GSIBs in 2020

The same 30 banks as in 2019 have been defined as GSIBs in 2020. JP Morgan, Wells Fargo and Goldman Sachs have all managed to move into lower tiers, requiring less capital. We look at the data behind the GSIB indicators using GSIBView, our latest data offering. Optimisation of the GSIB metrics is evident in […]

The GSIB Framework and Window Dressing

What Are GSIBs? If you need a refresher of the GSIB framework, please check-out our blogs on: G-SIB MECHANICS AND DEFINITIONS G-SIB SCORES FOR US BANKS We have recently introduced GSIBView, an app for analysing the scores in more detail. It provides a drill-down into the GSIB components and allows our data customers to analyse […]

Want to know all about Global Systemic Banks? Introducing GSIBView

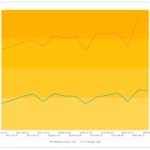

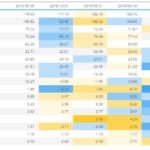

GSIBView is the latest data product from ClarusFT. We collect and calculate the GSIB scores for 118 banks. Data shows how GSIB scores and components change over time. Drill-down into components and compare across peer groups. This blog looks at funding data, payments data and derivative notionals of RBS, ICBC and Morgan Stanley. Global Systemically […]

G-SIB Scores for US Banks

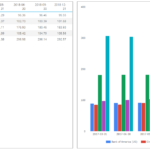

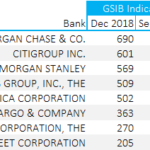

We detail the GSIB methodology for US banks, referred to as “Method 2” in the literature. We calculate the GSIB scores for 8 US banks as at December 2018 and September 2019. We find that the Method 2 scores are particularly penal for Morgan Stanley. It will be interesting to see how these scores change […]

G-SIB Mechanics and Definitions

There are 30 Global Systemically Important Banks (G-SIBs) in 2019. A bank must hold at least an extra 1% in Tier One capital as a result of qualifying as a G-SIB. We look at the calculations necessary to work out a bank’s G-SIB score and calculate the exact values for 2019. We estimate that HSBC […]