What’s new in CCP Disclosures? – Q1 2025

Clearing houses have published their latest CPMI-IOSCO Quantitative Disclosures for Q1 2025. Background Under the CPMI-IOSCO Public Quantitative Disclosures, central counterparties (CCPs) publish over 200 quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing, and more. CCPView has more than 8 years of these quarterly disclosures for 44 clearinghouses, each with multiple Clearing Services, covering […]

€STR volumes and market share – May 2025

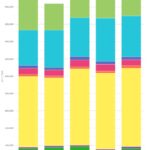

€STR futures Our €STR Dashboard summarizes key liquidity attributes in this growing market. Chart 1: €STR short-term interest rate futures dashboard. Source: Dashboard built using ClarusFT microservices connected to CCPView. The dashboard shows: In addition, CCPView provides longer-range time series, like the following on €STR futures OI. Chart 2: day-by-day €STR futures OI by CCP (notional […]

How much margin? The 2024 edition

This blog covers the 2024 edition of the “ISDA Year-End Margin Survey”, published on 14 May 2025, which covers over-the-counter (OTC) derivatives uncleared initial margin (IM) and variation margin (VM) for all asset classes, and cleared IM for interest rate derivatives (IRD) and credit derivatives (CRD) only. We combine the ISDA survey data with more […]

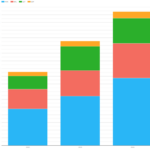

Q1 2025 CCP volumes and share in CRD and FXD

This blog reviews the volumes and central counterparty (CCP) market share of cleared credit derivatives (CRD) and FX derivatives (FXD) in Q1 2025. Comparing Q1 2025 with Q1 2024, we see 44 percent overall volume increases in cleared CRD – index, single-name, and swaptions. Comparing Q1 2025 with Q1 2024, we see 31 percent overall volume […]

What’s new in AUD swaps in 2025?

This blog looks at another year of AUD swaps activity, continuing from the blog with a similar title published at about the same time last year. Should you want more information on AUD swaps, the blog linked above contains links to several other blogs on the topic. AUD market total size First, we extend the […]

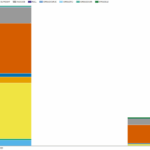

2024 CCP Volumes and Share in CRD and FXD

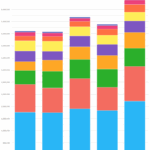

A review of Credit Derivatives (CRD) and FX Derivatives (FXD) volumes and market share at Clearing Houses (CCPs) in 2024. For CRD – index, single-name and swaptions: For FXD – NDF, options, forwards and spot: All the charts and detail from CCPView. Credit Derivatives Volume First, we look at USD CDX, single-name CDS and Swaptions. Chart 1 – […]

2024 US SDR-Reported IR Compression

Key takeaways: Data background For 8+ years, SDRView data has included the package type field to allow compression to be broken out from outright and other package types. In late 2022 we used the CFTC reporting upgrade to immediately add platform id which allows platforms’ compression market share to be analyzed. Platform id values consist […]

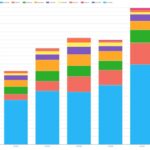

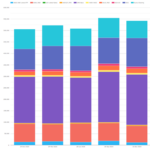

2025Q1 CCP volumes and share in IRD

Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalized, and aggregated to allow meaningful volume comparisons. Today, we look at 2025Q1 CCP volumes and market share in IRD for: Onto the charts, data, and details. Volumes and market share For major currencies and regions, vanilla swaps referencing IBORs and OIS Swaps referencing RFRs, using […]

What’s new in CCP Disclosures – 4Q24

Clearinghouses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, central counterparties (CCPs) publish over 200 quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing, and more. CCPView has more than 8 years of these quarterly disclosures for 44 clearinghouses, each with multiple Clearing Services, covering the period from 30 September […]

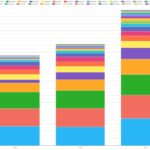

2024 CCP Volumes and Share in IRD

2024 volumes and market share for OTC Derivatives in Interest Rates reported by Clearing Houses. Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons. Contents: Onto the charts, data, and details. Volumes and Market Share For major currencies and regions, vanilla swaps referencing IBORs and OIS […]