Could “enshittification” happen in derivatives markets?

*Disclaimer – this is a tongue-in-cheek consideration of third-order risks in our markets. Hope you enjoy. For those who missed it, the FT introduced us to “enshittification” last week, and the article has no doubt made the rounds of trading floors ever since: https://www.ft.com/content/6fb1602d-a08b-4a8c-bac0-047b7d64aba5 Why are we choosing to talk about it on the Clarus […]

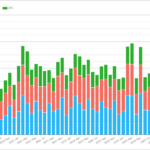

USD Rates Overview in 2024

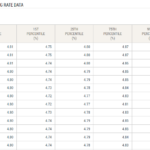

We have previously noted that EUR Rates are now larger than USD Rates in terms of notional traded across OTC swaps (see here and here). This change has arisen because EUR has continued in a multi-rate environment – both €STR and EURIBOR swaps still trade, whilst USD has largely moved to SOFR, with Fed Funds […]

Swaps Compression: What is it and why is it important?

Another interesting article on the ION Markets Blog provides an introduction to Swaps Compression, for those not familiar with this or just needing a referesher on the what and why, please read at Swaps Compression: What is it and why is it important?

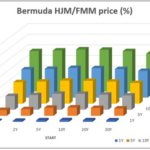

HJM-FMM Model – Fast Calibration via a Neural Network

Authored by, Davide Gianatti, Serena Manti and Gianluca Molteni of the Financial Engineering and A.I. team at List. The aim of this post is to introduce a novel systematic approach that could be used to calibrate quickly any model describing interest rates. The core of the algorithm is a Neural Network (NN) that outputs the parameters […]

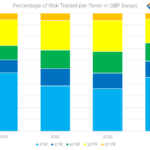

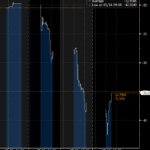

Gilty Secrets Of GBP Swaps

(Sorry/not sorry for the title) UK Rates UK rates markets have been interesting ever since the autumn meltdown, and there are now lots of headlines around as yields break the highs last reached in those tumultuous trading days: The FT Alphaville overview of why June 2023 is not September 2022 is well worth a read […]

HJM-FMM Model – A Deep Dive

Authored by, Serena Manti and Gianluca Molteni of the Financial Engineering and A.I. team at List. This is the follow-up of our first post introducing the paper “Parsimonious HJM-FMM Model with the New Risk-Free Term Rates“. Here, we would like to provide you with a brief more technical description of our innovative HJM-FMM model, followed by […]

Parsimonious HJM-FMM Model with Risk-Free Term Rates

Authored by, Serena Manti and Gianluca Molteni of the Financial Engineering and A.I. team at List. In this post we would like to introduce our paper “Parsimonious HJM-FMM Model with the New Risk-Free Term Rates“, a modified version of the Heath-Jarrow-Morton (HJM) model that addresses the limitations of the traditional approaches in the context of […]

Fast Valuation of Seasoned OIS Swaps

OIS swaps have coupons determined by compounded daily interest rates settled every few months. The valuation of future coupons is computationally similar to the valuation of a LIBOR payment, in that the valuation involves the ratio of two discount factors associated with the start and end of the accrual period. A problem can arise on […]

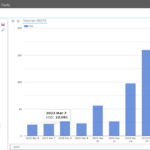

Credit Suisse & UBS LIVE Blog

SBSDRView allows us to track trading in single name CDS: Follow the blog live today to see what the market thinks of the Credit Suisse-UBS deal. We will also be following other banking CDS (Deutsche amongst others….) to monitor any potential contagion. 10:00am CET We have already had the first Credit Suisse CDS trade of […]

How to Trade A Bank Run

Much of what is written on this blog stems from the “OG” Financial Crisis back in 2008. Without that, we would not have seen the Dodd Frank Act or post trade transparency in OTC derivative markets. Back in 2008 I was trading cross currency swaps. These were one of the hardest hit instruments as the […]