ESG Basics and Fundamentals in Fixed Income

What role can credit derivatives play in ESG-themed trading strategies? As we continue to explore the ever-expanding world of ESG-linked derivatives, we look at primary market issuance in 2021 and the links with the CDS market. Introduction There are many “beginner guides” to ESG out there. Of the many we’ve trawled through, I suggest checking […]

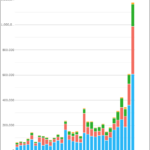

IR Futures – ADVs and OI in major currencies

We look at recent Average Daily Volume (ADV) and Open Interest (OI) of the major IR futures: Money Market and Bond Futures AUD, BRL, CAD, CHF, EUR, GBP, JPY and USD Relative size by ADV and OI on a comparable dollar notional basis Trends and market share in SOFR, SONIA and GBP Libor MM Futures […]

The New Status Quo For Derivatives Markets After Brexit

Brexit has now moved…. $1.3Trn of EUR and GBP IRS $169bn of EUR ITraxx and $46Trn of SPS and FRAs …onto US-based SEF venues. Barely a day has passed in 2021 without Clarus receiving an enquiry about Brexit. Our data looking at both where trades are executed and where trades are cleared has been in […]

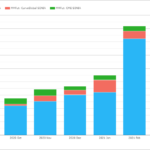

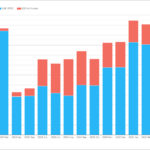

ESG Futures – S&P 500 and STOXX 600

In my recent article, ESG Investments – A first look at the detail, I noted that two of the major Equity Index Futures contracts, CME S&P 500 and Eurex STOXX 600 have ESG screened variants. In today’s article I look at the volume and open interest of these contracts. CME S&P 500 ESG Starting with […]

What’s New in USD Rates?

USD Rates volumes have returned to the levels we saw in March 2020. We look at whether these volumes are being driven by US Treasuries, bond futures or OTC swaps. Clarus provides volume data by tenor for all of these asset classes under a single data subscription. CCPView provides granular data on traded volumes across […]

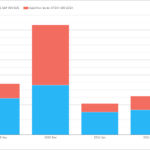

SONIA is now the Benchmark Rate in GBP Markets

February 2021 saw 10.6% of all derivatives risk traded versus an RFR. This has now been stable around 10% for some time. We cover the pre-cessation announcements concerning LIBOR and the historic spread calibration that took place last week. There has also been a sharp move higher in the amount of long-dated SONIA risk being […]

Climate Risk Disclosures of major UK Banks

Following on from the first ESG blog on the Clarus website, see ESG Investments, our second ESG blog takes a look at the Climate Risk Disclosures of major UK Banks. Combining many factors into a single score or rating, which can then be optimized is a common approach in Finance. While we do not want […]

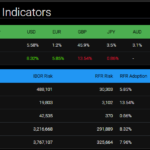

Monitoring your own RFR Adoption Indicators

Last summer I wrote Calculate Your Own RFR Adoption Indicators to explain why it was important on IBOR Transition projects to benchmark and monitor your own firms adoption rate versus the market. In a nutshell, your project needs to know if your firm is lagging, leading or in the middle of the pack and respond […]

Here is what is happening to derivatives market liquidity right now

The price of liquidity in USD swaps has risen in 2021 relative to 2020 when measured by Price Dispersion. However, USD Swap markets saw huge volumes traded during February 2021, showing that liquidity has still been available. Our analysis shows that the price of liquidity has increased as volatility increased. Everyone is talking about the […]

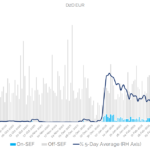

SOFR Futures and Swaps – Feb 2021

February 2021 was an interesting month in interest rate markets with the volatility in US Treasuries showing up in many products. Today I look at what happened to volumes in derivatives referencing SOFR. Volume and Open Interest in SOFR Futures Volume and OI in SOFR Swaps SOFR Swaps at US SDRs SOFR Swaps on SEFs Clarus Data provides […]