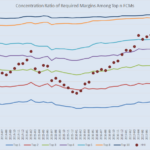

Final 2017 FCM Rankings & Concentration

The latest batch of FCM data has been assembled. Lets dig in. We start with the number of FCMs that are registered, by various metrics: Showing us: The number of FCMs registered dropped by 1 firm, from 64 to 63, with the removal of ETRADE Securities (leaving just ETRADE Futures) The number of FCM’s with […]

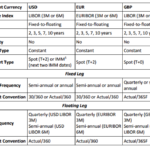

MAS plays catch up with proposed trading obligation mandate

MAS is playing catch up and proposing to mandate trading of USD, GBP and EUR fixed float swap trades in organised markets, aligning themselves with the EU and US regulators. The proposed tenors covered are the most liquid (under 10Ys) on the respective currencies curve. However no JPY, AUD or SGD trading mandate yet. Proposed […]

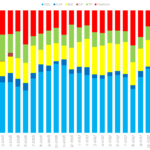

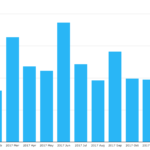

All time record volumes in Cross Currency Swaps

January 2018 saw all time notional volume records in Cross Currency Swaps. Some of this volume was in short-dated USDJPY products. BGC captured a large portion of the uptick in volumes, seeing a 40% market share for on-SEF products. We need to be able to see European volumes to improve our understanding of this important […]

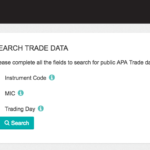

MiFID II – NEX APA Public Trade Data

NEX Regulatory Reporting operates a MiFID II APA and it is great that their public website now supports a Market Identifier Code (MIC) level search for post-trade data, which is then easily exportable into a csv file. Brilliant. Lets take a look at the data available. NEX APA The public website is here and selecting Trades shows […]

Swaps Data: the monopoly effect in clearing

My Monthly Swaps Data Review for Risk Magazine was published this week. This looks at 2017 CCP Volumes for: Interest Rate Swaps, in major and minor currencies Credit Derivatives, index and single-name Non-Deliverable Forwards It shows the dominance of one global CCP in each asset class and significant share by other CCPs in a specific […]

Clarus Daily Briefing

Our Clarus Daily Briefing is *FREE*. It provides a summary of price moves, volume trends and central bank expectations. Bringing you information about Swap markets straight to your inbox. Is your firm interested in sponsoring the Daily Briefing? If so, reach out to us. The FREE Clarus Daily Briefing Every morning, Clarus deliver our Daily […]

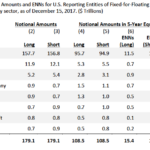

Entity Netted Notionals – Turning $179 trillion into $15 trillion

The Office of the Chief Economist at the CFTC, recently published the research paper “Introducing ENNs: A Measure of the Size of Interest Rate Swap Markets“, which I found very interesting. This paper argues that gross notional , a common measure of the size of swap markets, does not accurately represent the amount of risk […]

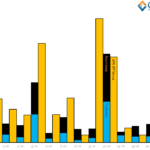

Is Eurex Gaining Share in IRS Clearing?

Reading Philip Stafford’s recent article in the Financial Times, Deutsche Borse makes ground in UK derivatives push, I was struck by the paragraph: Seven times! Impressive, indeed. Is this the start of a ratcheting up in Eurex volumes and gain in market share vs LCH SwapClear? Lets look at what the data shows in detail. EUR […]

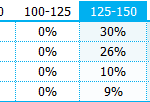

Tradeweb and Bloomberg MTF Market Share

Thanks to Tradeweb and Bloomberg for providing transparent data for January trading across their MTFs. Our analysis shows a 50/50 market share for D2C IRS trading. We have so far only looked at Interest Rate Swaps. Our analysis shows that 37% of customer EUR IRS trading is happening on-venue. MIFID Data…but first… We currently have […]