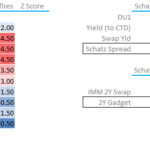

CAD Swaps – What’s New?

OMG. The last time I wrote about CAD Swaps was in 2017! Seven years later, what has changed? (Skip to the Summary to find out 😛 ). CDOR-CORRA Conversion The not-so-new news is that CDOR will cease in four days time (28th June 2024 will be the last fixing ever published). I have covered the […]

A Dummies Guide to Trading Interest Rate Swaps

This week marks the 10th Anniversary of my first ever blog. That also means it is a long time since I last traded an interest rate swap. To mark the occasion, I have documented the trading strategy that I used all those years ago. Enjoy! Three Rules This strategy follows three rules: What is Positive […]

What’s New in CCP Disclosures – 1Q24?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more. CCPView has over 8 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep […]

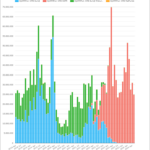

SOFR Options – How Healthy Is The Market?

With LIBOR now a distant memory, is options activity in USD rates markets back to pre-cessation levels? Let’s tour the data…. Futures – Exchange Traded Options on SOFR contracts Options on Exchange Traded Derivatives are the “standardised” version of non-linear liquidity, with standardised expiries (quarterly, monthly and even weekly for certain underlyings) and strikes in […]

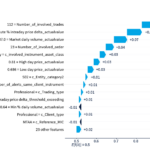

Improving transparency in ML models for market abuse detection

We recently covered an article on Using AI for Market Abuse Surveillance, a very interesting use of Machine Learning (ML) to improve the classification of alarms generated in market surveliance. One of the issues with ML is the lack of transparency, due to the “black-box” nature of the models. So you get an answer, but […]

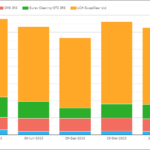

JPY Swap Clearing – Why do dealers prefer JSCC?

And equally “Why do clients prefer SwapClear?” The Data It was only recently that I provided a general overview of the JPY Swaps Market in 2024. As so often happens, that blog sparked some conversations, which sparked some number crunching, leading us here. Last time, I noted that the JSCC-LCH basis had shown a significant […]

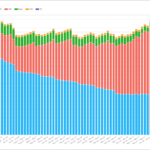

SOFR Swap SEF Volumes – May 2024

Continue reading for the charts, tables and details Background In February 2024, I published the blog 2023 SEF Volumes and Share in SOFR Swaps, which used data we collect, filter and enhance in our SDRView product. That blog looked at the type of SOFR Swaps that trade on Dealer-to-Dealer (D2D) and Dealer-to-Client (D2C) venues; namely Spreadovers, Curves […]