SONIA Term Rates

The Bank of England is running a consultation on term SONIA reference rates. We take a look at a complementary solution. We produce compounded SONIA in-arrears term fixings to help end-users adopt SONIA. Making Our Lives Easier François Jourdain, Chair of the Working Group on Sterling Risk-Free Reference Rates, recently stated that our industry needs […]

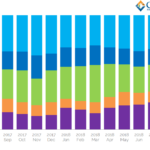

Capital and RWA for Tier 1 US Banks – 2Q 2018

Last year we wrote about Capital Ratios and Risk Weighted Assets for Tier 1 US Banks and that blog remains popular to this day. Today I will provide an update using the latest quarterly figures, to see if the trend we observed with US Banks increasing capital and reducing RWA has continued into 2018. Background The Basel […]

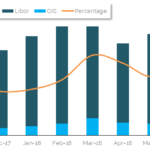

LIBOR OIS August 2018 Update

Libor-OIS spreads have collapsed since we last wrote about them in March. 1 year Libor-OIS spreads in USD have retreated to under 30 basis points. Notional traded has continued to be higher than in 2017. Cross currency basis has also moved tighter. We also take a quick look at OIS future volumes. Libor OIS Our Libor-OIS blogs […]

USD Spreadovers and SEF Market Share

Spreadovers account for roughly 35% of all USD risk traded on-SEF. In D2D USD swap markets, Spreadovers account for about 70% of volumes. This makes them by far the most important packages traded in USD. Almost all Spreadovers are transacted on a SEF. We look at D2D SEF market share in USD swaps. History We […]

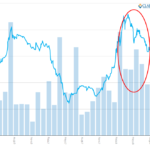

How are Futures on Bitcoin doing?

We last looked at Bitcoin Futures in January 2018, shortly after their launch by CBOE and CME, so high time to re-visit these to see how volumes have performed. Monthly Volumes In SEFView we collect daily volumes and aggregating these to look at YTD monthly volumes. Growth since January, but certainly not one that requires […]

More SOFR Swaps are Trading

Fannie Mae recently issued its first ever securities linked to SOFR (see here for details). The issuance was $6 billion in size, settled on 30 July with 6m, 12m and 18m tranches. So I wanted to update our recent SOFR Swaps Are Trading blog and see if this bond issue has led to any more […]

Creating a Swaps Dashboard using Python

Clarus Microservices make it easy to get Swaps data Swap volumes can be retrieved from SDRs using simple Python This data can be displayed in Tables and Charts Our Sandbox allows you to try quickly in your Browser Introduction Under the Dodd-Frank Act, all swaps, whether cleared or uncleared, that are executed by US persons, […]

How much of the swaps market is traded as an OIS?

We summarise the portion of risk that is traded as OIS across seven major markets. Benchmark reforms around the globe are helping transition trading away from Libor into Risk Free Rates. We monitor the progression of these reforms by looking at how much risk is trading in OIS products. How popular are OIS? Clarus use our data products, […]

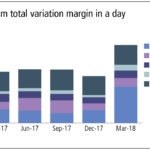

Swaps Data: OTC Margin Up, Futures Margin Down

My monthly Swaps Review in Risk Magazine looks at the most recent CPMI-IOSCO Quantitative Disclosures by Clearing Houses for Interest Rate Swaps, Credit Default Swaps and Futures and Options Showing strong year-on-year growth in each of these, except the last. I also look at the trend in client IM at LCH SwapClear and the maximum Variation margin call […]