CCP Initial Margin Models – A Comparison

Last week I looked at CCP Disclosures 1Q2016 – Trends in the Data , so this week I thought it would be interesting to focus on disclosures for Initial Margin Models to see how they compare. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, […]

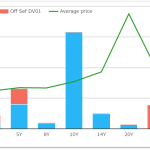

Liquidity Conditions in USD Swaps

We analyse Liquidity using our Price Dispersion Index We find that liquidity conditions have worsened for 10 year USD swaps The analysis quantifies liquidity using price and volume We conclude that illiquidity begets illiquidity Liquidity often feels ephemeral and fleeting when you’re trying to transact. To counteract this, it is beneficial to quantify liquidity conditions, taking the subjectivity out […]

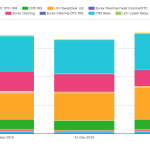

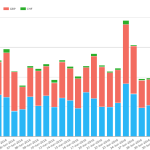

CCP Disclosures 1Q2016 – Trends in the Data

Central Counterparties recently published their new CPMI-IOSCO Quantitative Disclosures, meaning we now have three sets of disclosures, so I thought it would be interesting to look at trends in the data. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more […]

Mechanics and Definitions of Bond Futures

We focus on Bond Futures. They are a deep source of liquidity. We define the contracts and look at some of their common features. Analysing volumes across major bond futures is simple in CCPView. We find that around 60% of bond future notional is US related, with the remainder European. Invoice Spreads account for 3% of volumes in bond futures. What is […]

Will the Bank of England cut rates?

Our Brexit blogs and June Swaps Review both show that OIS volumes have been very large recently We therefore have greater price transparency for short end interest rates This is particularly interesting when a central bank may be about to change monetary policy The BoE may be about to cut rates in response to the surprise Brexit […]

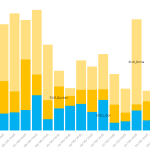

June 2016 Swaps Review – Volumes Up 30 to 50%

Continuing with our monthly review series, let’s take a look at Interest Rate Swap volumes in June 2016. First the highlights: On SEF USD IRS in June 2016 volume was 34% higher than May USD OIS volume has increased month on month USD Swap Curve dropped 30 to 35 bps across the term structure EUR & GBP volumes were higher […]

Mechanics and Definitions of Short Term Interest Rate Futures

We focus on Short Term Interest Rate Futures contracts. In volatile markets, they are a deep source of liquidity. We define the contracts and look at some of their common features. Analysing volumes across all Short Term Interest Rate futures is simple in CCPView. We find that Short Sterling is more liquid than expected…. …and that FRA volumes relative to […]

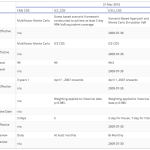

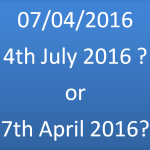

Auto-detecting date format in CSV files

When uploading data into systems, comma separated value format (CSV) is a common choice. A difficulty can arise when editing CSV files in Excel — date formats can easily (and accidentally) change causing upload failures and end-user frustration. It is possible to write CSV uploading routines to automatically detect date formats and alleviate this problem […]

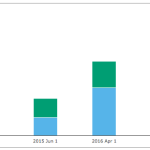

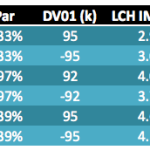

Higher Swap Margins after Brexit

Last week I looked at Brexit – The Impact on Swap Margin and stated that we will start to see increases in Initial Margin particularly for GBP Swaps. Now that a week has passed lets look at the what the data shows. Cleared IRS 10Y Lets start by using CHARM to calculate the IM of 10Y par vanilla swaps […]

BREXIT – What is Trading?

We may have skipped a day yesterday (prior commitments, sorry all!) but we can’t really ignore the price action this morning in GBP swaps. The BoE comments yesterday bringing rates lower this morning. Bye bye that 1.00% handle in ten years…. End of Day GBP Wrap-Up 187 trades were reported to the SDRs. Over £8bn in […]