Quo For Derivatives Markets After Brexit

Brexit has now moved…. $1.3Trn of EUR and GBP IRS $169bn of EUR ITraxx and $46Trn of SPS and FRAs …onto US-based SEF venues. Barely a day has passed in 2021 without Clarus receiving an enquiry about Brexit. Our data looking at both where trades are executed and where trades are cleared has been in […]

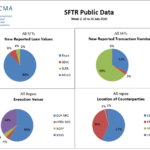

SFTR Public Data

In April I covered Securities Finance Transaction Reporting (SFTR) and ended that article by stating that I would check back end July for the first set of public reports from Trade Repositories. As there are four authorized Trade Repositories (DTCC, Regis-TR, UnaVista and KDPW), I had expected to look for the weekly data files published […]