Using SACCR to monitor Counterparty Credit Risk

Risk Weighted Assets Counterparty Credit Risk is typically the largest contributor to Risk Weighted Assets (RWAs) for banks. This Clarus blog covered RWAs way back in 2017 when looking at Basel III disclosures. It is highly unlikely to have changed in the intervening six years: In today’s blog, we don’t want to necessarily talk about […]

Now everyone can understand bank capital requirements

In January 2022, I wrote about SACCR: Bank Capital. A bank will typically have one of two constraints – either Leverage Ratio or Credit RWAs. This is because a bank has to hold a given pot of capital versus its exposures, and these exposures are not necessarily additive. It simply has to hold enough tier […]

Have You Listened to our new Podcast yet?

The first Clarus podcast is out – please take a listen! Podcasting You may have noticed that we’ve had reason to celebrate a few milestones on the blog over the past year: 1,000 blogs on Clarus 400 blogs for both Chris and Amir With the blog continuing to be well received and well read (even […]

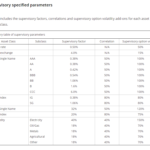

Mechanics and Definitions of SA-CCR (Part 3)

Please note: this is Part Three of a series. Part one of the story for SACCR provided critical background regarding key terms and concepts. Part Two covered the Maturity Factor and how different CSAs and/or treatments of derivatives impact SACCR calculations. We now need to look at how the SACCR calculations unfold in terms of netting. […]

Mechanics and Definitions of SA-CCR (Part 2)

The Maturity Factor is a key variable in determining bank capital under SACCR. It varies according to the type of margining agreement (CSA) in place. It also varies according to the number and type of underlying derivatives within a netting set. We look at large netting sets, CSAs with hard to value derivatives and settled […]

Mechanics and Definitions of SA-CCR (Part 1)

SACCR is the Standardised Approach to Counterparty Credit Risk (CRE52 under the consolidated Basel capital framework). It covers calculations for Credit Risk Weighted Assets and exposures under the Leverage Ratio (known as the Supplemental Leverage Ratio, SLR, in the US). It will impact the amount of Tier 1 capital banks must hold. SACCR means that […]

SACCR Multipliers, Initial Margin and KCCP

KCCP defines the amount of capital that must be held versus default fund contributions at a CCP. The lower the value of KCCP, the lower the overall cost of clearing. The SACCR multiplier used to calculate KCCP suggests that KCCP reduces for every extra dollar of Initial Margin posted at a CCP. We look at […]

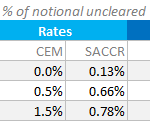

SACCR vs CEM for FX Products

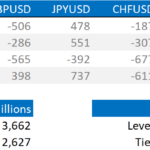

Blame our active community of readers if you must. But we’ve had the most requests for a comparison of FX products under SACCR and CEM in response to my original blog. Therefore, here we go… SACCR is Coming If you need a refresher on SACCR and CEM, then please check out our comprehensive coverage below: […]

SACCR vs CEM Comparisons

Welcome to my 250th blog for Clarus! That is quite a milestone – I’ve now inflicted nearly a quarter of a million words on our readers. I hope the vast majority have been useful. To celebrate, you will have to suffer a bit of true geekiness. Today we’ll take a look at Regulatory Capital, which […]

SA-CCR for US Banks

The US is introducing SA-CCR to calculate derivatives exposures in 2020. We look at the consultation. We compare add-ons under SA-CCR and the old CEM methodologies. Clarus offer FREE TRIALS of SA-CCR for Excel. SA-CCR Consultation The Federal Reserve, OCC and FDIC have launched a joint consultation on SA-CCR, the Standardised Approach to Counterparty Credit […]