Why Is There No Mainstream Swap Index?

All firms benchmark their performance. It’s relatively straightforward to compare your investment returns to the S&P 500, Dow Jones, Investment-Grade credit, or simply government bonds. All of these are simple because they have clear indices. As such, you can look at the level of the S&P 500 on Day X and Day Y, and come up […]

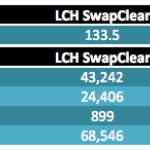

Comparing CCP Disclosures for CME, ICE, JSCC, LCH

Last week I wrote an article on European CCP Public Disclosures, following this I learn’t that in-fact the CPMI-IOSCO Public Disclosure is not limited to European CCPs but is Global. So there is a lot more data to look at. Today I will focus on the largest Interest Rate Swap CCPs and the largest Credit Default […]

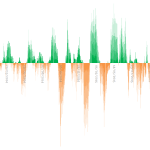

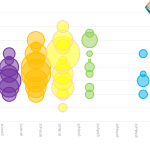

Volatility and Trading Volumes in Swap Markets

It’s been a volatile start to the year This has led to record volumes in benchmark swaps We explore the relationship between Volumes and Volatility in Swaps markets We find that there is a strong correlation worthy of investigation Volatility Everywhere Check this out from LPL Research via Advisor Perspectives – a six week change in […]

Invoice Spread Trading in the New CME Ultra-10 Year Treasury Futures Contract

We take a look at Invoice Spreads with the help of two new features in the Clarus SDRView products. We closely examine swaps related to the new CME Ultra 10y UST Future. Swaps related trading looks to be a strong driver of volumes in the new contract so far. Looking at the maturity profile of the Spreadover market suggests […]

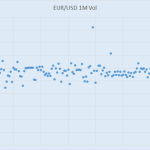

FX Options Data on the SDR

Chairman Massad has been vocal recently in his intent to clean up the quality of the data in the SDR. I recall him a few months ago speaking about the progress the CFTC has made policing the industry on data quality for vanilla interest rate swaps, so I thought I’d go have a look at […]

CPMI-IOSCO Public Disclosure by European CCPs

European CCPs have recently started to publish lots of quantitative data covering their Default Fund, Initial Margin, Collateral, Credit Risk, Liquidity Risk and other Financial Disclosures. This has been done in compliance with the guidance provided by CPMI-IOSCO with the public disclosure aiming to further increase the transparency of financial markets and CCPs in particular. The data […]

MIFID II and Transparency for Bonds: What You Need to Know

Following on from my article on MiFID II and Transparency for Swaps, I wanted to look at Fixed Income Securities and specifically Bonds. Background The ESMA Final Report deals with Draft Regulatory Technical Standards (RTS) of which there are 28 and describes the consultation feedback received, the rationale behind ESMA’s proposals and details each RTS. While MiFID […]

Rebuilding A Swaps Desk

Many firms are restructuring their fixed income businesses in order to compete in the new world of swaps. New regulations have made the industry more competitive, one where clients are no longer beholden to their large dealers; one where clients are reportedly taking liquidity based upon price, firmness, and response time. We are seeing the […]

CDS – Record Volumes, Expiring Swaptions and Bloomberg

We look at the SDR data for CDS Index and Swaption trading. In Options, we see a lot of Swaption expiries coming up next week. For the underlying Indices, there have been record volumes traded during 2016… …with Bloomberg’s SEF the number one venue. Automated Trading in Credit anyone? I recently saw a nice click-bait title on Bloomberg […]

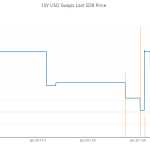

SDR Prices, Python and plotly

We supply simple code to retrieve SDR Prices into Python And create a streaming chart of swap prices and volumes The code was written by an ex-trader with no prior experience of Python Showing how easy it is to use the Clarus API Clarus continue to make swaps data more accessible than ever Is this a Stupid Thing to […]