Giancarlo looks to rescind CFTC Cross-border overreach

Following on from his Cross Border Swaps Regulation 2.0 whitepaper from last October, CFTC Chairman Giancarlo gave some updates in his speech at the recent FIA IDX in London . He is leaving the SEF cross-border proposals to be turned into proposed rules and voted on by his successor as Chairman – Heath Tarbert. On […]

Types of Cloud – A Primer on the Choices and Challenges

Cloud is now ubiquitous, but not all clouds are the same. In this blog we will look at the different types of cloud – Private, Public, Hybrid and Multi-Cloud, and think about their suitability and use in financial organisations. Private Cloud Private clouds are facilities created for a single organisation: they may be provided as […]

CCP Default Management Auctions

The Default at Nasdaq Clearing has re-invigorated industry discussions on default management practices and we are now seeing the fruits of these labours. For example CCP12 recently published a CCP Best Practices Paper and LCH published Best Practices in CCP Risk Management. Today I will look at the BIS CPMI-IOSCO “Discussion paper on central counterparty […]

Mechanics and Definitions of Singapore Benchmark Rates (SGD SOR and SGD SIBOR)

Singapore has unique benchmark interest rates. SOR is an FX-derived synthetic SGD interest rate from FX swaps. SOR will therefore be impacted by changes to USD LIBOR as a result of the latest ISDA consultation. Cross Currency in SGD trades versus the SOR index. Why isn’t the basis therefore zero? Singapore Interest Rates In response […]

LIBOR Fallbacks and Uncleared Margin Rules

LIBOR fallbacks and Uncleared Margin Rules are hot topics across the industry. We highlight the Basel guidance that any amendments to LIBOR contracts as a result of Benchmark reform will not trigger the need to post margin. This is important guidance to ensure the uptake of new RFRs is simple. Two of our big blog […]

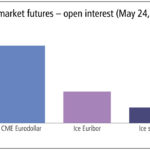

Swaps Data: A new era of competition in IR Futures

The demise of Libor has sett off a battle for market share in futures referencing new risk-free rates. My monthly Swaps Review looks at: The three largest IBOR contracts SOFR Futures market share SONIA Futures market share CME, ICE, CurveGlobal, Eurex Please click here for free access to the full article on Risk.net.

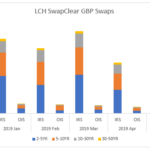

SONIA and SOFR trading and Term Risk Free Rates

The use of Risk Free Rates (RFRs) such as SONIA and SOFR continues to grow. Volumes are increasing as described in recent Clarus blogs, see SOFR Volumes April 2019, SARON Activity and Growth in RFR Markets. But the development of a term market in RFRs is still in it’s early stages. Clearing House data shows […]

Optimising IM in Swaptions

Whille writing my recent blogs on FX SIMM IM optimization (here and here), I wondered about progress on the Rates equivalent. I knew swaptions to be key and that Capitalab had focused on them from the get-go and also that Capitalab pipes executions through its affiliated BGC SEF. So, I took at look in SEFView […]

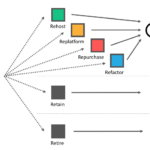

Migrating to Cloud – An Insider’s Guide

In earlier blogs we have discovered the agility inherent in Cloud, but how do organisations manage to tap into this, with all their legacy systems? In this blog we will cover the strategy and issues involved in migrating a large systems estate. We will start by assuming foundational Cloud concerns for financial organisations such as […]

LIBOR Fallbacks Again

ISDA has launched a second consultation on LIBOR fallbacks. This extends the number of benchmarks covered to eight currencies. The big one this time is USD LIBOR, which is interesting because USD SOFR has a limited history available. Fortunately, the New York Fed has made a proxy USD repo rate available back to 1998. 78% […]