Are Inflation Expectations Becoming Entrenched? The Data.

With inflation front and centre of everyone’s mind, let’s test a simple hypothesis. If inflation expectations are becoming entrenched – i.e. people expect inflation to be elevated for a longer period – is there evidence of this in trading activity? What evidence might we see? There are two potential signals: More trading activity in Inflation […]

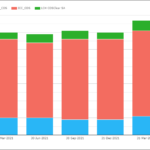

Did You Know That SACCR Now Makes FX Trading More Expensive?

This week I want to pull together two of my recent blogs: FX Clearing 2022 Mechanics and Definitions of SACCR (part 3) I was fully expecting to see a “SACCR effect” on the amount of FX Clearing we see in 2022. Let’s look into the details below. Widening Spreads FX and SACCR have made the […]

What’s New in CCP Quant Disclosures – 1Q22?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Initial margin for ETD at $571 billion is up 12% QoQ and 29% YoY Initial margin for IRS at $269 billion is up 3% QoQ and 7% YoY Initial margin for CDS at $66 billion is up 10% QoQ and 10% YoY LME Disclosures provide insight into the Nickel crisis Other CCP disclosures with record highs Background […]

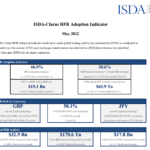

SOFR is now over half the market

The ISDA-Clarus RFR Adoption Indicator jumped to a new all-time high of 46.0% in May 2022. SOFR adoption cracked 50% (just!) of the market. 21.8% of EUR risk traded versus €STR, dipping slightly from last month’s all time high. We look at SEF activity in SOFR. The ISDA-Clarus RFR Adoption Indicator for May 2022 has now been published. […]

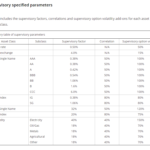

Mechanics and Definitions of SA-CCR (Part 3)

Please note: this is Part Three of a series. Part one of the story for SACCR provided critical background regarding key terms and concepts. Part Two covered the Maturity Factor and how different CSAs and/or treatments of derivatives impact SACCR calculations. We now need to look at how the SACCR calculations unfold in terms of netting. […]

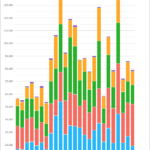

FX Clearing 2022

We look at the growth in cleared volumes across FX products. NDFs now see over $1Trn cleared in a single month. Open Interest has grown significantly in the past two years. NDFs in 8 currency pairs dominate cleared OTC volumes. For those interested in uncleared markets, and particularly FX, it may be interesting to know […]