SEC Security-Based Swap Repositories are now Live!

On February 14, 2022, public dissemination of security-based swap transactions under the Securities and Exchange Commissions (SEC) regulations went live. See the statement from Chairman Gary Gensler. Almost 9 years to the day of our first blog, Shining a light on Derivatives, covering the Swap Data Repository (SDR) operated by DTCC for the Commodity Futures […]

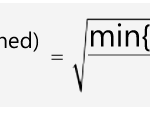

Mechanics and Definitions of SA-CCR (Part 2)

The Maturity Factor is a key variable in determining bank capital under SACCR. It varies according to the type of margining agreement (CSA) in place. It also varies according to the number and type of underlying derivatives within a netting set. We look at large netting sets, CSAs with hard to value derivatives and settled […]

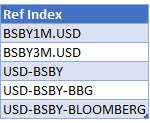

BSBY and Term SOFR Swap Volumes

As we note today in What did January teach us about RFR trading, SOFR Swap and Futures volume hit an all time high of 28.4% of all USD risk traded, which is up 3% from the prior month. CME also put out a press release, noting SOFR Futures and Options record volumes on February 10, […]

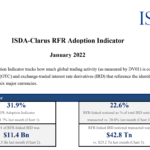

What did January teach us about RFR trading?

The January 2022 ISDA-Clarus RFR Adoption Indicator has now been published. It delivers a few really important lessons about the underlying markets (and data). The headlines include: A virtually unchanged headline adoption rate of 31.9%, versus 31.7% for the previous month. The full time-series is available at rfr.clarusft.com: 99.8% of all new GBP and CHF […]

The CFTC Monthly Cleared Margin Report

The Commodity Futures Trading Commission (CFTC) produces a monthly cleared margin report for DCOs (CCPs) required to file daily initial margin with the CFTC’s Division of Clearing and Risk. The report aggregates initial margin from six DCOs: CME, ICE Clear Credit, ICE Clear US, ICE Clear Europe, LCH Ltd and LCH SA. The latest report […]

Big Volumes In Credit And Inflation Plus European Equivalence

CDS index products are seeing unusually high trading activity. Inflation swaps have also seen significant volumes. These are two hot topics for market participants to monitor. Europe has also extended equivalence for non-European CCPs for another 3 years. There is now a consultation to understand which regulatory actions can most effectively move clearing activity to […]

What is now Trading in RFR Cross Currency Swaps?

Cross Currency swap trading has transition quickly to USD SOFR and away from USD LIBOR in 2022. All of the currency pairs we look at show evidence of a transition to USD SOFR. Some markets are now trading RFR vs RFR Cross Currency Swaps. Most of the other markets now trade Term domestic rates vs […]

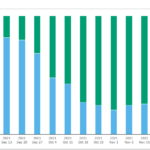

2021 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2021. Index, Single-name and Swaptions Volumes in USD of $10 trillion, down 9% Volumes in EUR of €6.7 trillion or $8.5 trillion, flat on the year Index is 90% in USD and 94% in EUR Single-name is 9% in USD […]