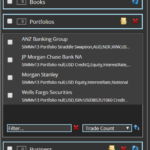

SOFR Swaps and SEF Venues

We have dedicated Risk Free Rate (RFR) views in most of our data products and today we complete the picture by adding these to SEFView, which aggregates daily volume from all Swap Execution Facilities. Let’s use this to see where SOFR Swaps are trading. D2D Venues The inter-dealer market trades SOFR vs FedFunds Basis Swaps, […]

Block Trades in HKD Derivative Markets

HKD Interest Rate Derivatives are the 5th most traded APAC currency. They trade in a range of maturities out to 30 years, but the block thresholds and lack of SEF market prevent us seeing the true size of trades. USDHKD FX Options are at least a $750bn per month market. Transparency in this market also […]

Trading RFRs

Clarus will be talking about trading RFRs at the ISDA/SIFMA AMG Benchmark Strategies Forum 2020 in London next week, February 26th 2020. For more information on the event and to register, please check out the event details page. It is free to attend for the buyside. Among the topics, you will hear our thoughts on: RFR […]

Spotlight on RFR Swaps

As the spotlight turns to RFR Swaps, in a “will they won’t they take off and replace Libor”, we have added new RFR views in most of our data products, to help answer that question. Today I will use SDRView Researcher and our new IBOR-RFR view to shine a spotlight on RFR Swaps. RFR Swaps […]

Our Partnership with AcadiaSoft

Last week we put out a joint press release, see AcadiaSoft Partners with Clarus Financial Technology to Provide Joint Initial Margin Analytics Service and I wanted to provide more detail on the value of this. Background Uncleared margin rules (UMR) require firms to exchange Initial Margin on bi-lateral derivatives exposures and the financial industry relies […]

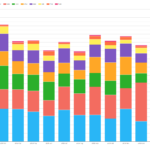

Block Trading

Our data shows that block trades are 30% larger than the amounts reported to SDRs. Block trades and trades capped at a reporting threshold make up just 7% of volume by trade count. However, the true size of these trades means they account for 43% of notional volume. This varies significantly from currency to currency. […]

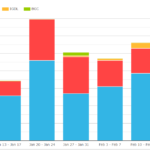

Risk Free Rates Trading January 2020

We look at the percentage of notional and risk that is traded as an OIS swap across six currencies. 55% of GBP trading activity when measured by risk (DV01) is currently transacted versus SONIA (OIS). Just 16% of USD trading activity is transacted as an OIS when measured by risk. AUD markets are leading the […]

After Libor, will Derivatives become more transparent for end users?

The move from Libor to Risk Free Rates should accelerate in 2020. We recently published, Will GBP Libor stop trading on 2nd March 2020? and Have SOFR and SONIA Swaps and Futures lived up to expectations? On 16th January 2020, the PRA and FCA published another letter to market participants (in this case SMFs) focused […]