You Need To See This SEF Liquidity In RFRs Now

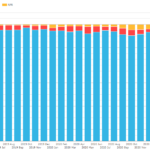

USD SOFR trading on D2C SEFs is very small, and well behind the industry average. 72% of GBP risk was versus SONIA on D2D SEFs in April 2021. CHF SARON adoption has jumped to 15% on D2D SEFs this month. RFR Adoption Indicators In this blog I turn the RFR Adoption Indicator methodology onto SEF […]

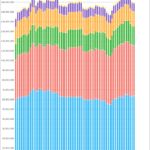

Cleared Swap Volumes and Share – 1Q 2021

USD IRS with record volume in 1Q 2021, LCH share up YoY SOFR Swaps at new highs, LCH dominant, CME share higher than in IRS EUR IRS volumes up, Eurex share up YoY as it’s gains continue €STR Swaps a record month, LCH dominant, Eurex share higher than in IRS JPY Swaps volumes up, JSCC […]

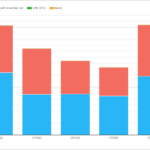

Latest: More EUR Are Trading on-SEF than ever before

16% of the global EUR D2D swaps market is now on-SEF. This has recently increased above the levels we saw in January 2021. We do not know why there has been another increase in EUR SEF trading. But the data shows it is happening! US venues continue to be the main beneficiaries of Brexit in […]

What happened to reduce RFR trading?

March 2021 saw 8.8% of all derivatives risk traded versus an RFR. This reduced from the previous levels around 10%. The pre-cessation announcements last month do not appear to have accelerated RFR Adoption. There was an increase in the amount of IBOR-related activity last month. Overall for Q1 2021, the total amount of RFR activity […]

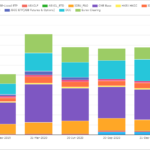

What’s new in CCP Quant Disclosures – 4Q20?

Clearing Houses just published their CPMI-IOSCO Quantitative Disclosures, lets look at what’s new: Initial margin for IRS remains close to record highs Initial margin for CDS down 12% from the high Initial margin for ETD down 15% from the high OCC and Eurex OTC IRS the only CCPs with IM QoQ up > 10% ASXCL, ICE Clear NL and ICE Clear SG are new additions to CCPView DTCC […]

Potential challenges of a synthetic LIBOR

Most active market participants were looking forward to the LIBOR cessation or pre-cessation announcement to provide certainty for the end of LIBOR. This was provided by FCA on 5th March 2021 as a pre-cessation or ‘loss of representativeness’ announcement which triggered many contracts to move to the fallbacks at a future date. However, another component […]