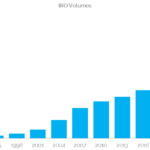

BIS Triennial Survey 2019

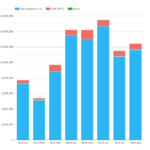

Trading reached $6.5trn per day in Interest Rate Derivatives during April 2019. Our markets have grown at unprecedented levels in the past three years. The BIS used our own CCPView data to cross-check the survey results. BIS IRD Volumes in April 2019 The latest BIS survey data is now available. Performed once every three years, […]

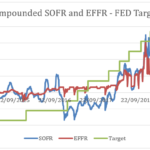

SOFR and FedFunds Rate Comparisons

SOFR has been topical for over a year as markets become more used to the near-new USD Risk Free Rate (RFR). The ARRC identified SOFR as the preferred replacement for USD Libor in 2017 and has stated: ‘The ARRC has identified the Secured Overnight Financing Rate (SOFR) as the rate that represents best practice for […]

SOFR Fixed at 5.25%. What happened to the volumes?

We are all repo traders now. SOFR has been volatile in the past week fixing from 2.20%, 2.43%, 5.25% (!) before back to 2.55% yesterday. We analyse the volumes that make up the fixing and the SOFR IRS volumes. For those that missed it, SOFR fixed at a scarcely believable 5.25% on 17th September. Surrounding […]

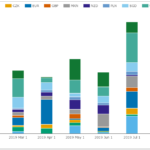

CME Swap Data Repository

Clarus SDRView consolidates all Swap or Trade Data Repositories that publish transaction level data and have meaningful volume. As only the United States and Canada have transaction level public reporting, our focus has been on these jurisdictions, which provide by far the most interesting and useful data. European, Japanese, Australian, Singapore and other jurisdictions have […]

SACCR vs CEM for FX Products

Blame our active community of readers if you must. But we’ve had the most requests for a comparison of FX products under SACCR and CEM in response to my original blog. Therefore, here we go… SACCR is Coming If you need a refresher on SACCR and CEM, then please check out our comprehensive coverage below: […]

Four Things to Understand about USD SOFR

USD SOFR is made up of both general collateral (GC) and non-GC trades. Recent data suggests that there is a difference (a “basis”) between GC and non-GC repo trades. USD SOFR combines Dealer to Dealer and Dealer to Customer trades. Only a limited history of SOFR is available. USD SOFR Components The transactions that make […]

Swap Volumes: SOFR v FedFunds

Back in February 2019, I wrote a blog on the state of the GBP and USD OIS markets. At that time, I held great hope for the USD SOFR markets to develop during 2019 to support a growing market in SOFR-based cash products and the derivatives used to hedge them. This blog looks at the […]

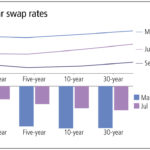

Swaps Data: Analysing the US rates collapse

My monthly Swaps Review looks at: USD Swap rates daily moves in 2019 YTD Highlighting the massive falls in August 2019 Putting these into historical context all the way back to 2008 The impact on Initial margin models The impact on CME-LCH-Basis and CCP Switch trades USD Swap volumes in August 2019 Please click here for […]

5 Things That Are Making MIFID II Data Useless

To all of our readers who, like me, are responding to the latest ESMA consultation, I thought I would provide a simple list of ways that MIFID II data is being made difficult to access. Hopefully this can help to get transparency right in Europe. ESMA report that the users of data that they spoke […]

ESMA: Let’s Get Transparency Right

Transparency under MIFID II has been a failure so far. ESMA is consulting to put this right. We have already lost three years of transparency. This issue is more important now than ever before as the transition to RFRs demands transparency. I return to work with possibly the most important consultation of the year to […]