What’s New in JPY Swaps in 2024?

Covering; ISDA AGM in Tokyo I thought I would try to be helpful with the timing of this blog. The ISDA AGM is due to take place April 16-18 in Tokyo: Most delegates will take time to also see Tokyo-based clients, and will therefore be discussing the JPY swap market whilst doing so. So consider […]

What You Need to Know About INR Swaps

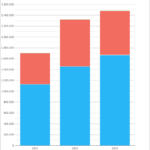

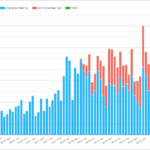

Where do INR Swaps Rank on the Global Picture? CCPView allows us to compare the relative size of INR swap markets to other currencies. Taking out the “G6” – USD, EUR, GBP, AUD, CAD and JPY – we see the below: Showing; Let’s look further into the INR Swaps market. Two Thirds of Cleared Volumes are […]

JPY TONA Futures: A Rising Star in the RFR Market

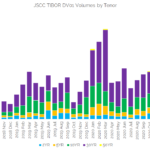

*I hope our readers don’t mind, but I chose to accept a little help from Bard this week. With so much web traffic generated via Google searches, I thought it a worthwhile experiment. TIBOR Cessation No two markets are the same, and we see this in the adoption of RFR trading. Whilst JPY LIBOR is […]

Swap Markets in China – What You Should Know

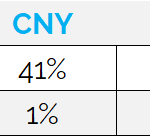

CNY Interest Rate Swap Introduction Before we look at some data on the Chinese swap markets, it is really important that readers are familiar with some of the terminology. Let’s start with the basics in terms of what the currency is actually called! Interest Rate Swap Market Conventions This blog looks at Interest Rate Swaps […]

The Latest in Aussie and Kiwi Swap Markets

The end of the year is a traditional time to reminisce. In that spirit, I remember writing my first blog on AUD swap markets from the back of a camper van on the West coast of Oz, after surfing in Yallingup. That experience now feels like a lifetime ago for me personally. Having recently returned […]

JPY TIBOR And RFRs: Is There A New Path?

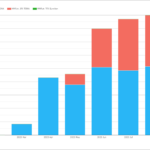

A large proportion of JPY swaps activity at JSCC has moved to JPY TIBOR. JPY LIBOR swaps have shrunk from 89% to just 66% of the market. At the same time, overall JPY IRS volumes have drastically shrunk. We look at the data behind cleared JPY IRS markets. A Bloomberg article last week flagged to […]

SGD Rates: SORA and the Fallback Rate (SOR)

A new Fallback Rate (SOR) will be used on SOR-referencing contracts in the event of a cessation of USD LIBOR. This rate should not be used in any new derivatives, and is only expected to be published for a period of about three years. As Clarus highlighted during the original ISDA consultation, the Fallback Rate […]

What You Need to Know About CNY Swaps

CNY Swaps are the 9th most traded interest rate swap at CCPs. The market is quite standardised, with 90% of volumes in just three tenors. Clearing is split between Shanghai Clearing and LCH SwapClear. 60% of the market is now cleared. When I took a look at trends in 2019 for swaps market data, I […]

SGX FlexC FX Futures

In March 2019, just over 8 years after its launch, SGX shut down it’s OTC Financials Clearing business. However SGX continues to innovate and has focused on the futures market. One example of this is the launch of FlexC FX Future, a product which aims to replicate a Non-Deliverable Forward and capture liquidity/volume from the […]

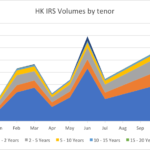

Overview of the Hong Kong Trade Repository

Hong Kong started interim trade reporting in August 2013, with Legislative vetted rules implemented on 10 July 2015. Unlike other jurisdictions in Asia, HKMA built the trade reporting solution themselves. The Hong Kong Trade Repository (HKTR) was built by their subsidiary Hong Kong Interbank Clearing Limited (HKICL). HKICL also built/manages Hong Kong’s payment infrastructure on […]